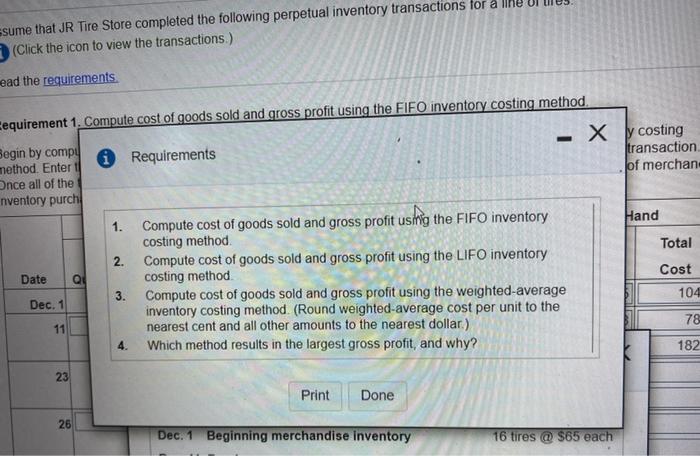

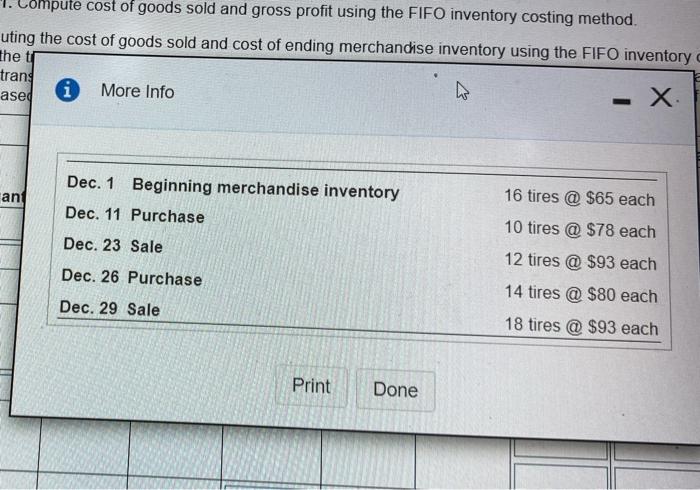

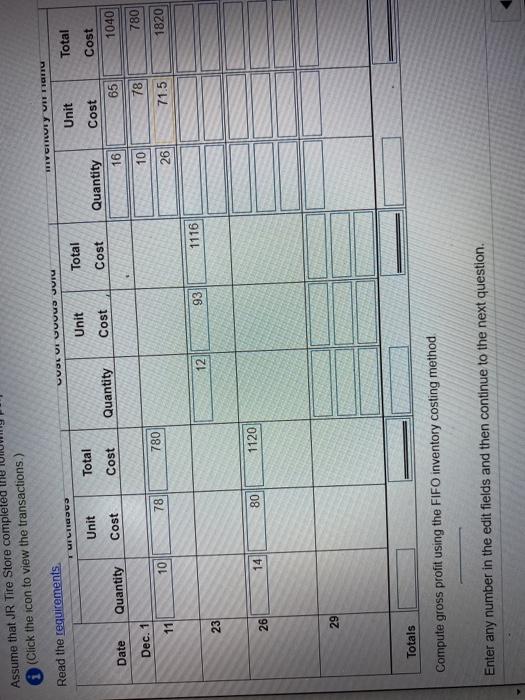

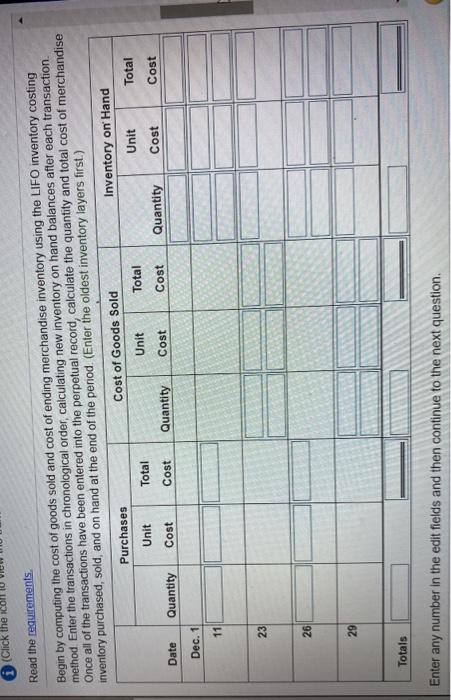

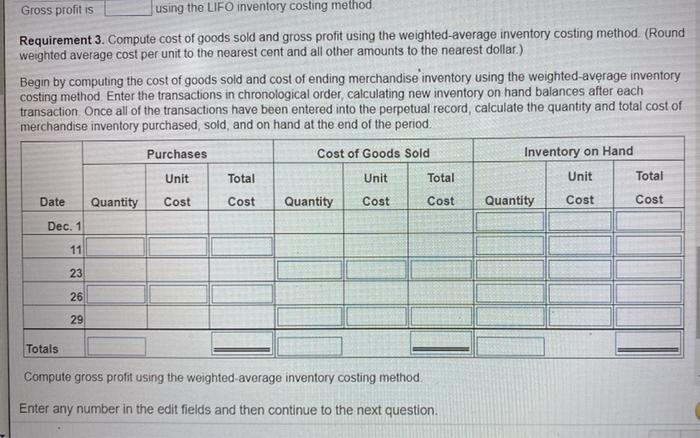

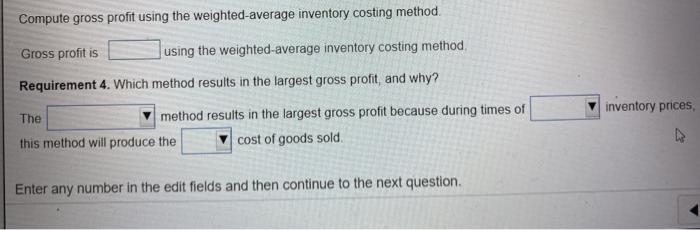

ssume that JR Tire Store completed the following perpetual inventory transactions for a Heur (Click the icon to view the transactions) ead the requirements Cequirement 1. Compute cost of goods sold and gross profit using the FIFO inventory costing method. y costing transaction of merchan 0 Requirements Begin by compy method. Enter Once all of the nventory purch Hand 1. Total 2. Cost Date QI Compute cost of goods sold and gross profit ustig the FIFO inventory costing method Compute cost of goods sold and gross profit using the LIFO inventory costing method Compute cost of goods sold and gross profit using the weighted average inventory costing method. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar) Which method results in the largest gross profit, and why? 3. 104 Dec. 1 78 11 182 23 Print Done 26 Dec. 1 Beginning merchandise inventory 16 tires @ $65 each ompute cost of goods sold and gross profit using the FIFO inventory costing method. uting the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory the ti trang i More Info . ased an Dec. 1 Beginning merchandise inventory Dec. 11 Purchase Dec. 23 Sale 16 tires @ $65 each 10 tires @ $78 each 12 tires @ $93 each 14 tires @ $80 each 18 tires @ $93 each Dec. 26 Purchase Dec. 29 Sale Print Done Assume that JR Tire Store completed (Click the icon to view the transactions.) MYCITY VIRO Read the requirements. VUOLUIUuua uur ULTADO Unit Total