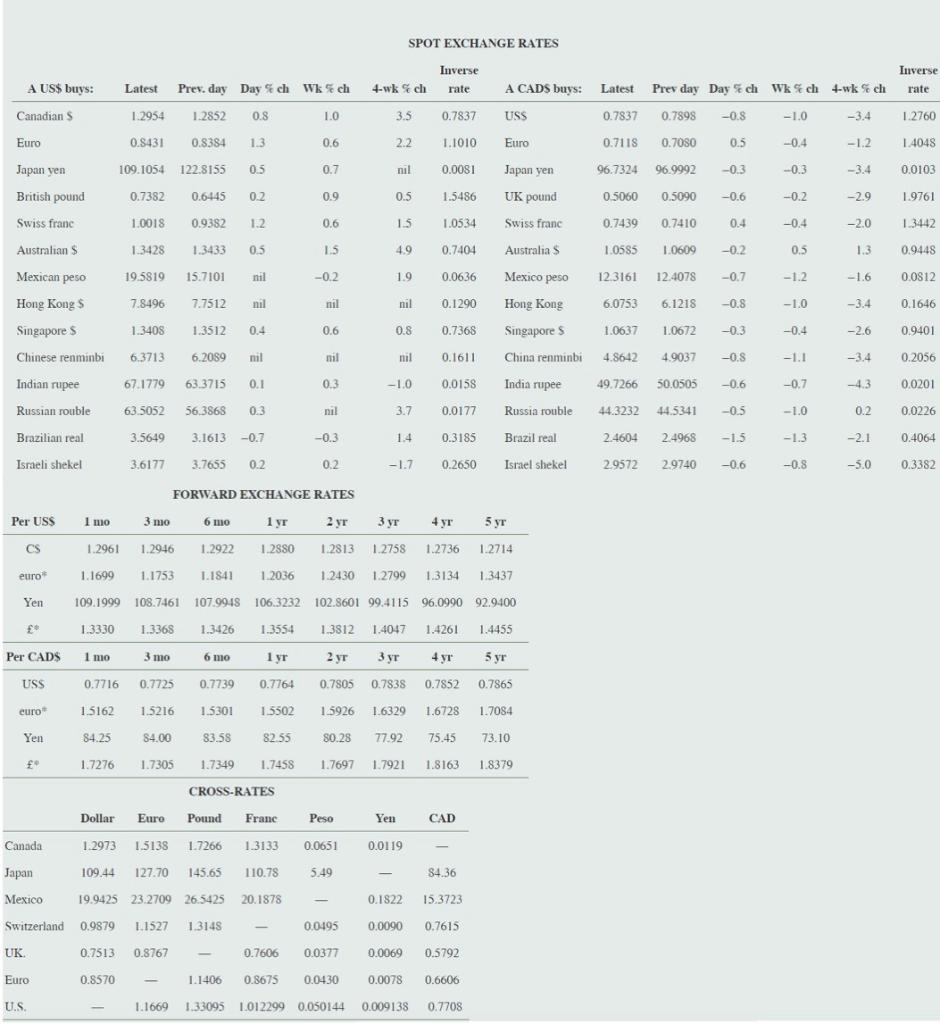

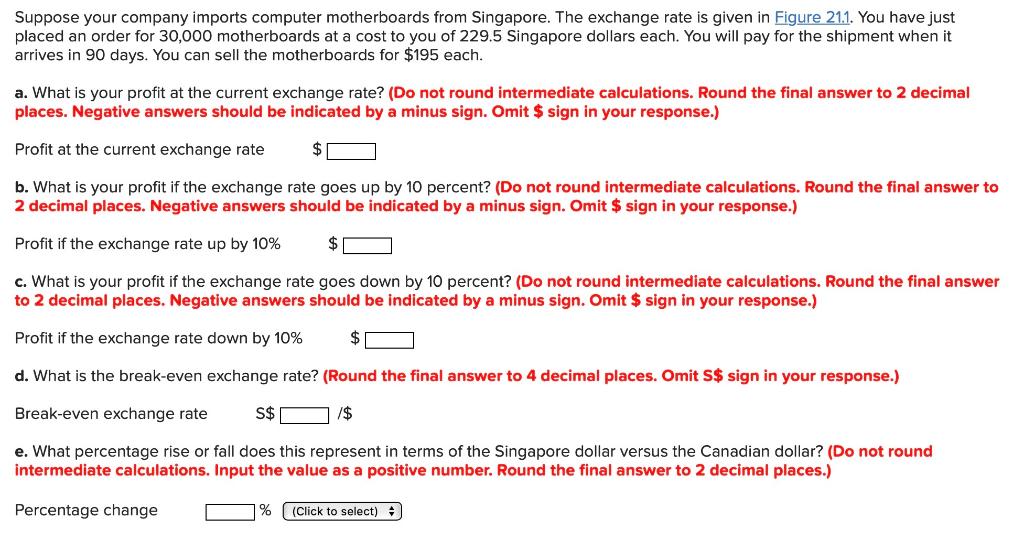

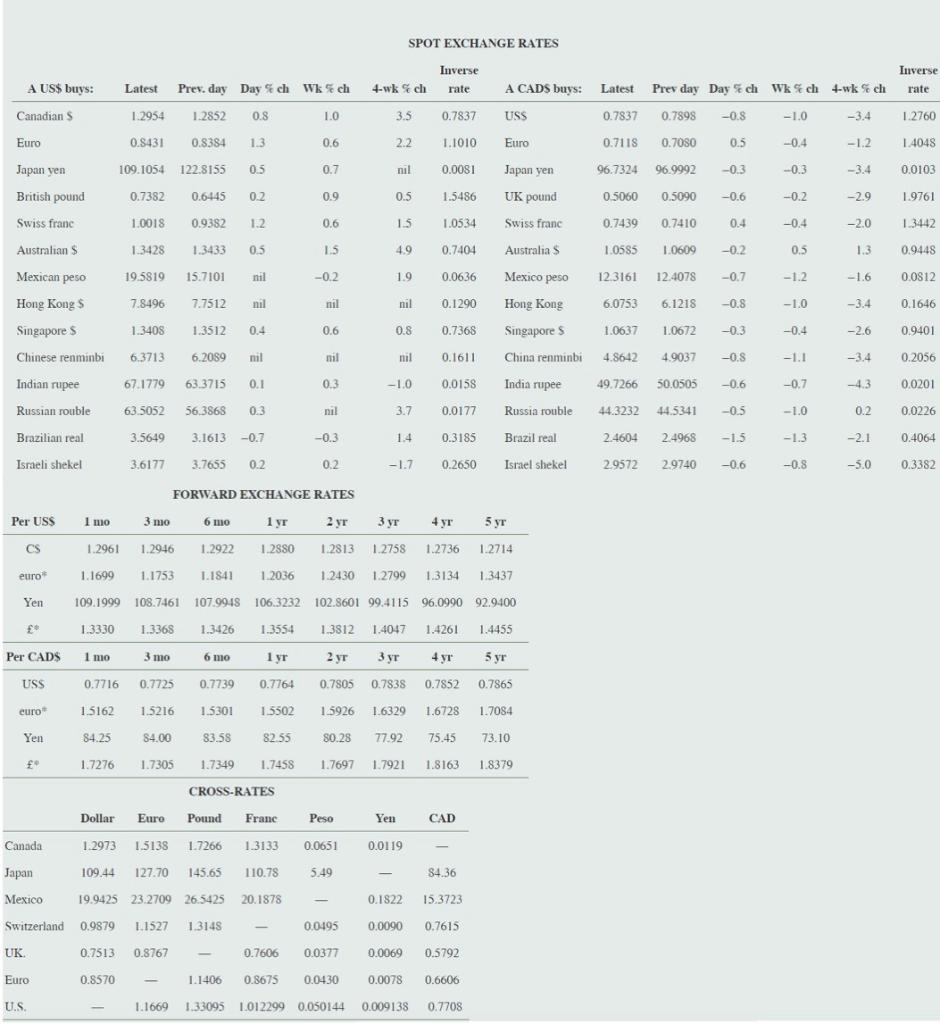

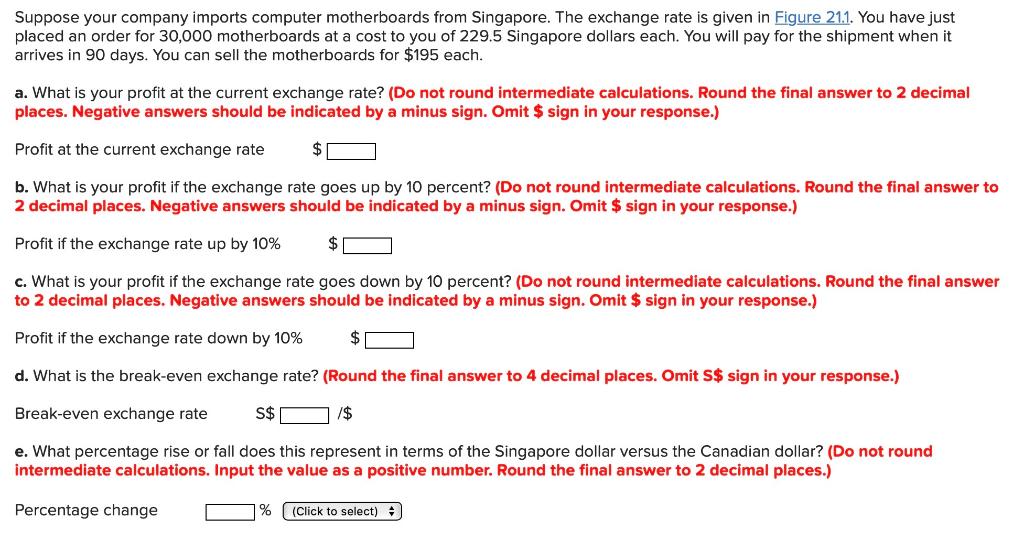

SPOT EXCHANGE RATES Inverse Inverse rate Prev. day Daych Wkech 4-wk sch rate A US$ buys: Canadians Euro Latest 1.2954 1.2852 0.8 1.0 3.5 0.7837 A CADS buys: Latest Prev day Day Ech WkSech t-wk ch USS 0.7837 0.7898 --0.8 -1.0 -3.4 Euro 0.7118 0.7080 0.5 -0.4 -1.2 1.2760 0.8431 0.8384 1.3 0.6 2.2. 1.1010 1.4048 Japan yen 109.1054 122.8155 0.5 0.7 nil 0.0081 Japan yen 96.7324 96-9992 -0.3 -0.3 -3.4 0.0103 British pound 0.7382 0.6-445 0.2 0.9 0.5 1.5486 UK pound 0.5060 0.5090 -0.6 -0.2 -2.9 1.9761 Swiss franc 1.0018 0.9382 1:2 0.6 1.5 1.0534 0.7439 0.7410 0.4 -0.4 -2.0 1.3442 Australian $ 1.3428 1.3433 0.5 1.5 4.9 0.7404 1.0585 1.0609 -0.2 0.5 1.3 0.9448 Mexican peso 19.5819 15.7101 nil -0.2 1.9 0.0636 12.3161 12.4078 -0.7 -1.2 -1.6 0.0812 Swiss franc Australia $ Mexico peso Hong Kong Singapore $ China renminbi Hong Kong $ 7.8496 7.7512 nil nil nil 0.1290 6.0753 6.1218 -0.8 -1.0 -3.4 0.1646 Singapore $ 1.3408 1.3512 0.4 0.6 0.8 0.7368 1.0637 1.0672 -0.3 -0.4 -2.6 0.9401 Chinese renminbi 6,3713 6.2019 mil mil nil 0.1611 4.8642 4.9037 -0.5 -1.1 -3.4 0.2056 Indian rupee 67.1779 63.3715 0.1 0.3 -1.0 0.0158 India rupee 49.7266 30.0505 -0.6 -0.7 -4.3 0.0201 Russian rouble 63.5052 56.3868 0.3 nil 3.7 0.0177 Russia rouble 44 3232 44.5341 -0.5 -1.0 0.2 0.0226 3.5649 3.1613 -0.7 -0.3 1.4 0.3185 Brazil real 2.4604 2.4968 -1.5 -1.3 -2.1 0.4064 Brazilian real Israeli shekel 3.6177 3.7655 0.2 0.2 -1.7 0.2650 Israel Shekel 29572 