Answered step by step

Verified Expert Solution

Question

1 Approved Answer

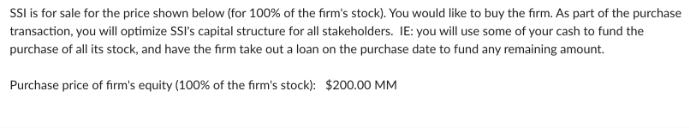

SSI is for sale for the price shown below (for 100% of the firm's stock). You would like to buy the firm. As part

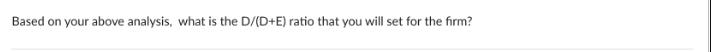

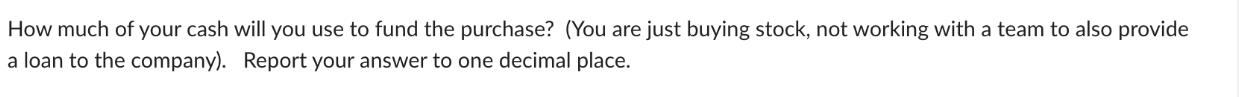

SSI is for sale for the price shown below (for 100% of the firm's stock). You would like to buy the firm. As part of the purchase transaction, you will optimize SSI's capital structure for all stakeholders. IE: you will use some of your cash to fund the purchase of all its stock, and have the firm take out a loan on the purchase date to fund any remaining amount. Purchase price of firm's equity (100% of the firm's stock): $200.00 MM Based on your above analysis, what is the D/(D+E) ratio that you will set for the firm? How much of your cash will you use to fund the purchase? (You are just buying stock, not working with a team to also provide a loan to the company). Report your answer to one decimal place.

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Since you are using all of your cash to buy the equity of the firm the debttoequity DE ratio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started