Unit Total Unit Cost Total Cost Cost Cost Quantity Quantity 16 Cost Date Quantity Dec. 1 11 10 1040 Cost 65 78 10 780 78 780 1820 26 71.5 12 1116 93 23 14 80 1120 26 29 Totals Compute gross profit using the FIFO inventory costing method Enter any number in the edit fields and then continue to the next question. (Click the Read the requirements Begin by computing the cost of goods sold and cost of ending merchandise inventory using the LIFO inventory costing method Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Inventory on Hand Cost of Goods Sold Purchases Unit Total Total Unit Unit Total Cost Quantity Cost Cost Cost Quantity Cost Quantity Date Cost Dec. 1 11 23 26 29 Totals Enter any number in the edit fields and then continue to the next question. Gross profit is using the LIFO inventory costing method Requirement 3. Compute cost of goods sold and gross profit using the weighted average inventory costing method (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted average inventory costing method Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Dec. 1 11 23 26 29 Totals Compute gross profit using the weighted average inventory costing method Enter any number in the edit fields and then continue to the next question. Compute gross profit using the weighted average inventory costing method Gross profit is using the weighted average inventory costing method Requirement 4. Which method results in the largest gross profit, and why? The method results in the largest gross profit because during times of this method will produce the cost of goods sold inventory prices Enter any number in the edit fields and then continue to the next