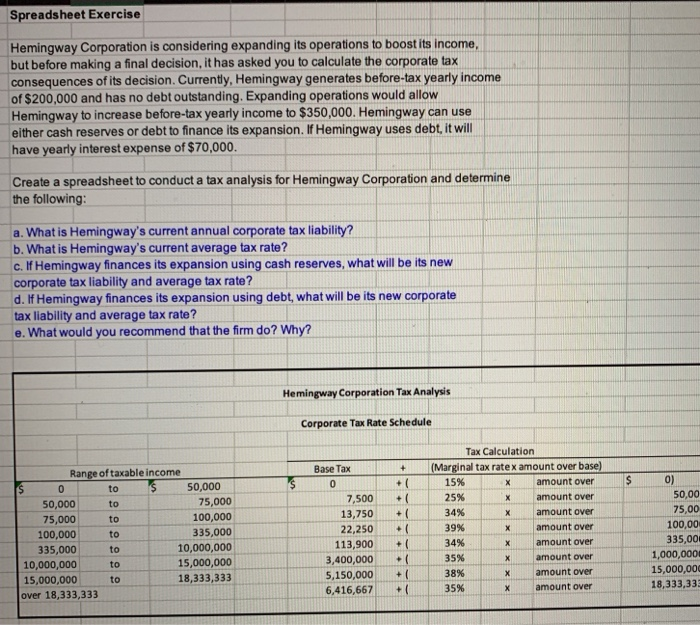

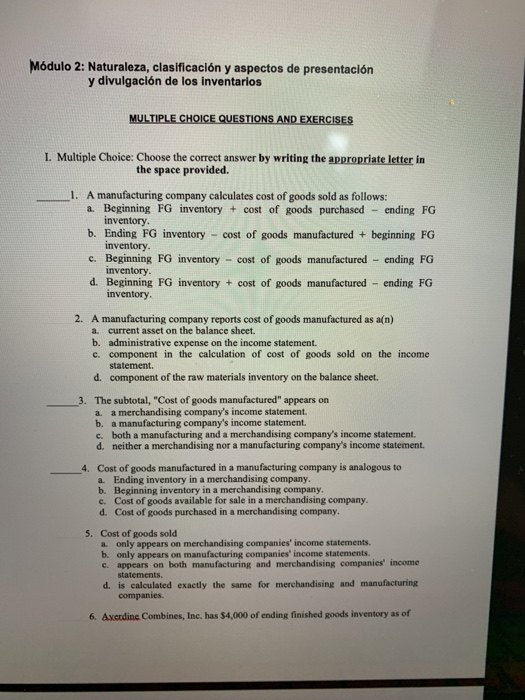

Spreadsheet Exercise Hemingway Corporation is considering expanding its operations to boost its income, but before making a final decision, it has asked you to calculate the corporate tax consequences of its decision. Currently, Hemingway generates before-tax yearly income of $200,000 and has no debt outstanding. Expanding operations would allow Hemingway to increase before-tax yearly income to $350,000. Hemingway can use either cash reserves or debt to finance its expansion. If Hemingway uses debt, it will have yearly interest expense of $70,000. Create a spreadsheet to conduct a tax analysis for Hemingway Corporation and determine the following: a. What is Hemingway's current annual corporate tax liability? b. What is Hemingway's current average tax rate? c. If Hemingway finances its expansion using cash reserves, what will be its new corporate tax liability and average tax rate? d. If Hemingway finances its expansion using debt, what will be its new corporate tax liability and average tax rate? e.What would you recommend that the firm do? Why? Hemingway Corporation Tax Analysits Corporate Tax Rate Schedule Tax Calculation Base Tax (Marginal tax rate x amount over base Range of taxable income x amount overS0) $50,000 to to to to 25% 34% 39% 34% 35% 38% 35% amount over amount over amount over x amount over amount over amount over x amount over 50,00 75,00 100,00 335,00 1,000,000 15,000,000 18,333,33 7,500 + 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 50,000 75,000 100,000 +( 13,750 22,250 113,900 3,400,000 5,150,000 6,416,667| +( + ( + ( +( 35000 to to .| 10,000,000 15,000,000 to | over 18,333,333 Mdulo 2: Naturaleza, clasificacin y aspectos de presentacin y divulgacin de los inventarios I. Multiple Choice: Choose the correct answer by writing the appropriate letter in the space provided. A manufacturing company calculates cost of goods sold as follows: a. Beginning FG inventory + cost of goods purchased ending FG 1. inventory b. Ending FG inventory cost of goods manufactured + beginning FG inventory c. Beginning FG inventory cost of goods manufactured ending FG inventory. d. Beginning FG inventory cost of goods manufactured ending FG inventory 2. A manufacturing company reports cost of goods manufactured as a(n) a. current asset on the balance sheet b. administrative expense on the income statement. c. component in the calculation of cost of goods sold on the income statement d. component of the raw materials inventory on the balance sheet. The subtotal, "Cost of goods manufactured" appears on a. 3. a merchandising company's income statement. b. a manufacturing company's income statement. both a manufacturing and a merchandising company's income statement. c. d. neither a merchandising nor a manufacturing company's income statement. 4. Cost of goods manufactured in a manufacturing company is analogous to Ending inventory in a merchandising company a. b. Beginning inventory in a merchandising company. Cost of goods available for sale in a merchandising company. c. d. Cost of goods purchased in a merchandising company. 5. Cost of goods sold a only appears on merchandising companies' income statements. b. only appears on manufacturing companies' income statements. c. appears on both manufacturing and merchandising companies income statements. d. is calculated exactly the same for merchandising and manufacturing companies. 