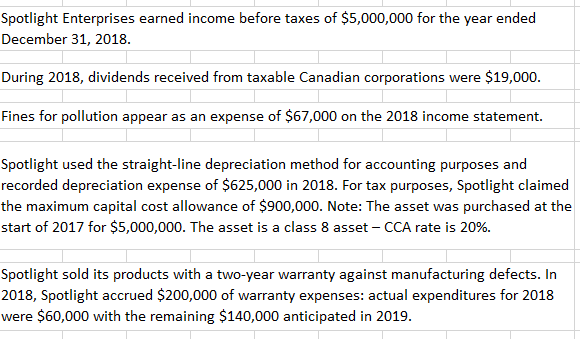

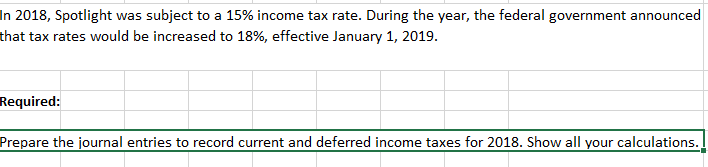

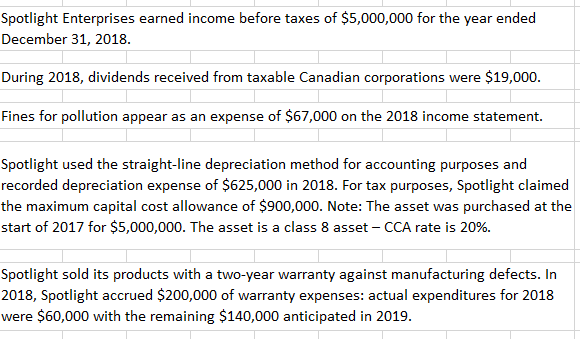

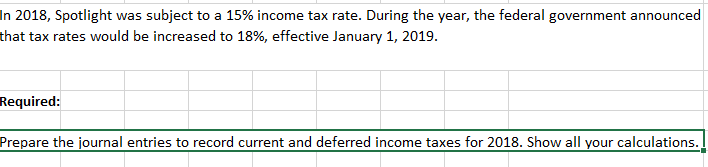

Spotlight Enterprises earned income before taxes of $5,000,000 for the year ended December 31, 2018. During 2018, dividends received from taxable Canadian corporations were $19,000. Fines for pollution appear as an expense of $67,000 on the 2018 income statement. Spotlight used the straight-line depreciation method for accounting purposes and recorded depreciation expense of $625,000 in 2018. For tax purposes, Spotlight claimed the maximum capital cost allowance of $900,000. Note: The asset was purchased at the start of 2017 for $5,000,000. The asset is a class 8 asset - CCA rate is 20%. Spotlight sold its products with a two-year warranty against manufacturing defects. In 2018, Spotlight accrued $200,000 of warranty expenses: actual expenditures for 2018 were $60,000 with the remaining $140,000 anticipated in 2019. In 2018, Spotlight was subject to a 15% income tax rate. During the year, the federal government announced that tax rates would be increased to 18%, effective January 1, 2019. Required: Prepare the journal entries to record current and deferred income taxes for 2018. Show all your calculations.! Spotlight Enterprises earned income before taxes of $5,000,000 for the year ended December 31, 2018. During 2018, dividends received from taxable Canadian corporations were $19,000. Fines for pollution appear as an expense of $67,000 on the 2018 income statement. Spotlight used the straight-line depreciation method for accounting purposes and recorded depreciation expense of $625,000 in 2018. For tax purposes, Spotlight claimed the maximum capital cost allowance of $900,000. Note: The asset was purchased at the start of 2017 for $5,000,000. The asset is a class 8 asset - CCA rate is 20%. Spotlight sold its products with a two-year warranty against manufacturing defects. In 2018, Spotlight accrued $200,000 of warranty expenses: actual expenditures for 2018 were $60,000 with the remaining $140,000 anticipated in 2019. In 2018, Spotlight was subject to a 15% income tax rate. During the year, the federal government announced that tax rates would be increased to 18%, effective January 1, 2019. Required: Prepare the journal entries to record current and deferred income taxes for 2018. Show all your calculations