2.9740 -06 -0.8 -5.0 0.3382 FORWARD EXCHANGE RATES Per USS CS euro 1 mo 3 mo 6 mo 1 yr 2 yr 3 yr 4 yr 5 yr 1.2961 1.2946 1.2922 1.2880 1.2813 1.2758 1.2736 1.2714 1.1699 1.1753 1.1841 1.2036 1.2430 1.2799 1.3134 1.3437 109.1999 108.7461 107.9918 106.3232 102.8601 99.4115 96.0990 92.9400 1.3330 1.3368 1.3426 1.3554 1.3812 1.4047 1.4261 1.4455 Yen Per CADS I mo 3 mo 6 mo 1 yr 2 yr 3 yr 4 yr 5 yr USS 0.7716 0.7725 0.7739 0.7764 0.7505 0.7838 0.7852 0.7865 euro 1.5162 1.5216 1.5301 1.5502 1.5926 1.6329 1.6728 1.7084 Yen 84.25 84.00 83.58 82.55 S0.28 77.92 75.45 73.10 1.7276 1.7305 1.7349 1.7458 1.7697 1.7921 1.8163 1.8379 CROSS-RATES Dollar Euro Pound Franc Peso Yen CAD Canada 1.2973 1.5138 1.7266 1.3133 0.0651 0.0119 110.78 5.49 84.36 20.1878 0.1822 15.3723 Japan 109.44 127.70 145.65 Mexico 19.9425 23.2709 26.5425 Switzerland 0.9879 1.1527 1.3148 UK 0.7513 0.8767 Euro 0.8570 1.1406 0.0495 0.0090 0.7615 0.7606 0.0377 0.0069 0.5792 0.8675 0.0430 0.0078 0.6606 U.S. 1.1669 1.33095 1012299 0.050144 0.009138 0.7708 Suppose your company imports computer motherboards from Singapore. The exchange rate is given in Figure 21.1. You have just placed an order for 30,000 motherboards at a cost to you of 229.5 Singapore dollars each. You will pay for the shipment when it arrives in 90 days. You can sell the motherboards for $195 each. a. What is your profit at the current exchange rate? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Negative answers should be indicated by a minus sign. Omit $ sign in your response.) Profit at the current exchange rate $ b. What is your profit if the exchange rate goes up by 10 percent? