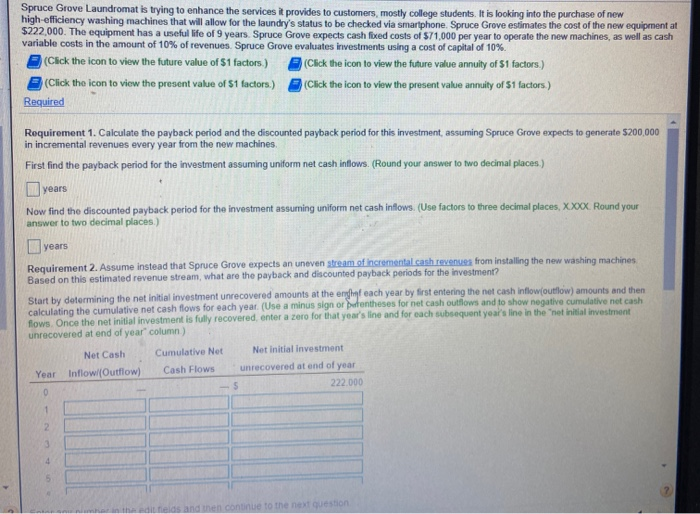

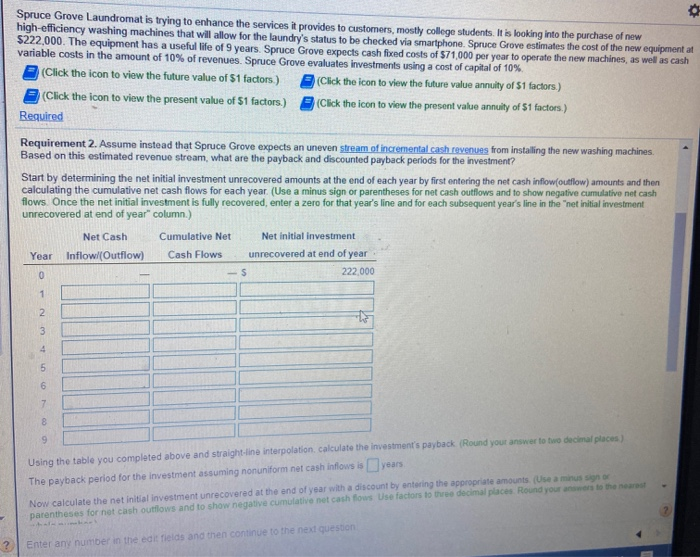

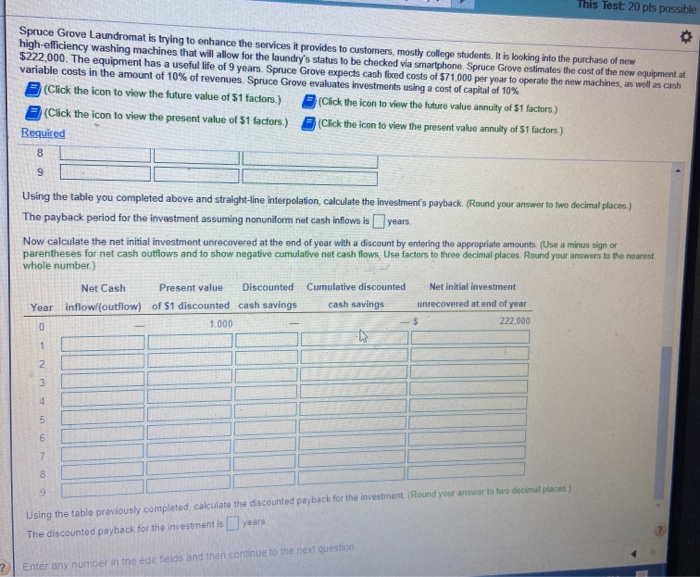

Spruce Grove Laundromat is trying to enhance the services it provides to customers, mostly college students. It is looking into the purchase of new high-efficiency washing machines that will allow for the laundry's status to be checked via smartphone. Spruce Grove estimates the cost of the new equipment at $222,000. The equipment has a useful life of 9 years. Spruce Grove expects cash fibed costs of $71,000 per year to operate the new machines, as well as cash variable costs in the amount of 10% of revenues. Spruce Grove evaluates investments using a cost of capital of 10% (Click the icon to view the future value of $1 factors.) Click the icon to view the future value annuity of $1 factors.) (Click the icon to view the present value of $1 factors.) Click the icon to view the present value annuity of 51 factors.) Required Requirement 1. Calculate the payback period and the discounted payback period for this investment, assuming Spruce Grove expects to generate $200,000 in incremental revenues every year from the new machines. First find the payback period for the investment assuming uniform net cash inflows. (Round your answer to two decimal places.) years Now find the discounted payback period for the investment assuring uniform net cash inflows. (Use factors to three decimal places, Xxxx. Round your answer to two decimal places.) years Requirement 2. Assume instead that Spruce Grove expects an uneven stream of incremental cash revenues from installing the new washing machines Based on this estimated revenue stream, what are the payback and discounted payback periods for the investment? Start by determining the net initial investment unrecovered amounts at the englyf each year by first entering the net cash inflowoutflow) amounts and then calculating the cumulative net cash flows for each year (Use a minus sign or putentheses for net cash outflows and to show negative cumulative net cash flows. Once the net initial investment is fully recovered, enter a zero for that year's line and for each subsequent year's line in the net initial investment unrecovered at end of year column) Net Cash Cumulative Net Net initial investment Year Inflowl(Outflow) Cash Flows unrecovered at end of year 222.000 anthone to the neon Spruce Grove Laundromat is trying to enhance the services it provides to customers, mostly college students. It is looking into the purchase of new high-efficiency washing machines that will allow for the laundry's status to be checked via smartphone. Spruce Grove estimates the cost of the new equipment at $222,000. The equipment has a useful life of 9 years. Spruce Grove expects cash fired costs of $71,000 per year to operate the new machines, as well as cash variable costs in the amount of 10% of revenues. Spruce Grove evaluates investments using a cost of capital of 10% * (Click the icon to view the future value of $1 factors ) Click the icon to view the future value annuity of $1 factors) (Click the icon to view the present value of $1 factors.) Click the icon to view the present value annuity of 51 factors.) Required Requirement 2. Assume instead