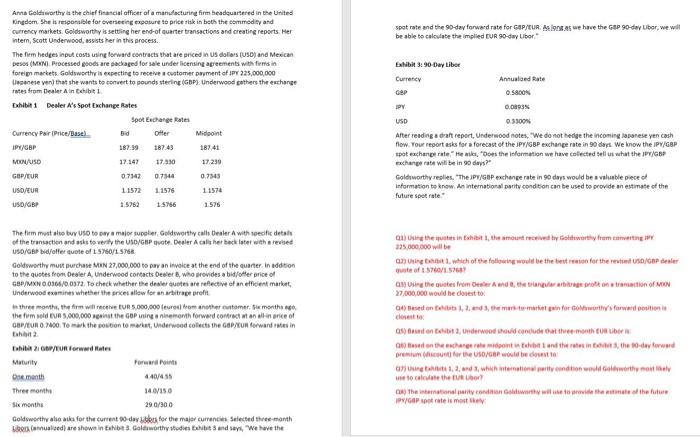

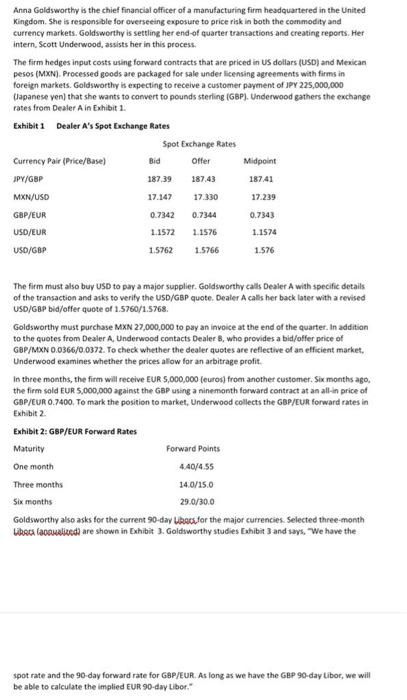

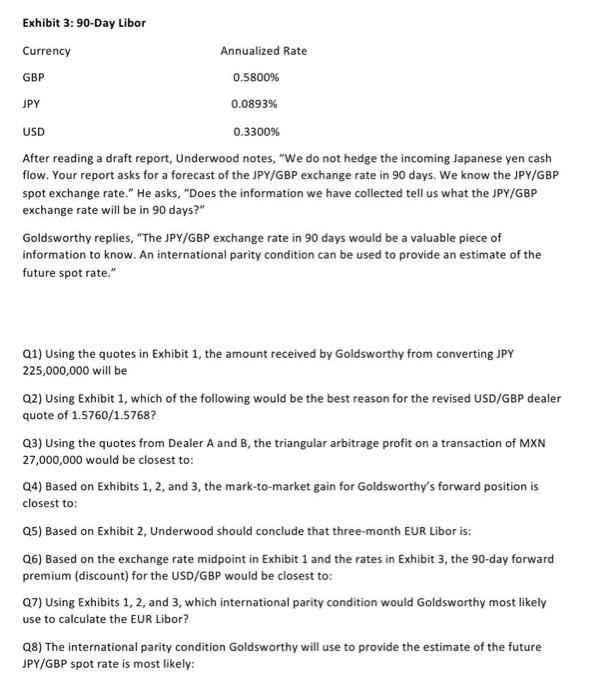

spot rate and the 90-day forward rate for GAP/EUR.Aslant we have the GP 90-day Lbor, we will be able to calculate the implied EUR 90-day Libor Anna Goldsworthy as the chief financial officer of a manufacturing firm headquartered in the United Kingdom. She is responsible for overseeing exposure to price risk in both the commodity and Currency markets. Goldsworthy is setting her end-of quarter transactions and creating reports. Her intern, Scott Underwood, assists her in this process. The firm hedges input costs using forward contracts that are priced in US dollar (USD) and Mexican peso (MXN). Processed goods are secaged for sale under licensing agreements with firms in foreign markets. Goldsworthy is expecting to receive customer payment of JPY 225,000,000 Cesente en that she wants to convert to sounds sterling (GBP) Underwood gathers the exchange rates from Dealer Ain behibe 1 Dhibit 1 Dealer A's Spot Exchange Rates Spot Exchange Rates Currency Pair iPrice/Basel Otter Midooint IP/GBP 187.39 187.43 MIN/USD 17.147 17.330 17.230 GBP/EUR 07342 0.744 0.7343 USD/EUR 11572 11576 11574 1.5762 1.5766 1.575 Exhibit 3: 90 Day Liber Currency Annuloed Rate 0.5800 JPY 0.08035 USD 0.100% After reading report, Underwood notes, "We do not hedge the incoming lapanese yen cash flow. Your report asks for a forecast of the JPV/GBP exchange rate in 90 days. We know the IPV/GBP pot exchange rate." Heikes the information we have collected tell us what the P/GBP Exchange rate will be in 90 days?" Goldsworthy replies. "The.JP/GBP exchange rate in 90 days would be a valuable piece of information to know. An international party condition can be used to provide an estimate of the future spot rate USD/GBP The firm must also buy USO to pay a major suppler Goldsworthy calls Dealer with specific details of the transaction and asks to verify the USD/GBP vote. Desler Alisher back later with a revised USD/GBP Wolfer quote of 1.5760/1.5768 Goldworthy must purchase MXN 27,000,000 to pay an invoice at the end of the quarter. In addition to the quotes from Dealer A, Underwood contacts Deser, who provides a bidlotter price of GBP/MXNO/00372. To check whether the deseruotes are reflective of an efficient market Underwood examine whether the nices allow for an arbitraprofit in three months, the firm will rece EUR.000.000 euro trom another citomer. Se months ago the fom sold EUR 3,000,000 ginot the GP in month forward contractan alinance of GBP/TUR0.00. To mark the soution to mar, Underwood collects the GAP/forward ter in in that, the most received by Gwerthyram ve PY 325.000.000 will be ansigtwhich of the following would be the best for the rest USD/GBP dealer uute of 5760/1.57687 as the quotes from Deler And, there are protraction of 27,000,000 would be done to do 1,2 edematon for Goworlysforwardini the 26/EUR Forward Bates Maturity Forward Point Dor month 440/455 Three month VISO Six months 290/300 Goldworthy alio anks for the current day likes for the major currencies Selected three month maled) are shown in the 3 Galworthy diet and says, we have the Gent 2, Underwood hid condude that the month ORLD Get on the charrematontin und here in toata 10-day forced Prenume for the USG be dous 07 i 1.2, and when it condition would Goldwerthynuly see the or The only and Gowth within the future PV/ GP rate is most Anna Goldsworthy is the chief financial officer of a manufacturing firm headquartered in the United Kingdom. She is responsible for overseeing exposure to price risk in both the commodity and currency markets. Goldsworthy is