Question

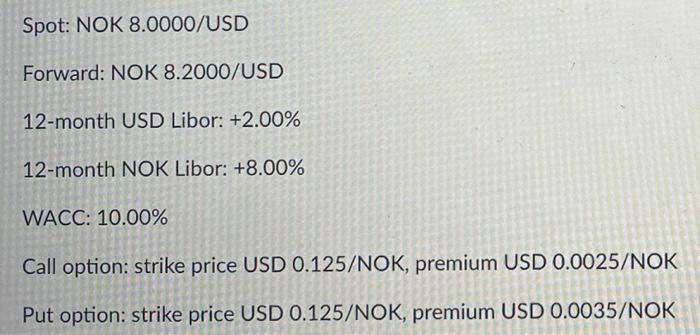

Spot: NOK 8.0000/USD Forward: NOK 8.2000/USD 12-month USD Libor: +2.00% 12-month NOK Libor: +8.00% WACC: 10.00% Call option: strike price USD 0.125/NOK, premium USD

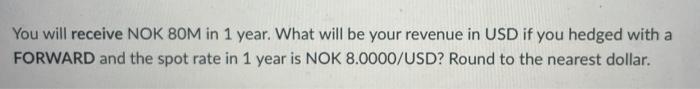

Spot: NOK 8.0000/USD Forward: NOK 8.2000/USD 12-month USD Libor: +2.00% 12-month NOK Libor: +8.00% WACC: 10.00% Call option: strike price USD 0.125/NOK, premium USD 0.0025/NOK Put option: strike price USD 0.125/NOK, premium USD 0.0035/NOK You will receive NOK 80M in 1 year. What will be your revenue in USD if you hedged with a FORWARD and the spot rate in 1 year is NOK 8.0000/USD? Round to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Since we want to hedge our NOK receivables we are worried about NOK going down vis a vis USD as we want to sell NOK in the future And if the NOK goes ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Market Practice In Financial Modelling

Authors: Tan Chia Chiang

1st Edition

9814366544, 978-9814366540

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App