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Negative answers should be indicated by a minus sign. Omit $ sign in your response.) Profit if the exchange rate up by 10% $ c. What is your profit if the exchange rate goes down by 10 percent? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Negative answers should be indicated by a minus sign. Omit $ sign in your response.) Profit if the exchange rate down by 10% $ d. What is the break-even exchange rate? (Round the final answer to 4 decimal places. Omit S$ sign in your response.) Break-even exchange rate S$ /$ e. What percentage rise or fall does this represent in terms of the Singapore dollar versus the Canadian dollar? (Do not round intermediate calculations. Input the value as a positive number. Round the final answer to 2 decimal places.) Percentage change 1% (Click to select) - SPOT EXCHANGE RATES Inverse Inverse rate Prev. day Daych Wkech 4-wk sch rate A US$ buys: Canadians Euro Latest 1.2954 1.2852 0.8 1.0 3.5 0.7837 A CADS buys: Latest Prev day Day Ech WkSech t-wk ch USS 0.7837 0.7898 --0.8 -1.0 -3.4 Euro 0.7118 0.7080 0.5 -0.4 -1.2 1.2760 0.8431 0.8384 1.3 0.6 2.2. 1.1010 1.4048 Japan yen 109.1054 122.8155 0.5 0.7 nil 0.0081 Japan yen 96.7324 96-9992 -0.3 -0.3 -3.4 0.0103 British pound 0.7382 0.6-445 0.2 0.9 0.5 1.5486 UK pound 0.5060 0.5090 -0.6 -0.2 -2.9 1.9761 Swiss franc 1.0018 0.9382 1:2 0.6 1.5 1.0534 0.7439 0.7410 0.4 -0.4 -2.0 1.3442 Australian $ 1.3428 1.3433 0.5 1.5 4.9 0.7404 1.0585 1.0609 -0.2 0.5 1.3 0.9448 Mexican peso 19.5819 15.7101 nil -0.2 1.9 0.0636 12.3161 