Answered step by step

Verified Expert Solution

Question

1 Approved Answer

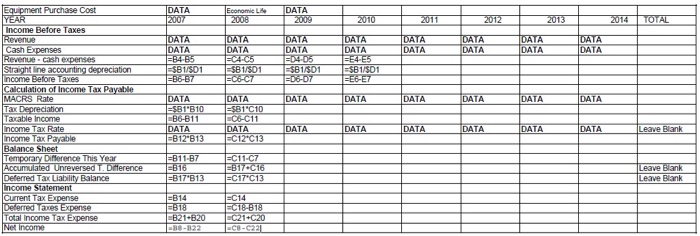

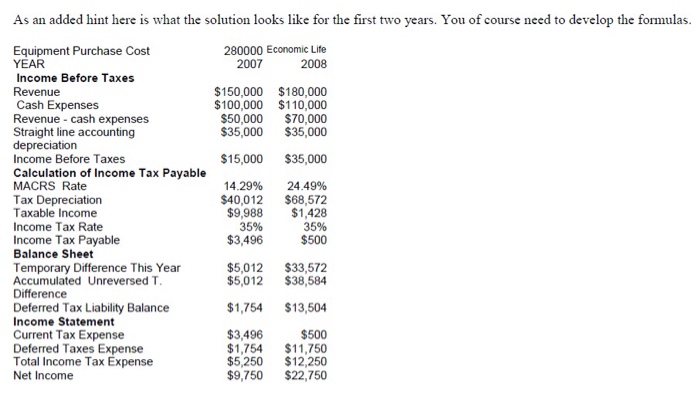

Spreadsheet Assignment Using the information from the case below develop a Spreadsheet to find income tax expense and net income for the years 2007 to

Spreadsheet Assignment Using the information from the case below develop a Spreadsheet to find income tax expense and net

income for the years 2007 to 2014 for the Quark Donut Company Inc. Submit the spreadsheet results and the formulas and answer all

questions required below!

THE CASE

Quark Donut Company was incorporated (as a C corporation) and started business in 2007, make and sell donuts. Quark rented

space in a local mall with a 8 year operating lease. Quark's only capital expenditure was the purchase in January of 2007 of equipment at a

cost of $280,000. This equipment has an economic life of 8 years and 0 expected salvage value. Quark uses straight line depreciation for

computation of GAAP net income because this best reflects the true economic depreciation of the equipment. For income tax purposes

Quark is permitted to use MACRS (the modified accelerated cost recovery system), and the equipment is considered to be in the 7 year

class. Therefore the allowed MACRS rates are: 14.29% the first year, 24.49% the second year, 17.49% the third year, 12.49% the fourth

year 8.93% the fifth year, 8.92% in the sixth 8.93% in the seventh year and 4.46% in the 8th year. Depreciation is the only non-cash

expense, and is the only source of a difference between taxable income and financial accounting income before tax. Assume an income

tax rate of 35% is enacted for the years 2007-2009. During the year 2010 a new income tax rate of 30% was enacted for 2010 to 2014.

Projected revenues and operating expenses (excluding taxes and depreciation) are as follows:

Year 2007 2008 2009 2010

Revenues $150,000 $180,000 $185,000 $190,000

Expenses $100,000 $110,000 $113,000 $116,000

Year 2011 2012 2013 2014

Revenues $195,000 $200,000 $200,000 $200,000

Expenses $127,000 $132,000 $135,000 $138,000

_____________________________________________________________

Required:

I. Use a spreadsheet to find: (note: your spreadsheet is the answer to part I)

a. income taxes paid that year(current income tax payable)

b. deferred tax liability

c. the change in deferred tax liability (equal to deferred income tax expense)

d. total income tax expense,

e. net income

II. Using the numbers from your spreadsheet hand write the correct journal entry for

income taxes for the year 2010.

III. Find the effective tax rate for 2010 and explain why the effective tax rate for 2010 is not 30%

IV. Assuming the straight line method yields the true economic depreciation what is the advantages of being able to use MACRS for

income tax determinations? Why are tax effects important in deciding whether this is a good investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started