settling her end of quarter transactions and creating reports. Her intern, Scott Underwood, assists her in this process. The firm hedges input costs using forward contracts that are priced in US dollars (USD) and Mexican pesos (MXN). Processed goods are packaged for sale under licensing agreements with firms in foreign markets. Goldsworthy is expecting to receive a customer payment of JPY 225,000,000 Uapanese yen) that she wants to convert to pounds sterling (GBP). Underwood gathers the exchange rates from Dealer Ain Exhibit 1. Exhibit 1 Dealer A's Spot Exchange Rates Spot Exchange Rates Currency Pair (Price/Base) Bid Midpoint JPY/GBP 187.39 187.43 18741 MXN/USD 17.147 17.330 17.239 GBP/EUR 0.7342 0.7344 0.7343 USD/EUR 1.1572 1.1576 1.1574 USD/GBP 1.5762 1.5766 1.576 Offer The firm must also buy USD to pay a major supplier. Goldsworthy calls Dealer A with specific details of the transaction and asks to verify the USD/GBP quote. Dealer A calls her back later with a revised USD/GBP bid/offer quote of 1.5760/1.5768 Goldsworthy must purchase MXN 27,000,000 to pay an invoice at the end of the quarter. In addition to the quotes from Dealer A, Underwood contacts Dealer B, who provides a bid/offer price of GBP/MXN 0.0366/0.0372. To check whether the dealer quotes are reflective of an efficient market, Underwood examines whether the prices allow for an arbitrage profit In three months, the firm will receive EUR 5,000,000 (euros) from another customer. Six months ago the firm sold EUR 5,000,000 against the GBP using a ninemonth forward contract at an all-in price of GBP/EUR 0.7400. To mark the position to market, Underwood collects the GBP/EUR forward rates in Exhibit 2. Exhibit 2: GBP/EUR Forward Rates Maturity Forward Points One month 4.40/4.55 Three months 14.0/15.0 Six months 29.0/30.0 Goldsworthy also asks for the current 90-day lines for the major currencies Selected three month Libeca laoanalized) are shown in Exhibit ). Goldsworthy studies Exhibit 3 and says. "We have the spot rate and the 90-day forward rate for GBP/EUR. As long as we have the GBP 90-day Libor, we will be able to calculate the implied EUR 90-day Libor." Exhibit 3: 90-Day Libor Currency Annualized Rate GBP 0.5800% JPY 0.0893% USD 0.3300% After reading a draft report, Underwood notes, "We do not hedge the incoming Japanese yen cash flow. Your report asks for a forecast of the JPY/GBP exchange rate in 90 days. We know the JPY/GBP spot exchange rate." He asks, "Does the information we have collected tell us what the JPY/GBP exchange rate will be in 90 days?" Goldsworthy replies, "The JPY/GBP exchange rate in 90 days would be a valuable piece of information to know. An international parity condition can be used to provide an estimate of the future spot rate." Q1) Using the quotes in Exhibit 1, the amount received by Goldsworthy from converting JPY 225,000,000 will be Q2) Using Exhibit 1, which of the following would be the best reason for the revised USD/GBP dealer quote of 1.5760/1.5768? Q3) Using the quotes from Dealer A and B the triangular arbitrage profit on a transaction of MXN 27,000,000 would be closest to: Q4) Based on Exhibits 1, 2, and 3, the mark-to-market gain for Goldsworthy's forward position is closest to: 25) Based on Exhibit 2, Underwood should conclude that three-month EUR Libor is: 26) Based on the exchange rate midpoint in Exhibit 1 and the rates in Exhibit 3, the 90-day forward premium (discount) for the USD/GBP would be closest to: 07) Using Exhibits 1, 2, and 3, which international parity condition would Goldsworthy most likely use to calculate the EUR Libor? Q8) The international parity condition Goldsworthy will use to provide