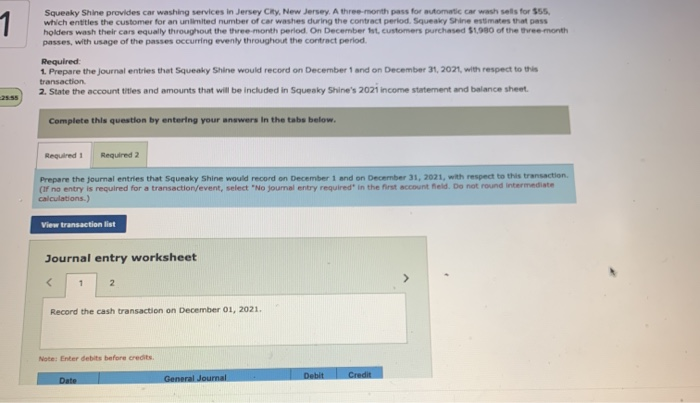

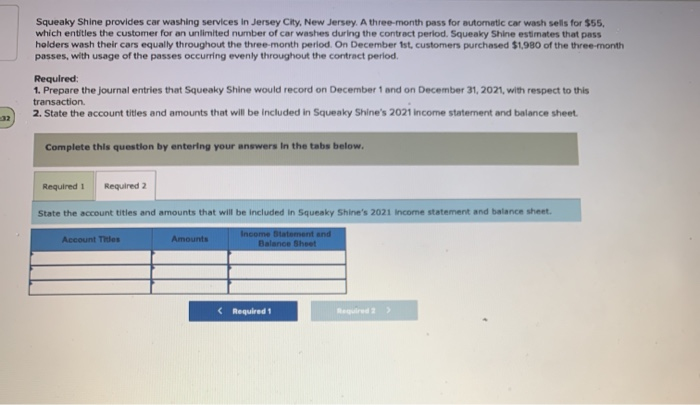

Squeaky Shine provides car washing services in Jersey Chy, New Jersey. A three-month pass for automatic car wash sets for $55 which entities the customer for an unlimited number of car washes during the contract period. Squeaky Shine estimates that pass holders wash their cars equally throughout the month period On December ist customers purchased $1,980 of the swee-month passes, with usage of the passes occurring evenly throughout the contract period Required 1. Prepare the journal entries that Squeaky Shine would record on December 1 and on December 31, 2021, with respect to this transaction 2. State the accounties and amounts that will be included in Squeaky Shine's 2021 income statement and balance sheet Complete this question by entering your answers in the tabs below. Required! Required 2 Prepare the journal entries that Squeaky Shine would record on December 1 and on December 31, 2021, with respect to this transaction. (If no entry is required for a transaction event, select "No journal entry required in the first account Red Do not round intermediate calculations.) View transaction list Journal entry worksheet Record the cash transaction on December 01, 2021 Note Enter debit before credits General Journal Date Debit Credit Squeaky Shine provides car washing services in Jersey City, New Jersey. A three month pass for automatic car wash sells for $55, which entitles the customer for an unlimited number of car washes during the contract period. Squeaky Shine estimates that pass holders wash their cars equally throughout the three month period. On December 1st, customers purchased $1.980 of the three month passes, with usage of the passes occurring evenly throughout the contract period. Required: 1. Prepare the journal entries that Squeaky Shine would record on December 1 and on December 31, 2021, with respect to this transaction. 2. State the account titles and amounts that will be included in Squeaky Shine's 2021 income statement and balance sheet. Complete this question by entering your answers in the tabs below. Required 1 Required 2 State the account tities and amounts that will be included in Squeaky Shine's 2021 Income statement and balance sheet. Account Titles Amounts Income Statement and Balance Sheet Required