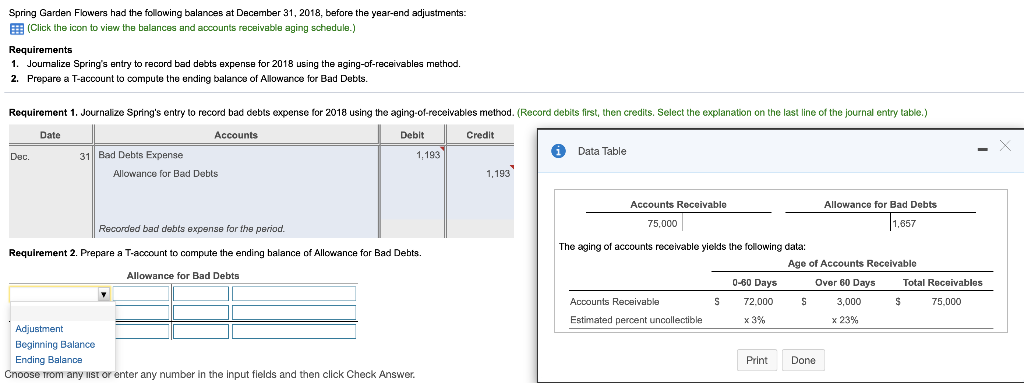

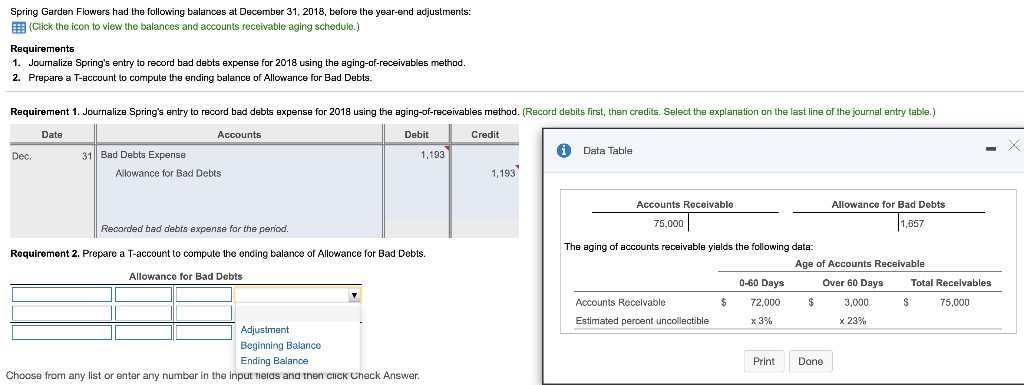

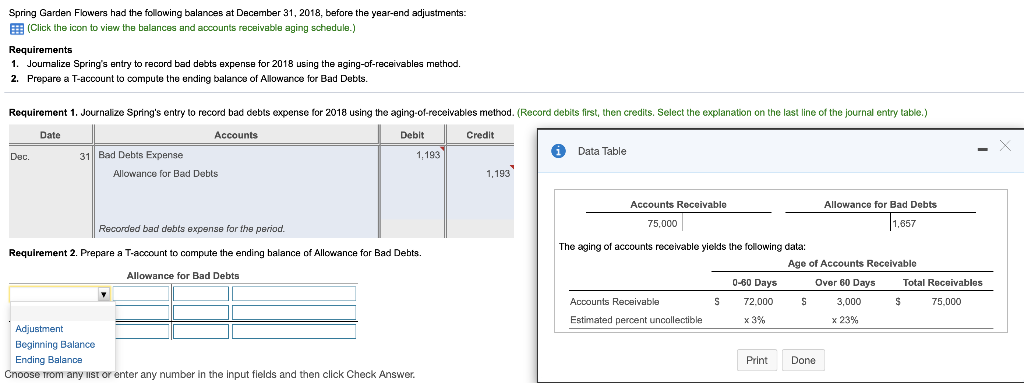

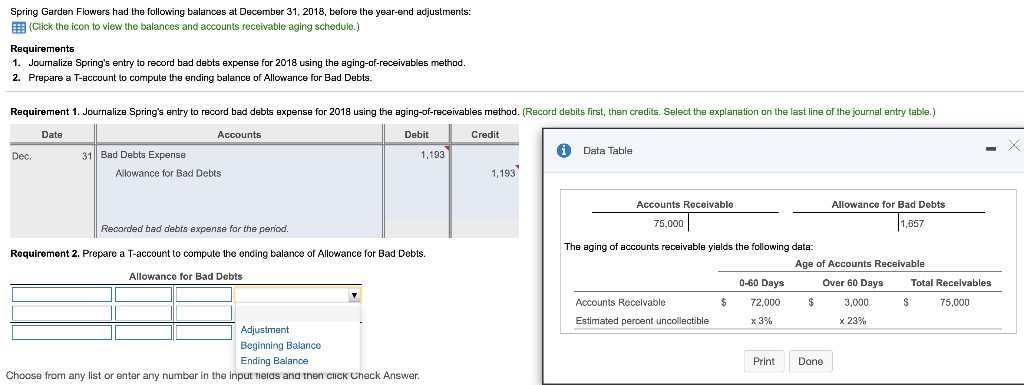

Spring Garden Flowers had the following balances at December 31, 2018, before the year-end adjustments: B (Click the icon to view the balances and accounts receivable aging schedule.) Requirements 1. Joumalize Spring's entry to record bad debts expense for 2018 using the aging-of-receivables method. 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Requirement 1. Journalize Spring's entry to record bad debts expense for 2018 using the aging-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Debit Credit Accounts 31 Bad Debts Expense Allowance for Bad Debts Dec. 1,193 Data Table 1,193 Accounts Receivable 75,000 Allowance for Bad Debts 1.857 Recorded bad debts expense for the period. Requirement 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Allowance for Bad Debts 3 The aging of accounts receivable yields the following data: Age of Accounts Receivable 0-60 Days Over 60 Days Total Receivables Accounts Receivable S 72.000 S 3,000 S 75,000 Estimated percent uncollectible x 3% x 23% Adjustment Beginning Balance Ending Balance Cnoose from any list or enter any number in the input fields and then click Check Answer. Print Done Spring Garden Flowers had the following balances at December 31, 2018, before the year-end adjustments: (Click the icon to view the balances and accounts receivable aging schedule.) Requirements 1. Journalize Spring's entry to record bad debts expense for 2018 using the aging-of-receivables method. 2. Prepare a T-account to corripute the ending balance of Allowance for Bad Debts. Requirement 1. Journalize Spring's entry to record bad debts expense for 2018 using the aging-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts Debit Credit Dec Data Table 1,193 31 Bad Debts Expense Allowance for Bad Debts 1,193 Allowance for Bad Debts Accounts Receivable 75,000 Recorded bad debts expense for the period. 1,657 Requirement 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Allowance for Bad Debts The aging of accounts receivable yields the following data: Age of Accounts Receivable 0-60 Days Over 60 Days Total Recelvables Accounts Receivable $ 72.000 3,000 $ 75,000 Estimated percent uncollectible x 23% $ x 3% Adjustment Beginning Balance Ending Balance Choose from any list or enter any number in the input Tields and then click Check Answer. Print Done