the estimate of the future JPY/GBP spot rate is most likely: spot rate and the 90-day forward rate for GAP/EUR.Aslant we have the GP 90-day Lbor, we will be able to calculate the implied EUR 90-day Libor Anna Goldsworthy as the chief financial officer of a manufacturing firm headquartered in the United Kingdom. She is responsible for overseeing exposure to price risk in both the commodity and Currency markets. Goldsworthy is setting her end-of quarter transactions and creating reports. Her intern, Scott Underwood, assists her in this process. The firm hedges input costs using forward contracts that are priced in US dollar (USD) and Mexican peso (MXN). Processed goods are secaged for sale under licensing agreements with firms in foreign markets. Goldsworthy is expecting to receive customer payment of JPY 225,000,000 Cesente en that she wants to convert to sounds sterling (GBP) Underwood gathers the exchange rates from Dealer Ain behibe 1 Dhibit 1 Dealer A's Spot Exchange Rates Spot Exchange Rates Currency Pair iPrice/Basel Otter Midooint IP/GBP 187.39 187.43 MIN/USD 17.147 17.330 17.230 GBP/EUR 07342 0.744 0.7343 USD/EUR 11572 11576 11574 1.5762 1.5766 1.575 Exhibit 3: 90 Day Liber Currency Annuloed Rate 0.5800 JPY 0.08035 USD 0.100% After reading report, Underwood notes, "We do not hedge the incoming lapanese yen cash flow. Your report asks for a forecast of the JPV/GBP exchange rate in 90 days. We know the IPV/GBP pot exchange rate." Heikes the information we have collected tell us what the P/GBP Exchange rate will be in 90 days?" Goldsworthy replies. "The.JP/GBP exchange rate in 90 days would be a valuable piece of information to know. An international party condition can be used to provide an estimate of the future spot rate USD/GBP The firm must also buy USO to pay a major suppler Goldsworthy calls Dealer with specific details of the transaction and asks to verify the USD/GBP vote. Desler Alisher back later with a revised USD/GBP Wolfer quote of 1.5760/1.5768 Goldworthy must purchase MXN 27,000,000 to pay an invoice at the end of the quarter. In addition to the quotes from Dealer A, Underwood contacts Deser, who provides a bidlotter price of GBP/MXNO/00372. To check whether the deseruotes are reflective of an efficient market Underwood examine whether the nices allow for an arbitraprofit in three months, the firm will rece EUR.000.000 euro trom another citomer. Se months ago the fom sold EUR 3,000,000 ginot the GP in month forward contractan alinance of GBP/TUR0.00. To mark the soution to mar, Underwood collects the GAP/forward ter in in that, the most received by Gwerthyram ve PY 325.000.000 will be ansigtwhich of the following would be the best for the rest USD/GBP dealer uute of 5760/1.57687 as the quotes from Deler And, there are protraction of 27,000,000 would be done to do 1,2 edematon for Goworlysforwardini the 26/EUR Forward Bates Maturity Forward Point Dor month 440/455 Three month VISO Six months 290/300 Goldworthy alio anks for the current day likes for the major currencies Selected three month maled) are shown in the 3 Galworthy diet and says, we have the Gent 2, Underwood hid condude that the month ORLD Get on the charrematontin und here in toata 10-day forced Prenume for the USG be dous 07 i 1.2, and when it condition would Goldwerthynuly see the or The only and Gowth within the future PV/ GP rate is most Anna Goldsworthy is the chief financial officer of a manufacturing firm headquartered in the United Kingdom. She is responsible for overseeing exposure to price risk in both the commodity and currency markets. Goldsworthy is settling her end of quarter transactions and creating reports. Her