Question

Spottify Electronics had a computer failure on October 1, 2020, that resulted in the loss of data, including the balance of its Cash account and

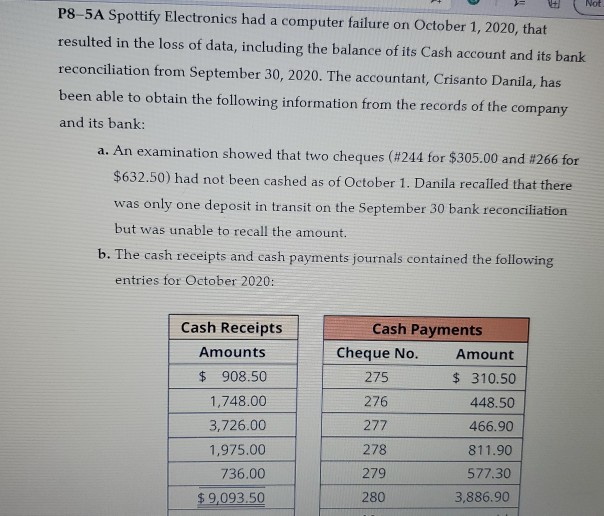

Spottify Electronics had a computer failure on October 1, 2020, that resulted in the loss of data, including the balance of its Cash account and its bank reconciliation from September 30, 2020. The accountant, Crisanto Danila, has been able to obtain the following information from the records of the company and its bank:

a)An examination showed that two cheques (#244 for $305.00 and #266 for $632.50) had not been cashed as of October 1. Danila recalled that there was only one deposit in transit on the September 30 bank reconciliation but was unable to recall the amount.

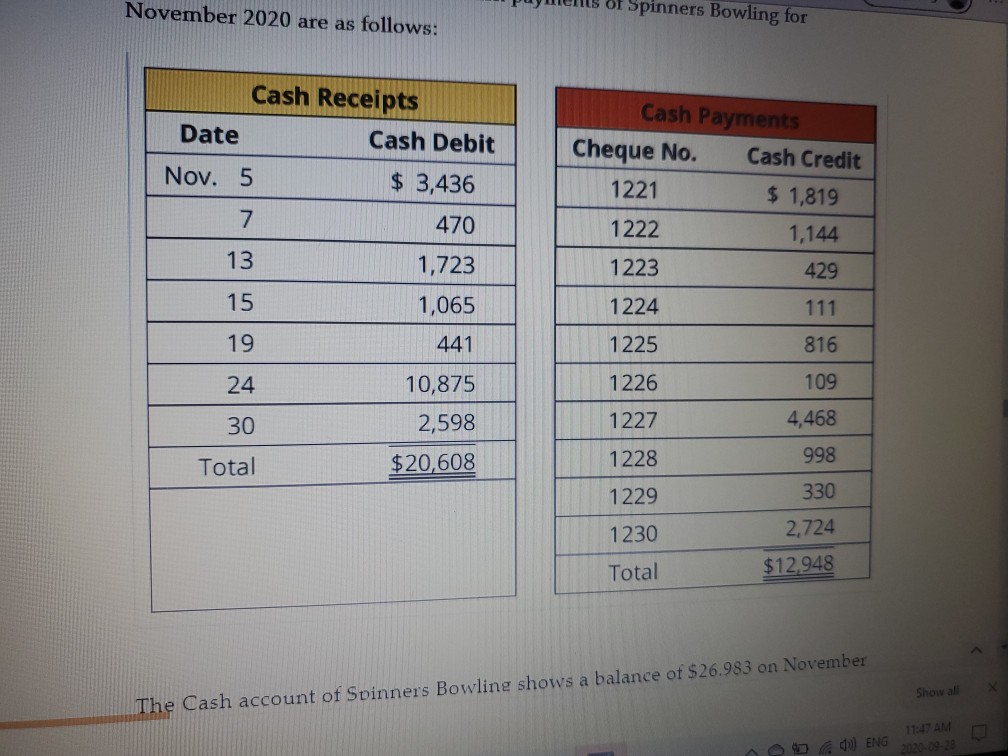

b)The cash receipts and cash payments journals contained the following entries for October 2020:

