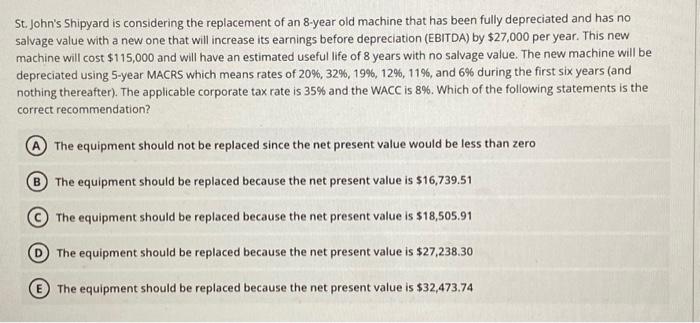

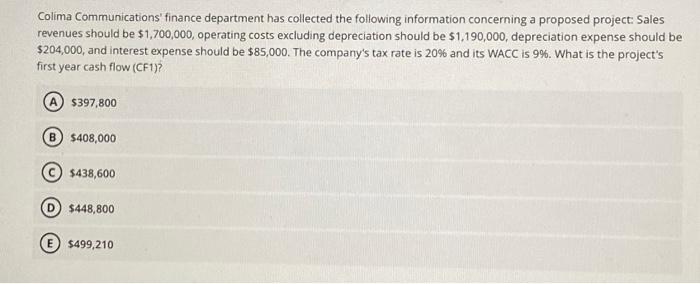

St. John's Shipyard is considering the replacement of an 8 -year old machine that has been fully depreciated and has no salvage value with a new one that will increase its earnings before depreciation (EBITDA) by \$27,000 per year. This new machine will cost $115,000 and will have an estimated useful life of 8 years with no salvage value. The new machine will be depreciated using 5-year MACRS which means rates of 20%,32%,19%,12%,11%, and 6% during the first six years (and nothing thereafter). The applicable corporate tax rate is 35% and the WACC is 8%. Which of the following statements is the correct recommendation? The equipment should not be replaced since the net present value would be less than zero The equipment should be replaced because the net present value is $16,739.51 The equipment should be replaced because the net present value is $18,505.91 (D) The equipment should be replaced because the net present value is $27,238.30 The equipment should be replaced because the net present value is $32,473.74 Colima Communications' finance department has collected the following information concerning a proposed project: Sales revenues should be $1,700,000, operating costs excluding depreciation should be $1,190,000, depreciation expense should be $204,000, and interest expense should be $85,000. The company's tax rate is 20% and its WACC is 9%. What is the project's first year cash flow (CF1)? (A) $397,800 (B) $408,000 (C) $438,600 (D) $448,800 (E) $499,210 St. John's Shipyard is considering the replacement of an 8 -year old machine that has been fully depreciated and has no salvage value with a new one that will increase its earnings before depreciation (EBITDA) by \$27,000 per year. This new machine will cost $115,000 and will have an estimated useful life of 8 years with no salvage value. The new machine will be depreciated using 5-year MACRS which means rates of 20%,32%,19%,12%,11%, and 6% during the first six years (and nothing thereafter). The applicable corporate tax rate is 35% and the WACC is 8%. Which of the following statements is the correct recommendation? The equipment should not be replaced since the net present value would be less than zero The equipment should be replaced because the net present value is $16,739.51 The equipment should be replaced because the net present value is $18,505.91 (D) The equipment should be replaced because the net present value is $27,238.30 The equipment should be replaced because the net present value is $32,473.74 Colima Communications' finance department has collected the following information concerning a proposed project: Sales revenues should be $1,700,000, operating costs excluding depreciation should be $1,190,000, depreciation expense should be $204,000, and interest expense should be $85,000. The company's tax rate is 20% and its WACC is 9%. What is the project's first year cash flow (CF1)? (A) $397,800 (B) $408,000 (C) $438,600 (D) $448,800 (E) $499,210