Answered step by step

Verified Expert Solution

Question

1 Approved Answer

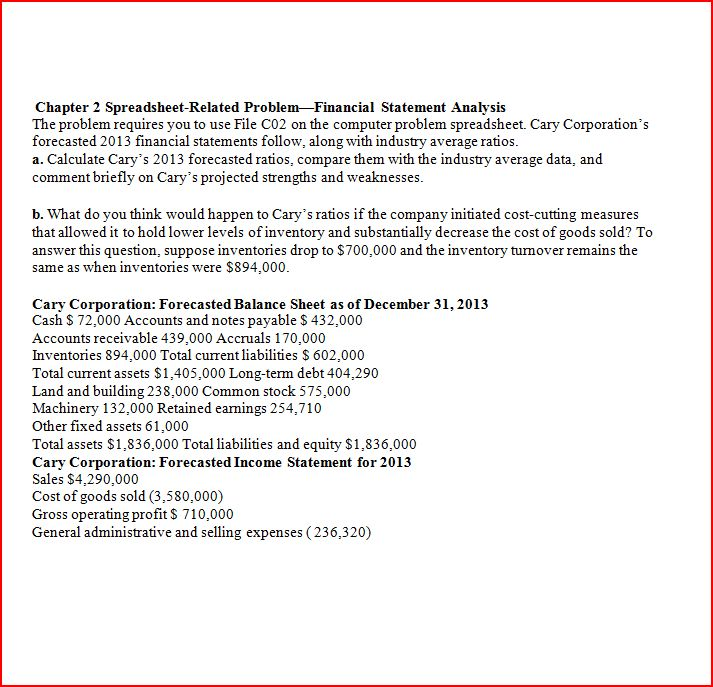

Spreadsheet-Related Problem-Financial Statement Analysis The problem requires you to use File C02 on the computer problem spreadsheet. Cary Corporation's forecasted 2013 financial statements follow, along

Spreadsheet-Related Problem-Financial Statement Analysis The problem requires you to use File C02 on the computer problem spreadsheet. Cary Corporation's forecasted 2013 financial statements follow, along with industry average ratios. Calculate Cary's 2013 forecasted ratios, compare them with the industry average data, and comment briefly on Cary's projected strengths and weaknesses. What do you think would happen to Cary's ratios if the company initiated cost-cutting measures that allowed it to hold lower levels of inventory and substantially decrease the cost of goods sold? To answer this question, suppose inventories drop to $700,000 and the inventory turnover remains the same as when inventories were $894,000. Cary Corporation: Forecasted Balance Sheet as of December 31,2013 Cash $ 72,000 Accounts and notes payable $ 432,000 Accounts receivable 439,000 Accruals 170,000 Inventories 894,000 Total current liabilities $ 602,000 Total current assets $1,405,000 Long-term debt 404,290 Land and building 238,000 Common stock 575,000 Machinery 132,000 Retained earnings 254,710 Other fixed assets 61,000 Total assets $1,836,000 Total liabilities and equity $1,836,000 Cary Corporation: Forecasted Income Statement for 2013 Sales $4,290,000 Cost of goods sold (3,580,000) Gross operating profit $ 710,000 General administrative and selling expenses (236,320) Spreadsheet-Related Problem-Financial Statement Analysis The problem requires you to use File C02 on the computer problem spreadsheet. Cary Corporation's forecasted 2013 financial statements follow, along with industry average ratios. Calculate Cary's 2013 forecasted ratios, compare them with the industry average data, and comment briefly on Cary's projected strengths and weaknesses. What do you think would happen to Cary's ratios if the company initiated cost-cutting measures that allowed it to hold lower levels of inventory and substantially decrease the cost of goods sold? To answer this question, suppose inventories drop to $700,000 and the inventory turnover remains the same as when inventories were $894,000. Cary Corporation: Forecasted Balance Sheet as of December 31,2013 Cash $ 72,000 Accounts and notes payable $ 432,000 Accounts receivable 439,000 Accruals 170,000 Inventories 894,000 Total current liabilities $ 602,000 Total current assets $1,405,000 Long-term debt 404,290 Land and building 238,000 Common stock 575,000 Machinery 132,000 Retained earnings 254,710 Other fixed assets 61,000 Total assets $1,836,000 Total liabilities and equity $1,836,000 Cary Corporation: Forecasted Income Statement for 2013 Sales $4,290,000 Cost of goods sold (3,580,000) Gross operating profit $ 710,000 General administrative and selling expenses (236,320)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started