6. Axerdine Combines, Inc, has $4,000 of ending finished goods inventory as of Spreadsheet Exercise Hemingway Corporation is considering expanding its operations to boost its income, but before making a final decision, it has asked you to calculate the corporate tax consequences of its decision. Currently, Hemingway generates before-tax yearly income of $200,000 and has no debt outstanding. Expanding operations would allow Hemingway to increase before-tax yearly income to $350,000. Hemingway can use either cash reserves or debt to finance its expansion. If Hemingway uses debt, it will have yearly interest expense of $70,000. Create a spreadsheet to conduct a tax analysis for Hemingway Corporation and determine the following: a. What is Hemingway's current annual corporate tax liability? b. What is Hemingway's current average tax rate? c. If Hemingway finances its expansion using cash reserves, what will be its new corporate tax liability and average tax rate? d. If Hemingway finances its expansion using debt, what will be its new corporate tax liability and average tax rate? e.What would you recommend that the firm do? Why? Hemingway Corporation Tax Analysits Corporate Tax Rate Schedule Tax Calculation Base Tax (Marginal tax rate x amount over base Range of taxable income x amount overS0) $50,000 to to to to 25% 34% 39% 34% 35% 38% 35% amount over amount over amount over x amount over amount over amount over x amount over 50,00 75,00 100,00 335,00 1,000,000 15,000,000 18,333,33 7,500 + 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 50,000 75,000 100,000 +( 13,750 22,250 113,900 3,400,000 5,150,000 6,416,667| +( + ( + ( +( 35000 to to .| 10,000,000 15,000,000 to | over 18,333,333 Mdulo 2: Naturaleza, clasificacin y aspectos de presentacin y divulgacin de los inventarios I. Multiple Choice: Choose the correct answer by writing the appropriate letter in the space provided. A manufacturing company calculates cost of goods sold as follows: a. Beginning FG inventory + cost of goods purchased ending FG 1. inventory b. Ending FG inventory cost of goods manufactured + beginning FG inventory c. Beginning FG inventory cost of goods manufactured ending FG inventory. d. Beginning FG inventory cost of goods manufactured ending FG inventory 2. A manufacturing company reports cost of goods manufactured as a(n) a. current asset on the balance sheet b. administrative expense on the income statement. c. component in the calculation of cost of goods sold on the income statement d. component of the raw materials inventory on the balance sheet. The subtotal, "Cost of goods manufactured" appears on a. 3. a merchandising company's income statement. b. a manufacturing company's income statement. both a manufacturing and a merchandising company's income statement. c. d. neither a merchandising nor a manufacturing company's income statement. 4. Cost of goods manufactured in a manufacturing company is analogous to Ending inventory in a merchandising company a. b. Beginning inventory in a merchandising company. Cost of goods available for sale in a merchandising company. c. d. Cost of goods purchased in a merchandising company. 5. Cost of goods sold a only appears on merchandising companies' income statements. b. only appears on manufacturing companies' income statements. c. appears on both manufacturing and merchandising companies income statements. d. is calculated exactly the same for merchandising and manufacturing companies. 6. Axerdine Combines, Inc, has $4,000 of ending finished goods inventory as of