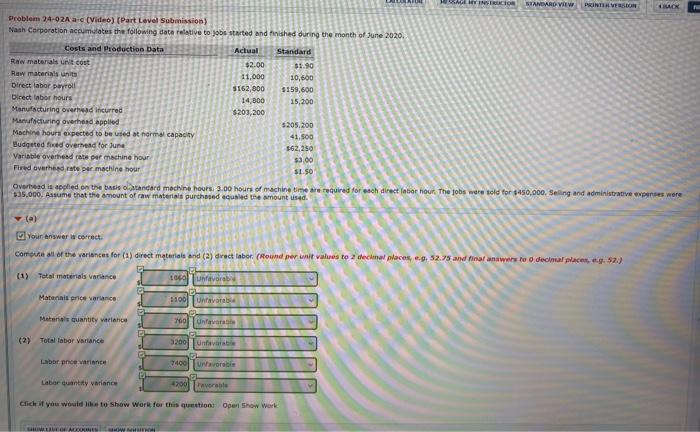

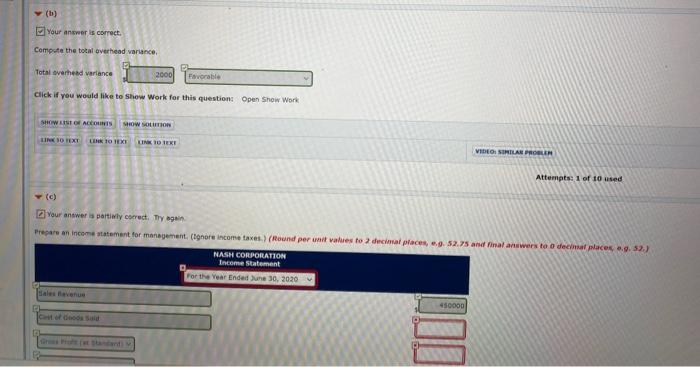

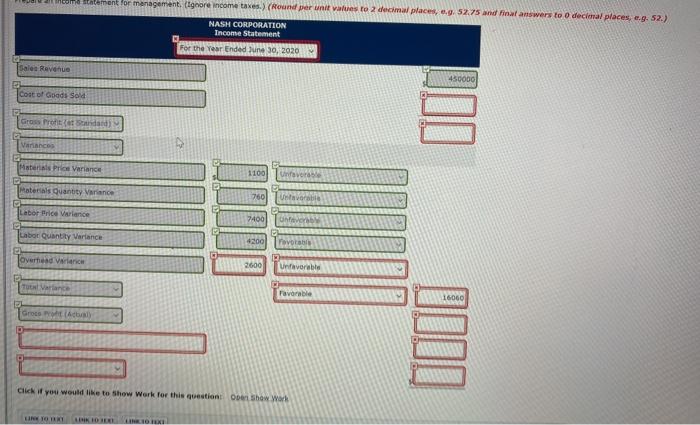

SSAGESTREICH STANDARD VIEW PRINTER VERSION ROK Problem 24-02A a-c (Video) (Part Level Submission) Nash Corporation accumulates the following data relative to obe started and finished during the month of June 2020, Costs and Production Data Actual Standard Raw materials unit cost $2.00 $1.90 Raw materials units 11,000 10,600 Direct labor payroll 5162,800 $159,600 Direct labor hours 14,800 15,200 Manufacturing overhead incurred $203,200 Manufacturing overhead applied 5205.200 Machine hours expected to be used at normal capacity 41.500 Budgeted fixed over and for June $62,250 Variable overhead rate per machine hour $3.00 Fired overhead rate per machine hour $1.50 Oversed is applied on the basis oftandard machine hours: 3.00 hours of machine time are required for each direct labor hour. The jobs were sold for $450,000. Selling and administrative ses were 135,000. Assume that the amount of raw materials purchased outled the amount 4d. () Your answer la correct Come of the variances for (1) direct materials and (2) direct labor (Hound per unit vahes to decimal places, e.g. 52.75 and final answers to decimal aces, eg. 52) (1) Total materiais variance 100 unfavorab Materiais price variance 1100 Uhtavaa Material quantity wariance Mounfall G (2) Total labor variance 3200 un G Labor price variance 7400 Tvorable Labor quantity variance 4700 worable Click if you would like to show Work for this question Open Show Work WHEN (b) Your answer is correct. Compute the total overhead variance Total verhead variance 2000 Favorable Click if you would like to show Work for this questions Open Show Work SHOW LIST OF ACCOUNTS WOW SOLUTION LIND TEXT TEXT LINE 10 TEXT VIDEO SIMILAR PROBLEM Attempts 1 of 10 used Your answer la partiwly correct. Try again Prepare an income statement for management (Ignore income taxes.) (Round per unit values to decimal places.. 52.75 and final answers to o decimal places g. 32.) NASH CORPORATION Income Statement For the Year Ended June 30, 2020 450000 statement for management (Ignore income taxes.) (Round per unit values to 2 decimal places, .g. 52.75 and final answers to decinal places, e.g. 52.) NASH CORPORATION Income Statement For the Year Ended June 30, 2020 Sales Revenue 450000 Cost of Goods Sold Gros Portada Vancos E Material Pro Variance 1100 Unaver Materials Quantity Variance 760 Uvorite Labor Price Variance 7400 One Labor Quantity Variance 4200 Povable Overhead Vranch 2600 Unfavorable Tu Varance Favorable 16060 Grote til Click if you