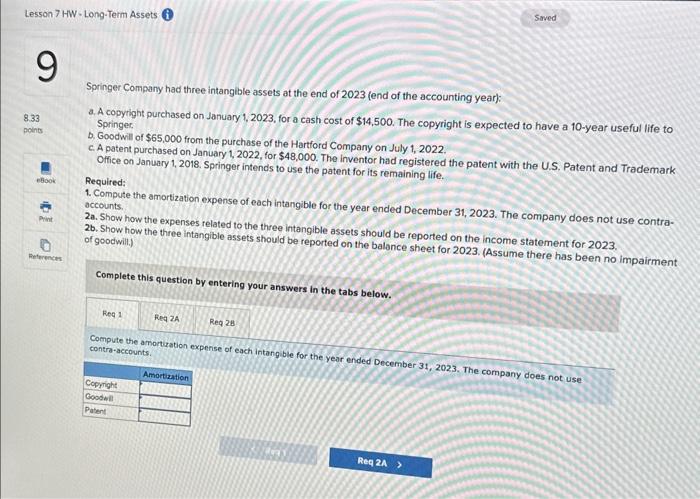

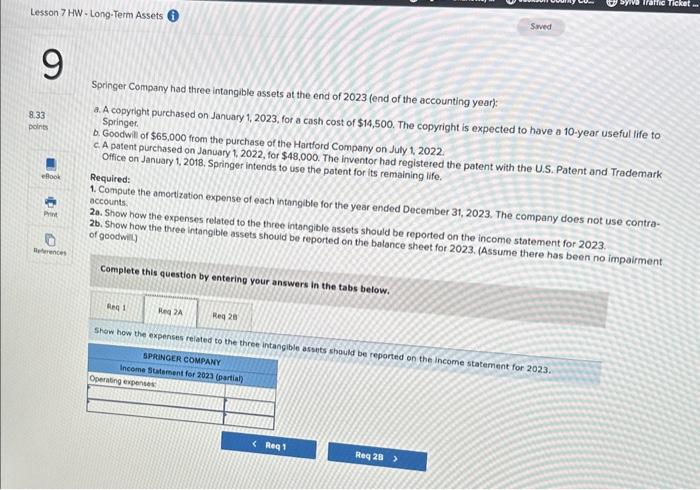

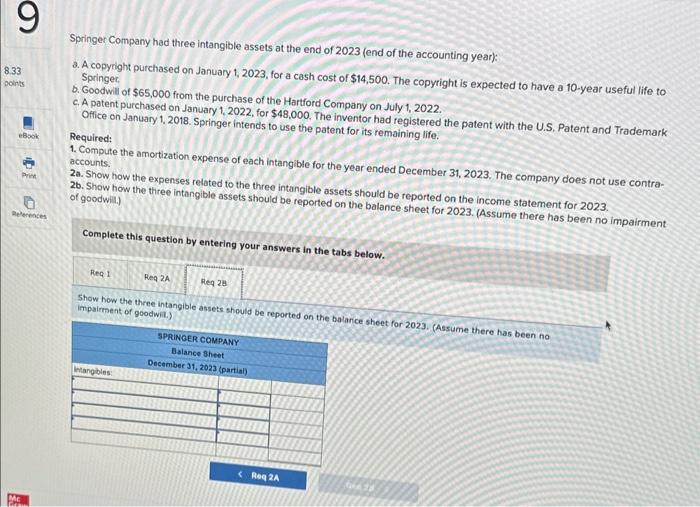

Springer Company had three intangible assets at the end of 2023 (end of the accounting year): a. A copyright purchased on January 1, 2023, for a cash cost of $14,500. The copyright is expected to have a 10-year useful life to Springer. b. Goodwill of $65,000 from the purchase of the Hartford Company on July 1, 2022. c. A patent purchased on January 1, 2022, for $48,000. The inventor had registered the patent with the U.S. Patent and Trademark Office on January 1, 2018. Springer intends to use the patent for its remaining life. Required: 1. Compute the amortization expense of each intangible for the year ended December 31, 2023. The company does not use contraaccounts. 2a. Show how the expenses related to the three intangible assets should be reported on the income statement for 2023 . 26. Show how the three intangible assets should be reported on the balance sheet for 2023 . (Assume there has been no impairment Complete this question by entering your answers in the tabs below. Compute the amortization expense of each intang ble for the yeor ended December 31, 2023. The company does not use. consteacsounts. contra-accounts. Springer Company had three intangible assets at the end of 2023 (end of the accounting year): a. A copyright purchased on January 1, 2023, for a cash cost of $14,500. The copyright is expected to have a 10-year useful life to Springer. b. Goodwil of $65,000 from the purchase of the Hartford Company on July 1,2022. C. A patent purchased on January 1, 2022, for $48,000. The inventor had registered the patent with the U.S. Patent and Trademark Office on January 1, 2018, Springer intends to use the patent for its remaining life. Required: 1. Compute the amortization expense of each intangible for the year ended December 31, 2023. The company does not use contraaccounts: 20. Show how the expenses related to the three intangible assets should be reported on the income statement for 2023. 2b. Show how the three intangible assets should be reported on the balonce sheet for 2023. (Assume there has been no impairment: Complete this question by entering your answers in the tabs below. Show how the expenses related to the thice intangible assuts shauld be reported on the income statement for 2023. Springer Company had three intangible assets at the end of 2023 (end of the accounting year): 3. A copyright purchased on January 1, 2023, for a cash cost of $14,500. The copyright is expected to have a 10-year useful life to Springer b. Goodwill of $65,000 from the purchase of the Hartford Company on July 1,2022. c. A patent purchased on January 1, 2022, for $48,000. The inventor had registered the patent with the U.S. Patent and Trademark Office on January 1, 2018. Springer intends to use the patent for its remaining life. Required: 1. Compute the amortization expense of each intangible for the year ended December 31, 2023. The company does not use contraaccounts. 2a. Show how the expenses related to the three intangible assets should be reported on the income statement for 2023. of goodwili.) Complete this question by entering your answers in the tabs below. Show how the three intangible assets should be reported on the balance sheet for 2023. (Assume there has been no impaiment of goodwil.)