intern, Scott Underwood, assists her in this process. The firm hedges input costs using forward contracts that are priced in US dollars (USD) and Mexican pesos (MXN). Processed goods are packaged for sale under licensing agreements with firms in foreign markets. Goldsworthy is expecting to receive a customer payment of JPY 225,000,000 Uapanese yen) that she wants to convert to pounds sterling (GBP). Underwood gathers the exchange rates from Dealer Ain Exhibit 1. Exhibit 1 Dealer A's Spot Exchange Rates Spot Exchange Rates Currency Pair (Price/Base) Bid Midpoint JPY/GBP 187.39 187.43 18741 MXN/USD 17.147 17.330 17.239 GBP/EUR 0.7342 0.7344 0.7343 USD/EUR 1.1572 1.1576 1.1574 USD/GBP 1.5762 1.5766 1.576 Offer The firm must also buy USD to pay a major supplier. Goldsworthy calls Dealer A with specific details of the transaction and asks to verify the USD/GBP quote. Dealer A calls her back later with a revised USD/GBP bid/offer quote of 1.5760/1.5768 Goldsworthy must purchase MXN 27,000,000 to pay an invoice at the end of the quarter. In addition to the quotes from Dealer A, Underwood contacts Dealer B, who provides a bid/offer price of GBP/MXN 0.0366/0.0372. To check whether the dealer quotes are reflective of an efficient market, Underwood examines whether the prices allow for an arbitrage profit In three months, the firm will receive EUR 5,000,000 (euros) from another customer. Six months ago the firm sold EUR 5,000,000 against the GBP using a ninemonth forward contract at an all-in price of GBP/EUR 0.7400. To mark the position to market, Underwood collects the GBP/EUR forward rates in Exhibit 2. Exhibit 2: GBP/EUR Forward Rates Maturity Forward Points One month 4.40/4.55 Three months 14.0/15.0 Six months 29.0/30.0 Goldsworthy also asks for the current 90-day lines for the major currencies Selected three month Libeca laoanalized) are shown in Exhibit ). Goldsworthy studies Exhibit 3 and says. "We have the spot rate and the 90-day forward rate for GBP/EUR. As long as we have the GBP 90-day Libor, we will be able to calculate the implied EUR 90-day Libor." Exhibit 3: 90-Day Libor Currency Annualized Rate GBP 0.5800% JPY 0.0893% USD 0.3300% After reading a draft report, Underwood notes, "We do not hedge the incoming Japanese yen cash flow. Your report asks for a forecast of the JPY/GBP exchange rate in 90 days. We know the JPY/GBP spot exchange rate." He asks, "Does the information we have collected tell us what the JPY/GBP exchange rate will be in 90 days?" Goldsworthy replies, "The JPY/GBP exchange rate in 90 days would be a valuable piece of information to know. An international parity condition can be used to provide an estimate of the future spot rate." Q1) Using the quotes in Exhibit 1, the amount received by Goldsworthy from converting JPY 225,000,000 will be Q2) Using Exhibit 1, which of the following would be the best reason for the revised USD/GBP dealer quote of 1.5760/1.5768? Q3) Using the quotes from Dealer A and B the triangular arbitrage profit on a transaction of MXN 27,000,000 would be closest to: Q4) Based on Exhibits 1, 2, and 3, the mark-to-market gain for Goldsworthy's forward position is closest to: 25) Based on Exhibit 2, Underwood should conclude that three-month EUR Libor is: 26) Based on the exchange rate midpoint in Exhibit 1 and the rates in Exhibit 3, the 90-day forward premium (discount) for the USD/GBP would be closest to: 07) Using Exhibits 1, 2, and 3, which international parity condition would Goldsworthy most likely use to calculate the EUR Libor? Q8) The international parity condition Goldsworthy will use to provide the estimate of the future JPY/GBP spot rate is most likely