would like to show Work for this questions or Show Work HOTELI SSAGESTREICH STANDARD VIEW PRINTER VERSION ROK Problem 24-02A a-c (Video) (Part Level Submission) Nash Corporation accumulates the following data relative to obe started and finished during the month of June 2020, Costs and Production Data Actual Standard Raw materials unit cost $2.00 $1.90 Raw materials units 11,000 10,600 Direct labor payroll 5162,800 $159,600 Direct labor hours 14,800 15,200 Manufacturing overhead incurred $203,200 Manufacturing overhead applied 5205.200 Machine hours expected to be used at normal capacity 41.500 Budgeted fixed over and for June $62,250 Variable overhead rate per machine hour $3.00 Fired overhead rate per machine hour $1.50 Oversed is applied on the basis oftandard machine hours: 3.00 hours of machine time are required for each direct labor hour. The jobs were sold for $450,000. Selling and administrative ses were 135,000. Assume that the amount of raw materials purchased outled the amount 4d. () Your answer la correct Come of the variances for (1) direct materials and (2) direct labor (Hound per unit vahes to decimal places, e.g. 52.75 and final answers to decimal aces, eg. 52) (1) Total materiais variance 100 unfavorab Materiais price variance 1100 Uhtavaa Material quantity wariance Mounfall G (2) Total labor variance 3200 un G Labor price variance 7400 Tvorable Labor quantity variance 4700 worable Click if you would like to show Work for this question Open Show Work WHEN (b) Your answer is correct. Compute the total overhead variance Total verhead variance 2000 Favorable Click if you would like to show Work for this questions Open Show Work SHOW LIST OF ACCOUNTS WOW SOLUTION LIND TEXT TEXT LINE 10 TEXT VIDEO SIMILAR PROBLEM Attempts 1 of 10 used Your answer la partiwly correct. Try again Prepare an income statement for management (Ignore income taxes.) (Round per unit values to decimal places.. 52.75 and final answers to o decimal places g. 32.) NASH CORPORATION Income Statement For the Year Ended June 30, 2020 450000 statement for management (Ignore income taxes.) (Round per unit values to 2 decimal places, .g. 52.75 and final answers to decinal places, e.g. 52.) NASH CORPORATION Income Statement For the Year Ended June 30, 2020 Sales Revenue 450000 Cost of Goods Sold Gros Portada Vancos E Material Pro Variance 1100 Unaver Materials Quantity Variance 760 Uvorite Labor Price Variance 7400 One Labor Quantity Variance 4200 Povable Overhead Vranch 2600 Unfavorable Tu Varance Favorable 16060 Grote til Click if you would like to show Work for this questions or Show Work HOTELI