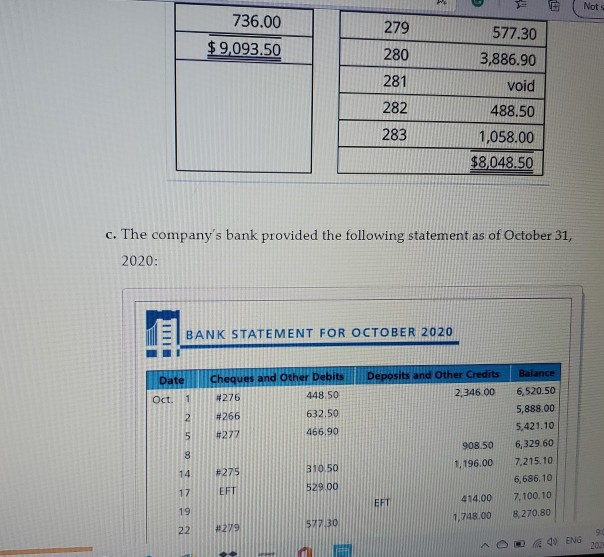

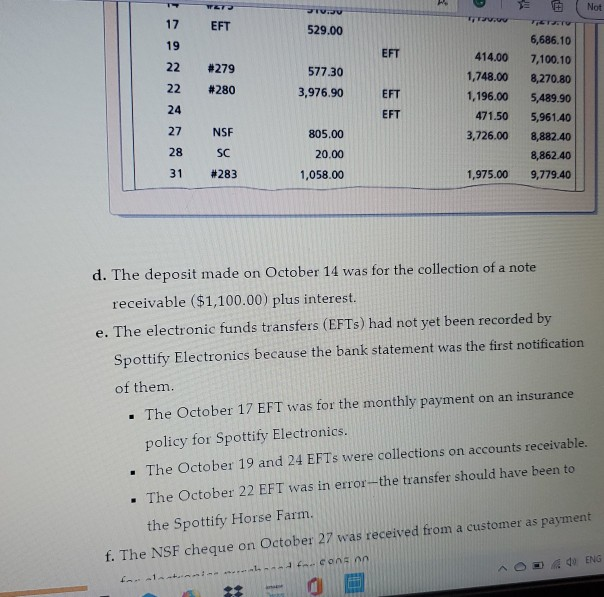

The companys bank provided the following statement as of October 31, 2020:

d)The deposit made on October 14 was for the collection of a note receivable ($1,100.00) plus interest.

f)The electronic funds transfers (EFTs) had not yet been recorded by Spottify Electronics because the bank statement was the first notification of them.

-The October 17 EFT was for the monthly payment on an insurance policy for Spottify Electronics. The

-October 19 and 24 EFTs were collections on accounts receivable.

-The October 22 EFT was in errorthe transfer should have been to the Spottify Horse Farm.

f)The NSF cheque on October 27 was received from a customer as payment for electronics purchased for $805.00. g)Cheque #280 was correctly written for $3,976.90 for the purchase of inventory (assume a periodic system) but incorrectly recorded by the cash payments clerk.

Required Prepare a bank reconciliation as of October 31, 2020, including the calculation of the book balance of October 31, 2020.

Prepare all journal entries that would be required by the bank reconciliation. No explanations are needed.

