Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SQ 6.2: Dynamic Asset Allocation (2014-2015 Resit) Consider at t=0 the following dynamic asset allocation strategy for an investor with a wealth W of 2,500,

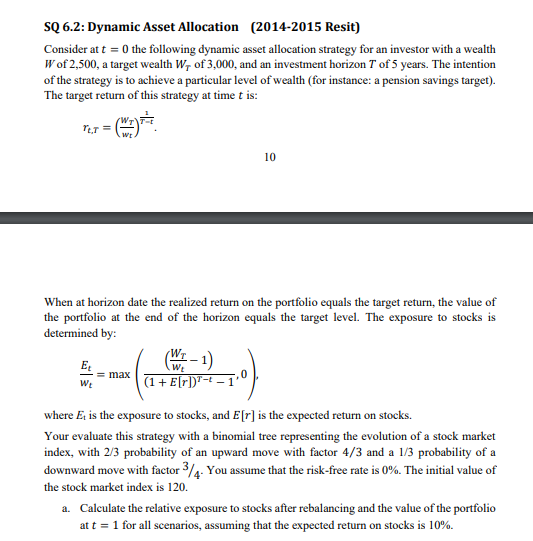

SQ 6.2: Dynamic Asset Allocation (2014-2015 Resit) Consider at t=0 the following dynamic asset allocation strategy for an investor with a wealth W of 2,500, a target wealth WT of 3,000 , and an investment horizon T of 5 years. The intention of the strategy is to achieve a particular level of wealth (for instance: a pension savings target). The target return of this strategy at time t is: rt,T=(wtWT)Tt1. 10 When at horizon date the realized return on the portfolio equals the target return, the value of the portfolio at the end of the horizon equals the target level. The exposure to stocks is determined by: wtEt=max((1+E[r])Tt1(WtWT1),0), where Et is the exposure to stocks, and E[r] is the expected return on stocks. Your evaluate this strategy with a binomial tree representing the evolution of a stock market index, with 2/3 probability of an upward move with factor 4/3 and a 1/3 probability of a downward move with factor 3/4. You assume that the risk-free rate is 0%. The initial value of the stock market index is 120 . a. Calculate the relative exposure to stocks after rebalancing and the value of the portfolio at t=1 for all scenarios, assuming that the expected return on stocks is 10%

SQ 6.2: Dynamic Asset Allocation (2014-2015 Resit) Consider at t=0 the following dynamic asset allocation strategy for an investor with a wealth W of 2,500, a target wealth WT of 3,000 , and an investment horizon T of 5 years. The intention of the strategy is to achieve a particular level of wealth (for instance: a pension savings target). The target return of this strategy at time t is: rt,T=(wtWT)Tt1. 10 When at horizon date the realized return on the portfolio equals the target return, the value of the portfolio at the end of the horizon equals the target level. The exposure to stocks is determined by: wtEt=max((1+E[r])Tt1(WtWT1),0), where Et is the exposure to stocks, and E[r] is the expected return on stocks. Your evaluate this strategy with a binomial tree representing the evolution of a stock market index, with 2/3 probability of an upward move with factor 4/3 and a 1/3 probability of a downward move with factor 3/4. You assume that the risk-free rate is 0%. The initial value of the stock market index is 120 . a. Calculate the relative exposure to stocks after rebalancing and the value of the portfolio at t=1 for all scenarios, assuming that the expected return on stocks is 10% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started