Question

SPS Ltd operates in the high-technology energy solutions sector. The PV Division designs, manufactures and installs solar panel systems. These systems are sold as either:

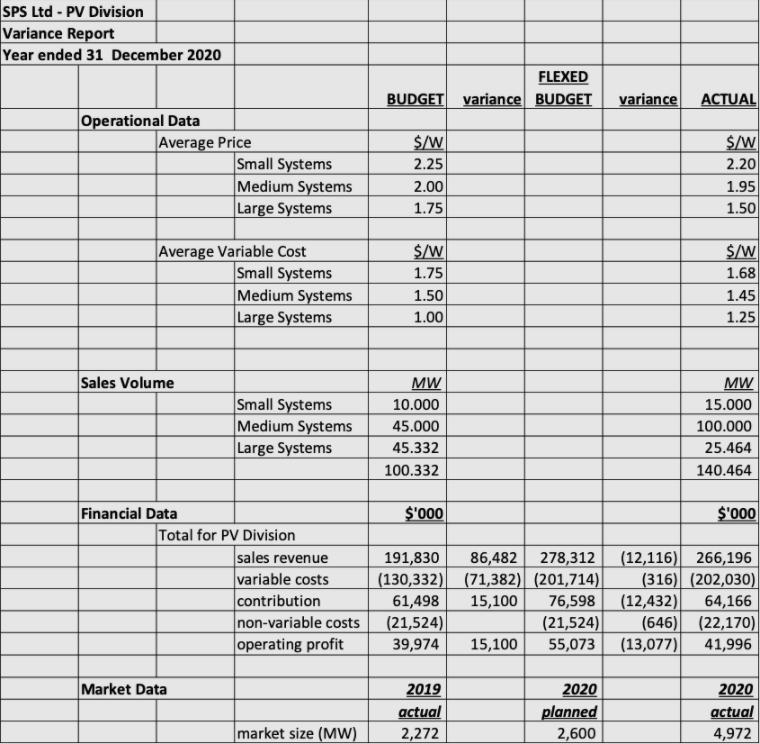

SPS Ltd operates in the high-technology energy solutions sector. The PV Division designs, manufactures and installs solar panel systems. These systems are sold as either: small, medium or large systems. Small systems have a peak power generating capacity up to 100 kW (100,000 W); medium systems up to 1 MW (1,000,000 W); and large systems above 1 MW. The following information relates to the planning and actual data for 2020 year.

Please respond True or False to the following statement:

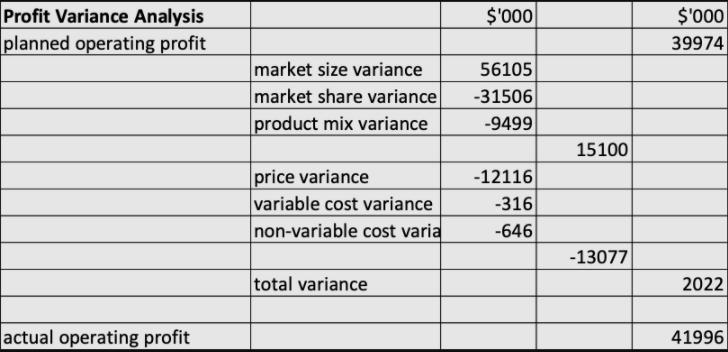

1.The market size variance could be explained by an underestimation of the growth in the market for 2020

2.In terms of analyzing managerial performance, the market share variance is more useful than the market size variance

3.The positive market size variance suggests profits are higher than expected due to the market share being higher than expected

4.$15 100 of the operating profit variance is due to actual sales volumes being different from expected sales volumes

5.The market size for PV panels is increasing as the planned market size for 2020 is above the actual market size for 2019:

6.Non-variable costs are within budget

7.According to the market share variance, the PV Division has experienced a decrease in market share from last year

8.The product mix variance is wholly due to the lower volumes for large PV systems than expected

SPS Ltd- PV Division Variance Report Year ended 31 December 2020 FLEXED BUDGET variance BUDGET variance ACTUAL Operational Data Average Price S/W 2.20 Small Systems Medium Systems Large Systems 2.25 2.00 1.95 1.75 1.50 Average Variable Cost Small Systems Medium Systems Large Systems /W S/W 1.68 1.75 1.50 1.45 1.00 1.25 Sales Volume MW MW Small Systems Medium Systems Large Systems 10.000 15.000 45.000 100.000 45.332 25.464 100.332 140.464 Financial Data $'000 $'000 Total for PV Division sales revenue variable costs contribution non-variable costs operating profit 86,482 278,312 (130,332) (71,382) (201,714) 76,598 (21,524) 55,073 (12,116) 266,196 (316) (202,030) (12,432) 191,830 15,100 61,498 (21,524) 39,974 64,166 (646) (22,170) (13,077) 15,100 41,996 Market Data 2019 2020 2020 actual planned 2,600 actual market size (MW) 2,272 4,972

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

1 True The market size variance is favorable 56105 which means that the actual market size has been higher than budgeted This could be due to estimati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started