12.4078 -0.7 -1.2 -1.6 0.0812 Swiss franc Australia $ Mexico peso Hong Kong Singapore $ China renminbi Hong Kong $ 7.8496 7.7512 nil nil nil 0.1290 6.0753 6.1218 -0.8 -1.0 -3.4 0.1646 Singapore $ 1.3408 1.3512 0.4 0.6 0.8 0.7368 1.0637 1.0672 -0.3 -0.4 -2.6 0.9401 Chinese renminbi 6,3713 6.2019 mil mil nil 0.1611 4.8642 4.9037 -0.5 -1.1 -3.4 0.2056 Indian rupee 67.1779 63.3715 0.1 0.3 -1.0 0.0158 India rupee 49.7266 30.0505 -0.6 -0.7 -4.3 0.0201 Russian rouble 63.5052 56.3868 0.3 nil 3.7 0.0177 Russia rouble 44 3232 44.5341 -0.5 -1.0 0.2 0.0226 3.5649 3.1613 -0.7 -0.3 1.4 0.3185 Brazil real 2.4604 2.4968 -1.5 -1.3 -2.1 0.4064 Brazilian real Israeli shekel 3.6177 3.7655 0.2 0.2 -1.7 0.2650 Israel Shekel 29572 2.9740 -06 -0.8 -5.0 0.3382 FORWARD EXCHANGE RATES Per USS CS euro 1 mo 3 mo 6 mo 1 yr 2 yr 3 yr 4 yr 5 yr 1.2961 1.2946 1.2922 1.2880 1.2813 1.2758 1.2736 1.2714 1.1699 1.1753 1.1841 1.2036 1.2430 1.2799 1.3134 1.3437 109.1999 108.7461 107.9918 106.3232 102.8601 99.4115 96.0990 92.9400 1.3330 1.3368 1.3426 1.3554 1.3812 1.4047 1.4261 1.4455 Yen Per CADS I mo 3 mo 6 mo 1 yr 2 yr 3 yr 4 yr 5 yr USS 0.7716 0.7725 0.7739 0.7764 0.7505 0.7838 0.7852 0.7865 euro 1.5162 1.5216 1.5301 1.5502 1.5926 1.6329 1.6728 1.7084 Yen 84.25 84.00 83.58 82.55 S0.28 77.92 75.45 73.10 1.7276 1.7305 1.7349 1.7458 1.7697 1.7921 1.8163 1.8379 CROSS-RATES Dollar Euro Pound Franc Peso Yen CAD Canada 1.2973 1.5138 1.7266 1.3133 0.0651 0.0119 110.78 5.49 84.36 20.1878 0.1822 15.3723 Japan 109.44 127.70 145.65 Mexico 19.9425 23.2709 26.5425 Switzerland 0.9879 1.1527 1.3148 UK 0.7513 0.8767 Euro 0.8570 