Question

Spotify is looking at another potential acquisition in the music field. The music service, Stream X, has projected sales of $125 million next year. Costs

Spotify is looking at another potential acquisition in the music field. The music service, Stream X, has projected sales of $125 million next year. Costs (including depreciation) are expected to be 74 percent of sales and depreciation and net investment (PPE and working capital) are expected to be 3 percent and 5 percent of sales, respectively. Sales are expected to grow at 20 percent the following year, with the growth rate declining by 4 percentage points per year until the growth rate reaches 4 percent, where it is expected to then drop to 3 percent the next year and remain there indefinitely. Stream X has debt of $65 million outstanding . There are 1.5 million shares of stock outstanding and investors require a return of 12 percent on the company's stock. The corporate tax rate is 25 percent.

Create a new Excel worksheet tab with the name of the company at the top. Show all steps in your process to answer the following questions.

Start a new worksheet tab to answer this question. Place your name and the name of the company at the top of the page.

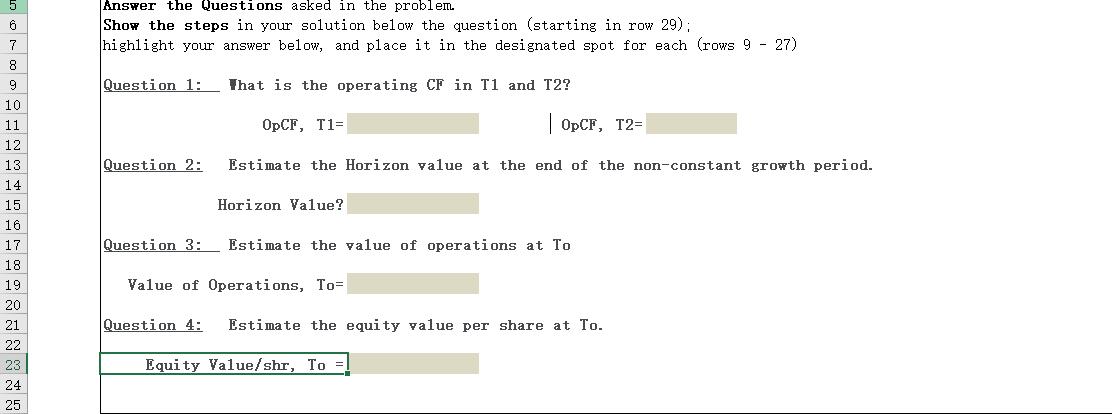

What is your estimate of the value of Stream X today? In answering, provide an explicit detailing of the following:

The Operating Cash flow in T1 and T2.

The Horizon value at the end of the non-constant growth period.

Your estimate of the Value of Operations.

Your estimate of the Equity value per share.

Use Excel to show work.

Answer the Questions asked in the problem Show the steps in your solution below the question (starting in row 29); highlight your answer below, and place it in the designated spot for each (rows 9 - 27) 6 7 8. 9 Question 1: That is the operating CF in T1 and T2? 10 11 OPCF, T1= |OPCF, T2= 12 13 Question 2: Estimate the Horizon value at the end of the non-constant growth period. 14 15 Horizon Value? 16 17 Question 3: Estimate the value of operations at To 18 19 Value of Operations, To= 20 21 Question 4: Estimate the equity value per share at To. 22 23. Equi ty Value/shr, To 24 25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

FL42 fe FC FD FE FF FG FH FI FJ 1 Share Price StreamX 2 Year 2 3 4 5 6 Growth Rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started