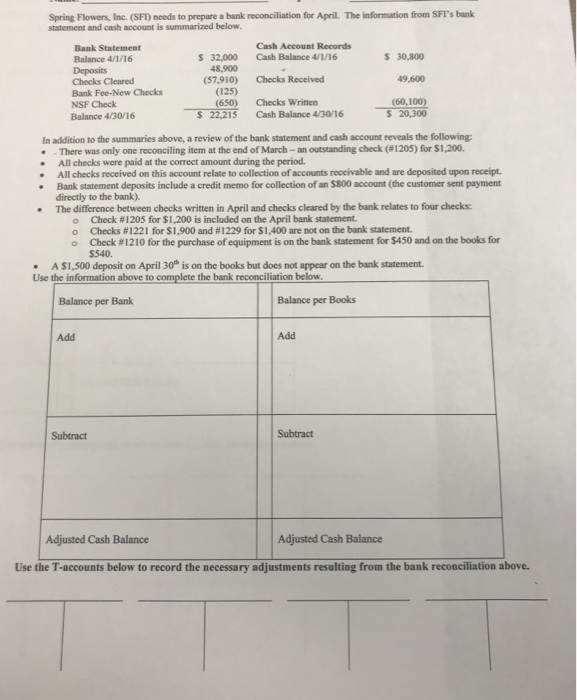

Spring Flowers, Inc. (SFI) needs to prepare a bank reconciliation for April. The information from SFI's bank statement and cash account is summarized below. Cash Account Records Bank Statement Balance 4/1/16 Deposits Checks Cleared Bank Fee-New Checks NSF Check Balance 4/30/16 30,800 S 32,000 48,900 (57,910) (125) (650) Cash Balance 4/1/16 Checks Received Checks Written 49,600 S 22,213 Cash Balance 4/30/16 s 20,300 In addition to the summaries above, a review of the bank statement and cash account reveals the following * There was only one reconciling item at the end ofMarch-an outstanding check (#1205) for S1200. . All checks were paid at the correct amount during the period .All checks received on this account relate to collection of accounts receivable and are deposited upon receipt. Bank statement deposits include a credit memo for collection of an S$800 account (the customer sent payment directly to the bank). The difference between checks written in April and checks cleared by the bank relates to four checks: . Check #1205 for $1,200 is included on the April bank statement. o aecks #1221 for $1,900 and #1229 for $1,400 are not on the barnk statement. o Check # 12 10 for the purchase ofequipment is on the bank statement for $450 and on the books for S540. A$1,500 deposit on April 30th is on the books but does not appear on the bank statement. Use the information above to complete the bank reconciliation below Balance per Bank Balance per Books Add Add Subtract Subtract Adjusted Cash Balance Adjusted Cash Balance Use the T-accounts below to record the necessary adjustments resulting from the bank reconciliation above. Spring Flowers, Inc. (SFI) needs to prepare a bank reconciliation for April. The information from SFI's bank statement and cash account is summarized below. Cash Account Records Bank Statement Balance 4/1/16 Deposits Checks Cleared Bank Fee-New Checks NSF Check Balance 4/30/16 30,800 S 32,000 48,900 (57,910) (125) (650) Cash Balance 4/1/16 Checks Received Checks Written 49,600 S 22,213 Cash Balance 4/30/16 s 20,300 In addition to the summaries above, a review of the bank statement and cash account reveals the following * There was only one reconciling item at the end ofMarch-an outstanding check (#1205) for S1200. . All checks were paid at the correct amount during the period .All checks received on this account relate to collection of accounts receivable and are deposited upon receipt. Bank statement deposits include a credit memo for collection of an S$800 account (the customer sent payment directly to the bank). The difference between checks written in April and checks cleared by the bank relates to four checks: . Check #1205 for $1,200 is included on the April bank statement. o aecks #1221 for $1,900 and #1229 for $1,400 are not on the barnk statement. o Check # 12 10 for the purchase ofequipment is on the bank statement for $450 and on the books for S540. A$1,500 deposit on April 30th is on the books but does not appear on the bank statement. Use the information above to complete the bank reconciliation below Balance per Bank Balance per Books Add Add Subtract Subtract Adjusted Cash Balance Adjusted Cash Balance Use the T-accounts below to record the necessary adjustments resulting from the bank reconciliation above