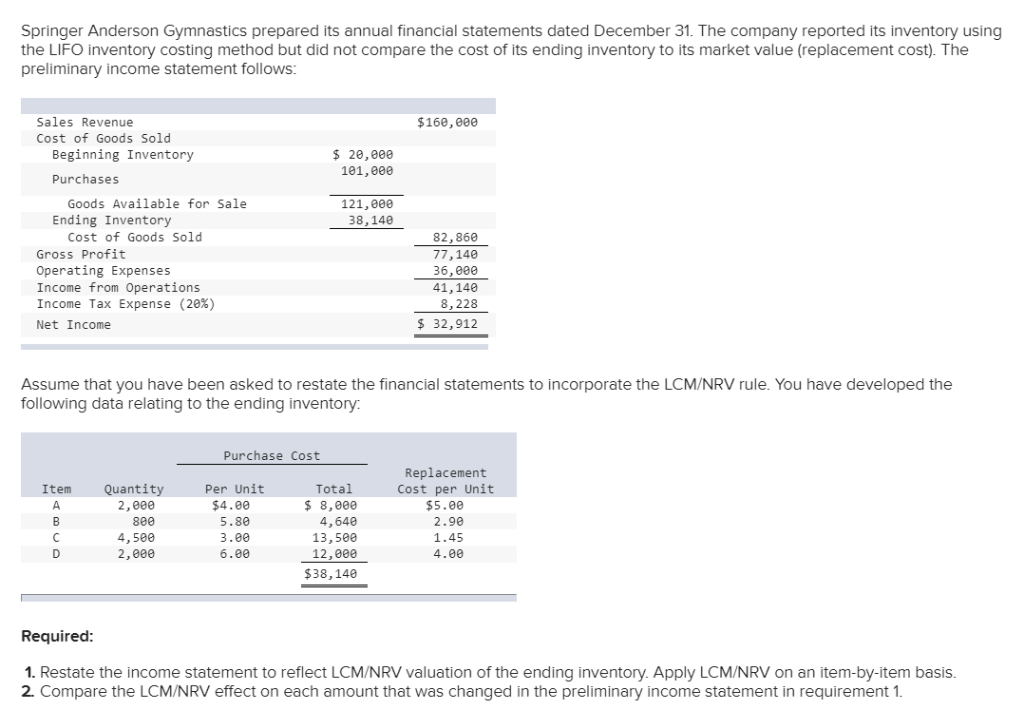

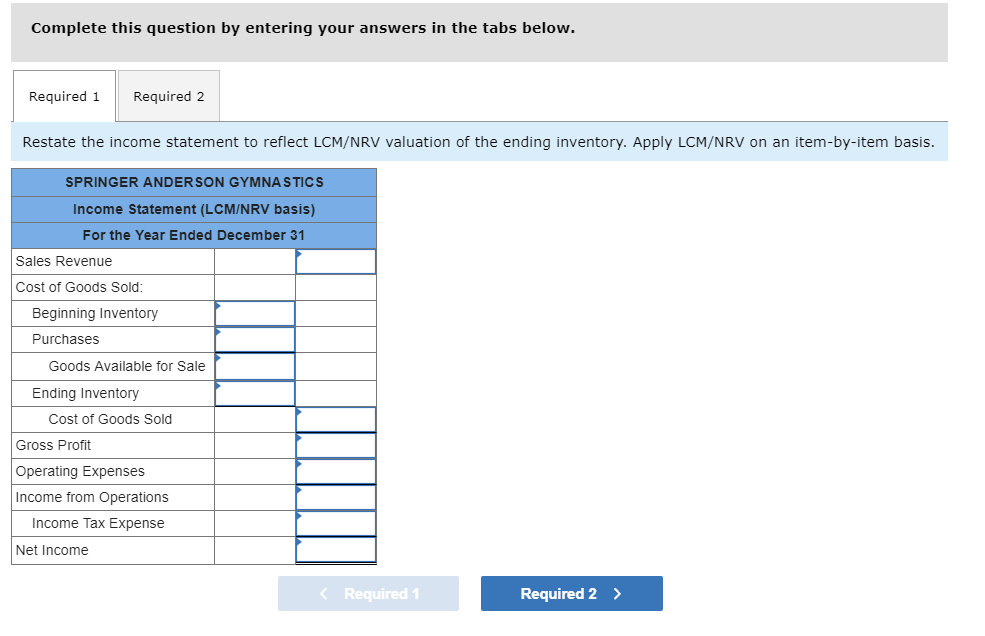

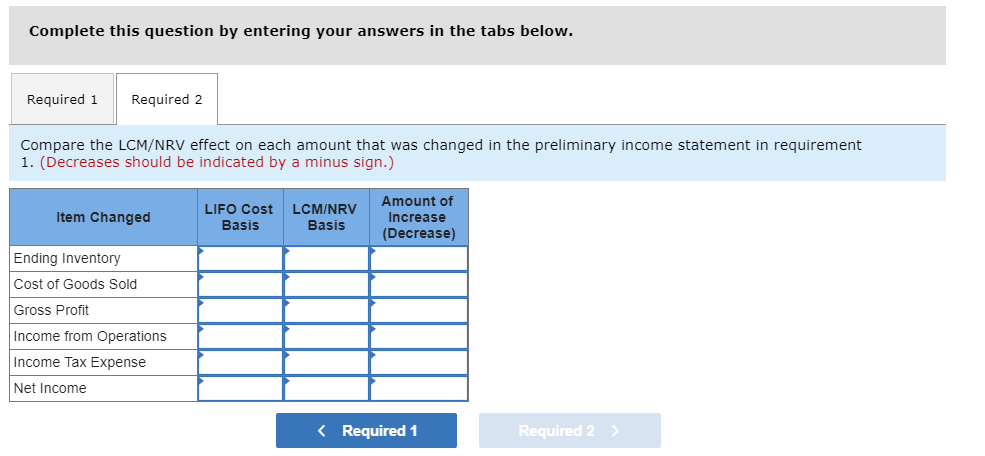

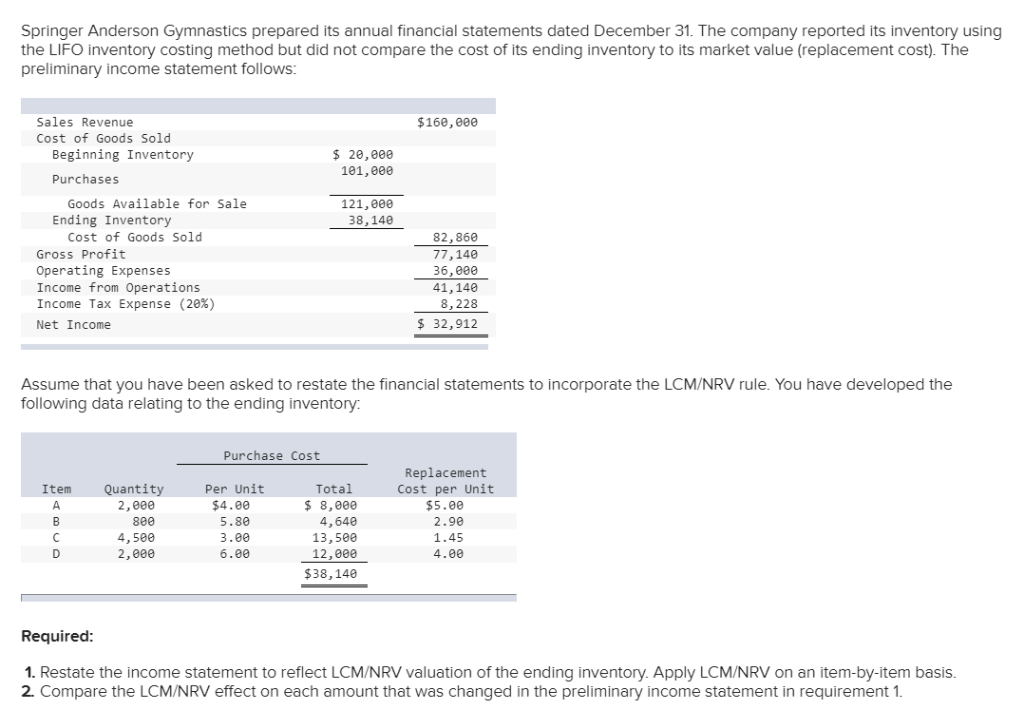

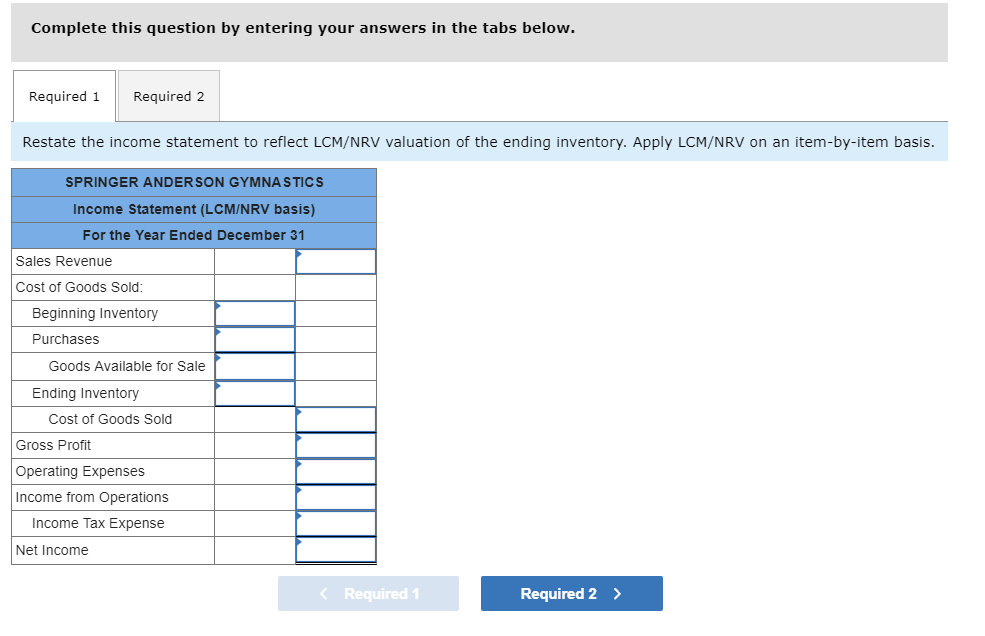

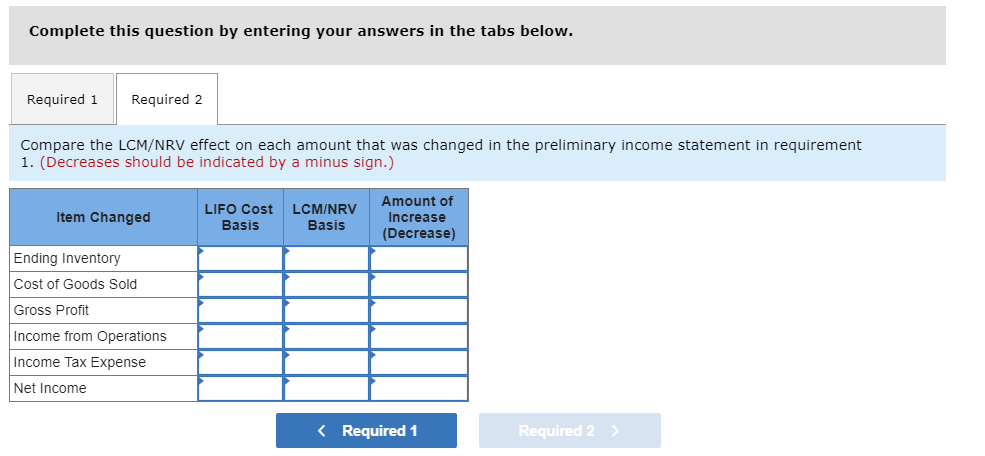

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: Sales Revenue Cost of Goods Sold $160,000 Beginning Inventory $ 20,00e 101,000 Purchases Goods Available for Sale 121,ee0 38,140 Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (28%) Net Income 82,860 77,140 36,800 41,140 8,228 32,912 Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You have developed the following data relating to the ending inventory Purchase Cost Total $ 8,000 4,640 13,500 12,000 $38,140 Replacement Cost per Unit $5.00 2.90 1.45 4.00 Item Quantity 2,900 800 4, 500 2,980 Per Unit 4.00 5.80 3.00 6.00 Required 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. 2. Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis SPRINGER ANDERSON GYMNA STICS Income Statement (LCM/NRV basis) For the Year Ended December 31 Sales Revenue Cost of Goods Sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense Net Income Required 2 Complete this question by entering your answers in the tabs below. Required1 Required 2 Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. (Decreases should be indicated by a minus sign.) Amount of Increase (Decrease) LIFO Cost LCM/NRV Item Changed Basis Basis Ending Inventory Cost of Goods Sold Gross Profit Income from Operations Income Tax Expense Net Income Required 1 Required 2