Answered step by step

Verified Expert Solution

Question

1 Approved Answer

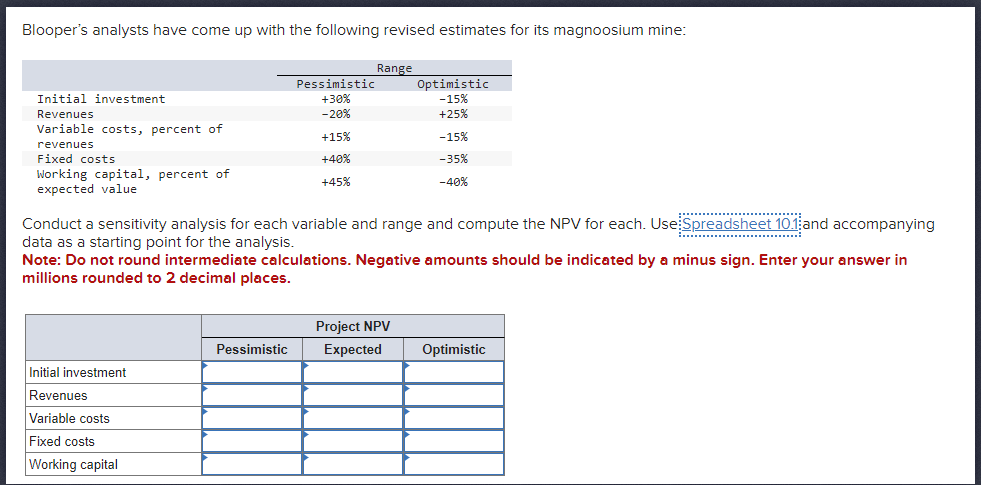

SPREADSHEET 10.1 Financial projections for Blooper's Magnoosium mine (dollar values in millions) A. Inputs Initial investment 150 Salvage value 20 Initial revenues 150 Variable costs

| SPREADSHEET 10.1 Financial projections for Blooper's Magnoosium mine (dollar values in millions) | |||||||

| A. Inputs | |||||||

| Initial investment | 150 | ||||||

| Salvage value | 20 | ||||||

| Initial revenues | 150 | ||||||

| Variable costs (% of revenues) | 40.0% | ||||||

| Initial fixed costs | 40 | ||||||

| Inflation rate (%) | 5.0% | ||||||

| Discount rate (%) | 12.0% | ||||||

| Receivables (% of sales) | 16.7% | ||||||

| Inventory (% of next year's costs) | 15.0% | ||||||

| Tax rate (%) | 21.0% | ||||||

| Year: | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

| B. Capital Investments | |||||||

| Investments in fixed assets | 150.00 | ||||||

| Sales of fixed assets | 15.80 | ||||||

| Cash flow investment in fixed assets | -150.00 | 15.80 | |||||

| C. Operating cash flow | |||||||

| Revenues | 150.00 | 157.50 | 165.38 | 173.64 | 182.33 | ||

| Variable expenses | 60.00 | 63.00 | 66.15 | 69.46 | 72.93 | ||

| Fixed expenses | 40.00 | 42.00 | 44.10 | 46.31 | 48.62 | ||

| Depreciation | 30.00 | 30.00 | 30.00 | 30.00 | 30.00 | ||

| Pretax profit | 20.00 | 22.50 | 25.13 | 27.88 | 30.78 | ||

| Tax | 4.20 | 4.73 | 5.28 | 5.86 | 6.46 | ||

| Profit after tax | 15.80 | 17.78 | 19.85 | 22.03 | 24.31 | ||

| Operating cash flow | 45.80 | 47.78 | 49.85 | 52.03 | 54.31 | ||

| D. Working capital | |||||||

| Working capital | 15.00 | 40.75 | 42.79 | 44.93 | 47.17 | 30.39 | 0.00 |

| Change in working capital | 15.00 | 25.75 | 2.04 | 2.14 | 2.25 | -16.79 | -30.39 |

| Cash flow from investment in working capital | -15.00 | -25.75 | -2.04 | -2.14 | -2.25 | 16.79 | 30.39 |

| 0.408 | 0.408 | 0.408 | 0.408 | 0.250 | |||

| E. Project valuation | |||||||

| Total project cash flow | -165.00 | 20.05 | 45.74 | 47.71 | 49.78 | 71.10 | 46.19 |

| Discount factor | 1.00 | 0.8929 | 0.7972 | 0.7118 | 0.6355 | 0.5674 | 0.5066 |

| PV of cash flow | -165.00 | 17.90 | 36.46 | 33.96 | 31.64 | 40.34 | 23.40 |

| Net present value | 18.70 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started