1.1406 0.0495 0.0090 0.7615 0.7606 0.0377 0.0069 0.5792 0.8675 0.0430 0.0078 0.6606 U.S. 1.1669 1.33095 1012299 0.050144 0.009138 0.7708 Suppose your company imports computer motherboards from Singapore. The exchange rate is given in Figure 21.1. You have just placed an order for 30,000 motherboards at a cost to you of 229.5 Singapore dollars each. You will pay for the shipment when it arrives in 90 days. You can sell the motherboards for $195 each. a. What is your profit at the current exchange rate? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Negative answers should be indicated by a minus sign. Omit $ sign in your response.) Profit at the current exchange rate $ b. What is your profit if the exchange rate goes up by 10 percent? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Negative answers should be indicated by a minus sign. Omit $ sign in your response.) Profit if the exchange rate up by 10% $ c. What is your profit if the exchange rate goes down by 10 percent? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Negative answers should be indicated by a minus sign. Omit $ sign in your response.) Profit if the exchange rate down by 10% $ d. What is the break-even exchange rate? (Round the final answer to 4 decimal places. Omit S$ sign in your response.) Break-even exchange rate S$ /$ e. What percentage rise or fall does this represent in terms of the Singapore dollar versus the Canadian dollar? (Do not round intermediate calculations. Input the value as a positive number. Round the final answer to 2 decimal places.) Percentage change 1% (Click to select)