Answered step by step

Verified Expert Solution

Question

1 Approved Answer

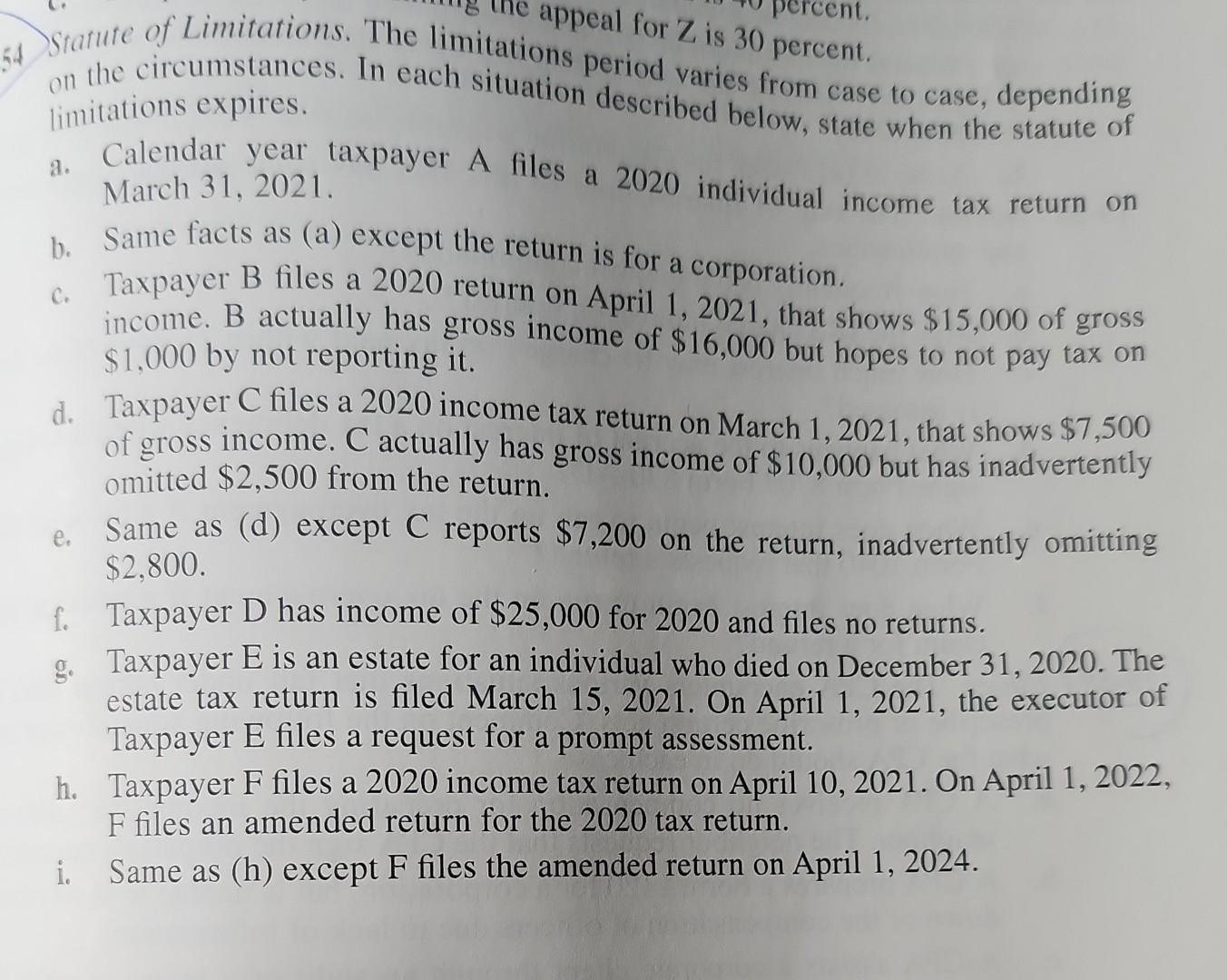

Sratufe of Limitations. The limitations per for Z is 30 percent. on the circumstances. In each situation period varies from case to case, depending limitations

Sratufe of Limitations. The limitations per for Z is 30 percent. on the circumstances. In each situation period varies from case to case, depending limitations expires. a. Calendar year taxpayer A files a 2020 individual income tax return on March 31, 2021. b. Same facts as (a) except the return is for a corporation. c. Taxpayer B files a 2020 return on April 1, 2021, that shows $15,000 of gross income. B actually has gross income of $16,000 but hopes to not pay tax on $1,000 by not reporting it. d. Taxpayer C files a 2020 income tax return on March 1, 2021, that shows $7,500 of gross income. C actually has gross income of $10,000 but has inadvertently omitted $2,500 from the return. e. Same as (d) except C reports $7,200 on the return, inadvertently omitting $2,800. f. Taxpayer D has income of $25,000 for 2020 and files no returns. g. Taxpayer E is an estate for an individual who died on December 31, 2020. The estate tax return is filed March 15, 2021. On April 1, 2021, the executor of Taxpayer E files a request for a prompt assessment. h. Taxpayer F files a 2020 income tax return on April 10, 2021. On April 1, 2022, F files an amended return for the 2020 tax return. i. Same as (h) except F files the amended return on April 1, 2024

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started