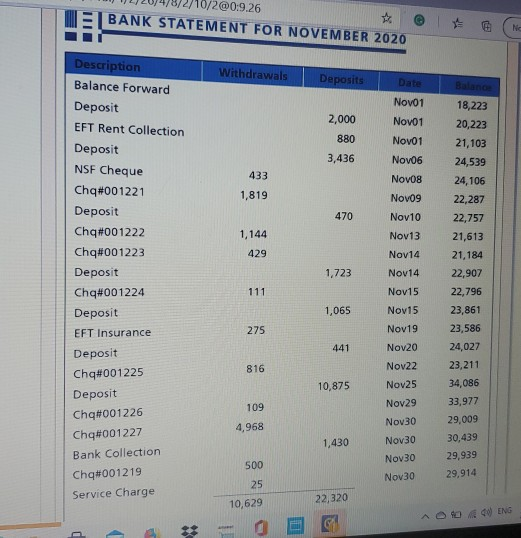

November 2020 are as follows: of Spinners Bowling for Cash Receipts Date Cash Debit Nov. 5 $ 3,436 7 470 Cash Payments Cheque No. Cash Credit 1221 $ 1,819 1222 1,144 13 1,723 1223 429 15 1,065 1224 111 19 441 1225 816 24 1226 109 10,875 2,598 30 1227 4,468 Total 998 $20, 1228 1229 330 1230 2,724 Total $12.948 Show all The Cash account of Spinners Bowling shows a balance of $26.983 on November (0) ENG 11:47 AM 202009 /10/200:9.26 BANK STATEMENT FOR NOVEMBER 2020 Na Withdrawals Deposits Nov01 Novo1 2,000 880 3,436 Novo1 Nov06 433 Nov08 1,819 Description Balance Forward Deposit EFT Rent Collection Deposit NSF Cheque Chq#001221 Deposit Chq#001222 Chq#001223 Deposit Cha#001224 Deposit EFT Insurance Deposit Chq#001225 Novog Nov10 470 1,144 429 Nov13 Nov14 1,723 Nov14 18,223 20,223 21,103 24,539 24, 106 22,287 22,757 21,613 21,184 22,907 22,796 23,861 23,586 24,027 23,211 34,086 33,977 29,009 30,439 29,939 111 Nov15 Nov15 1,065 275 Nov19 441 816 Nov20 Nov22 Nov25 10,875 109 4,968 Deposit Cha#001226 Ch#001227 Bank Collection Chq#001219 Service Charge Nov29 Nov 30 Nov 30 Nov 30 1,430 500 Nov 30 29,914 25 10,629 22,320 400 ENG * Not P8-5A Spottify Electronics had a computer failure on October 1, 2020, that resulted in the loss of data, including the balance of its Cash account and its bank reconciliation from September 30, 2020. The accountant, Crisanto Danila, has been able to obtain the following information from the records of the company and its bank: a. An examination showed that two cheques (#244 for $305.00 and #266 for $632.50) had not been cashed as of October 1. Danila recalled that there was only one deposit in transit on the September 30 bank reconciliation but was unable to recall the amount. b. The cash receipts and cash payments journals contained the following entries for October 2020: Cash Receipts Amounts $ 908.50 1,748.00 3,726.00 1,975.00 736.00 $9,093.50 Cash Payments Cheque No. Amount 275 $ 310.50 276 448.50 277 466.90 278 811.90 279 577.30 280 3,886.90 W Not 736.00 279 $ 9,093.50 577.30 3,886.90 280 281 void 282 488.50 283 1,058.00 $8,048.50 c. The company's bank provided the following statement as of October 31, 2020: BANK STATEMENT FOR OCTOBER 2020 Date Deposits and Other Credits 2,346.00 Oct. 1 Cheques and Other Debits 9276 448.50 #266 632.50 #27% 466,90 2 5 908.50 Balance 6,520.50 5,888.00 5,421.10 6,329.60 7,215.10 6,686.10 7,100,10 8.270.80 8 1196.00 310.50 14 #275 17 EFT 529.00 EFT 19 414.00 1,748.00 22 #279 577.30 40 ENG ET- Not JV.D 17 EFT 529.00 19 EFT 22 #279 22 577.30 3,976.90 #280 EFT 414.00 1,748.00 1,196.00 471.50 3,726.00 24 6,686.10 7,100.10 8,270.80 5,489.90 5,961.40 8,882.40 8,862.40 9,779.40 EFT 27 NSF 805.00 28 SC 20.00 31 #283 1,058.00 1,975.00 d. The deposit made on October 14 was for the collection of a note receivable ($1,100.00) plus interest. e. The electronic funds transfers (EFTs) had not yet been recorded by Spottify Electronics because the bank statement was the first notification of them. The October 17 EFT was for the monthly payment on an insurance policy for Spottify Electronics. The October 19 and 24 EFTs were collections on accounts receivable. The October 22 EFT was in error--the transfer should have been to the Spottify Horse Farm. f. The NSF cheque on October 27 was received from a customer as payment ENG 1. COA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started