Answered step by step

Verified Expert Solution

Question

1 Approved Answer

spring 2 0 2 4 Final Exam - Real Exam 0 5 1 6 ? 2 0 2 2 4 . ( 2 0 /

spring Final Exam Real Exam

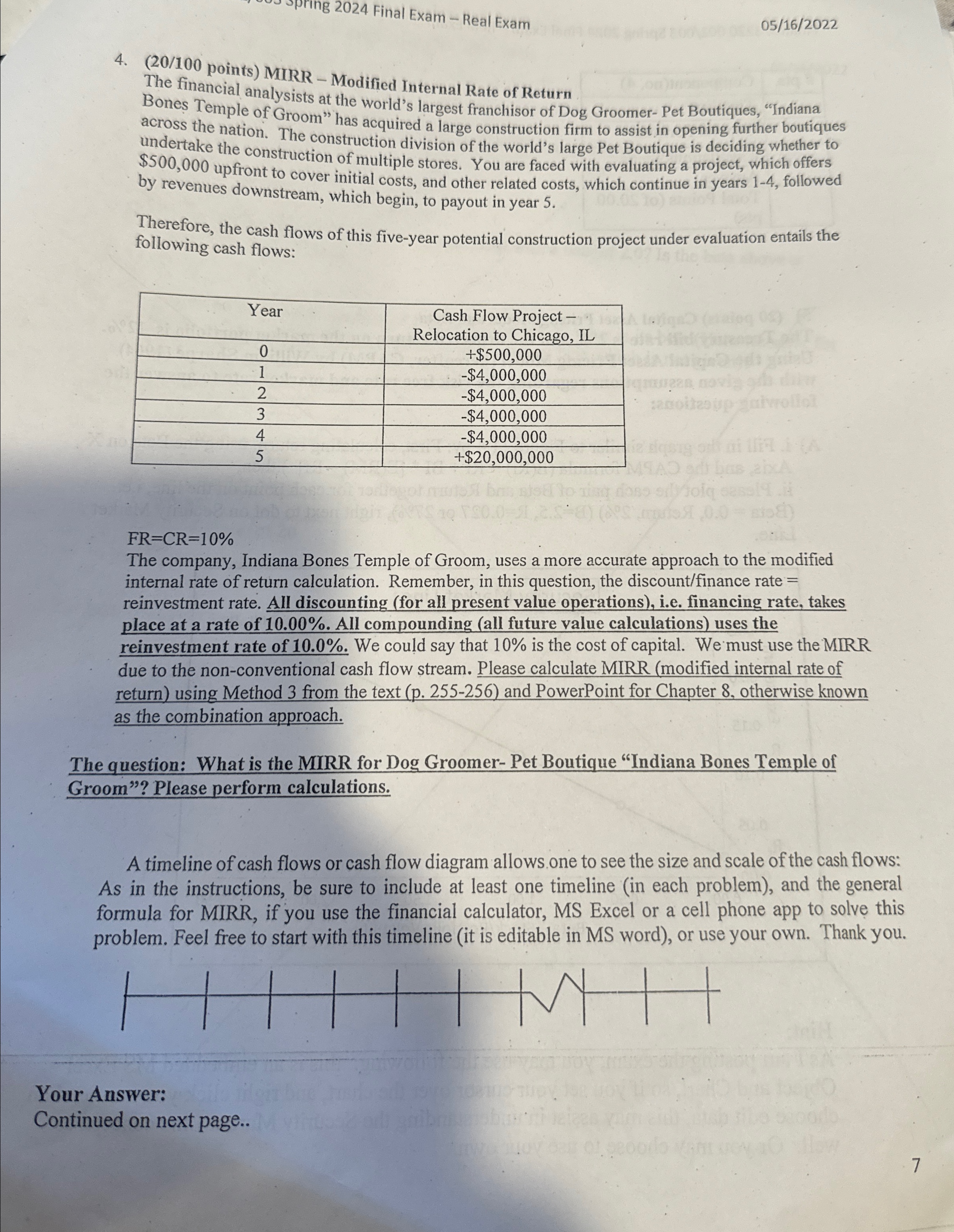

points MIRR Modified Internal Rate of Return

The financial analysists at the world's largest franchisor of Dog Groomer Pet Boutiques, "Indiana Bones Temple of Groom" has acquired a large construction firm to assist in opening further boutiques across the nation. The construction division of the world's large Pet Boutique is deciding whether to undertake the construction of multiple stores. You are faced with evaluating a project, which offers $ upfront to cover initial costs, and other related costs, which continue in years followed by revenues downstream, which begin, to payout in year

Therefore, the cash flows of this fiveyear potential construction project under evaluation entails the following cash flows:

tableYeartableCash Flow Project Relocation to Chicago, IL$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started