that Spruce Grove expects an uneven stream of incremental cash revenues from installing the new washing machines. Based on this estimated revenue stream, what are the payback and discounted payback periods for the investment? Start by determining the net initial investment unrecovered amounts at the end of each year by first entering the net cash inflow(outflow) amounts and then calculating the cumulative net cash flows for each year (Use a minus sign or parentheses for net cash outflows and to show negative cumulative net cash flows. Once the net initial investment is fully recovered, enter a zero for that year's line and for each subsequent year's line in the net initial investment unrecovered at end of year column.) Net Cash Year Inflowl(Outflow) Cumulative Net Cash Flows Net initial investment unrecovered at end of year 222.000 o w N i in o co Using the table you completed above and straight line interpolation calculate the investment's payback Round your answer to the decimal places) The payback period for the investment assuming nonuniform net cash inflows is years Now calculate the net initial investment unrecovered at the end of year with a discount by entering the appropriate amounts parentheses for net cash outflows and to show negative cumulative net cash fos Use factors de places Rody Enter any number the deeds and then continue to the next question This Test: 20 pls possible Spruce Grove Laundromat is trying to enhance the services it provides to customers, mostly college students. It is looking into the purchase of now high-efficiency washing machines that will allow for the laundry's status to be checked via smartphone. Spruce Grove estimates the cost of the new equipment at $222,000. The equipment has a useful life of 9 years. Spruce Grove expects cash fixed costs of $71.000 per year to operate the new machines, as well as cash variable costs in the amount of 10% of revenues. Spruce Grove evaluates Investments using a cost of capital of 10% (Click the icon to view the future value of 51 factors.) Click the icon to view the future value annuity of $1 factors.) (Click the icon to view the present value of $1 factors ) Click the icon to view the present value annuity of $1 factors) Required 1 Using the table you completed above and straight-line interpolation, calculate the investment's payback (Round your answer to two decimal places.) The payback period for the investment assuming nonuniform net cash inflows is years Now calculate the net initial investment unrecovered at the end of year with a discount by entering the appropriate amounts (Use a minus sign or parentheses for net cash outflows and to show negative cumulative net cash flows Use factors to three decimal places. Round your answers to the nearest whole number) Net Cash Present value D iscounted Cumulative discounted Net initial investment Year inflow (outflow) of $1 discounted cash savings c ash savings unrecovered at end of year 1.000 222,000 oooo in w No Using the table previously completed, calculate the discounted payback for the investment (Round your answer to two decimal places) The discounted payback for the investment is years ? Enter any number in the edit fields and then continue to the next