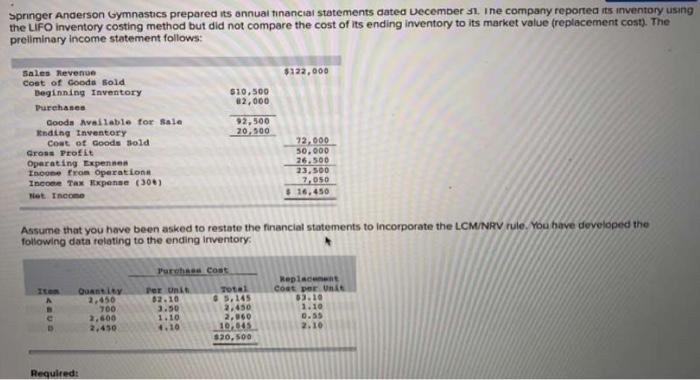

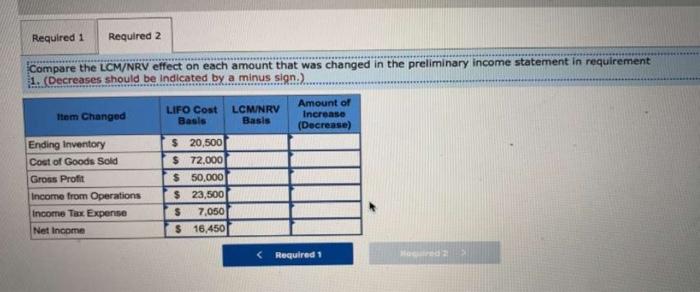

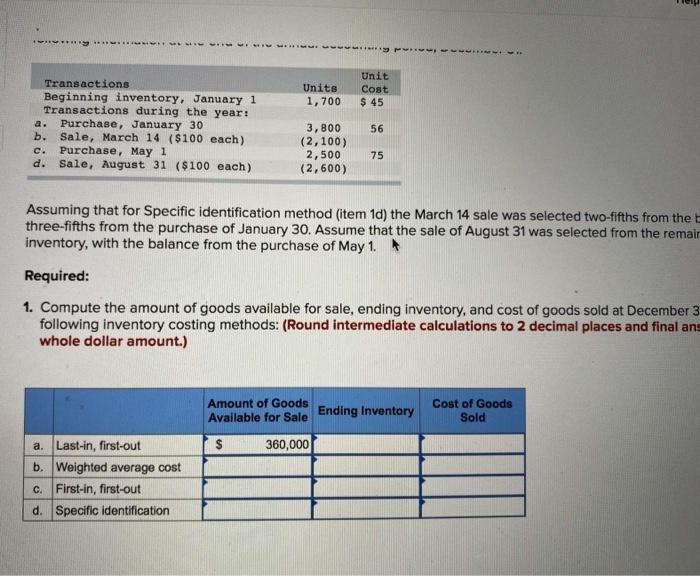

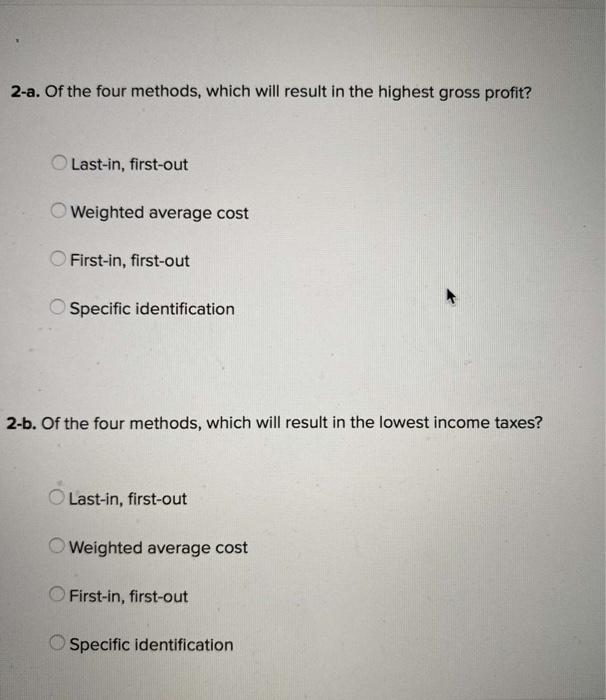

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $122.000 $10,500 82,000 Sales Revenue cost of Goods sold Deginning Inventory Purchase Goods Available for sale Inding Inventory Coat of Goods Sold Gross Profit Operating Expensen Inone from operations Incode Tax Xxpense (308) Net Income 92,500 20,500 22,000 50.000 26.500 23.500 7.050 $ 16.450 Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You have developed the following data relating to the ending Inventory Purwheed cost Quantity 2.450 700 2.600 2.430 Per Unit 02.10 3.50 1.10 Total 3,145 2.450 2.960 10.045 $20,500 Replacement Coat per un 03.10 1.10 0.55 2.10 e Required: Required 1 Required 2 Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. (Decreases should be indicated by a minus sign.) LIFO Cost Basis LCMNRV Basis Amount of Increase (Decrease) Item Changed Ending Inventory Cost of Goods Sold Gross Profit Income from Operations Income Tax Expense Net Income $ 20,500 $ 72,000 $ 50,000 $ 23,500 $ 7,050 $ 16,450 Required ***** - My .. Units 1,700 Unit Cost $ 45 Transactions Beginning inventory, January 1 Transactions during the year: Purchase, January 30 b. Sale, March 14 ($100 each) c. Purchase, May 1 d. Sale, August 31 ($100 each) 56 3,800 (2,100) 2,500 (2,600) 75 Assuming that for Specific identification method (item 1d) the March 14 sale was selected two-fifths from the three-fifths from the purchase of January 30. Assume that the sale of August 31 was selected from the remain inventory, with the balance from the purchase of May 1 Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 3 following inventory costing methods: (Round intermediate calculations to 2 decimal places and final ang whole dollar amount.) Amount of Goods Available for Sale Ending Inventory Cost of Goods Sold $ 360,000 a. Last-in, first-out b. Weighted average cost C. First-in, first-out d. Specific identification 2-a. Of the four methods, which will result in the highest gross profit? Last-in, first-out Weighted average cost First-in, first-out Specific identification 2-b. Of the four methods, which will result in the lowest income taxes? Last-in, first-out Weighted average cost First-in, first-out Specific identification