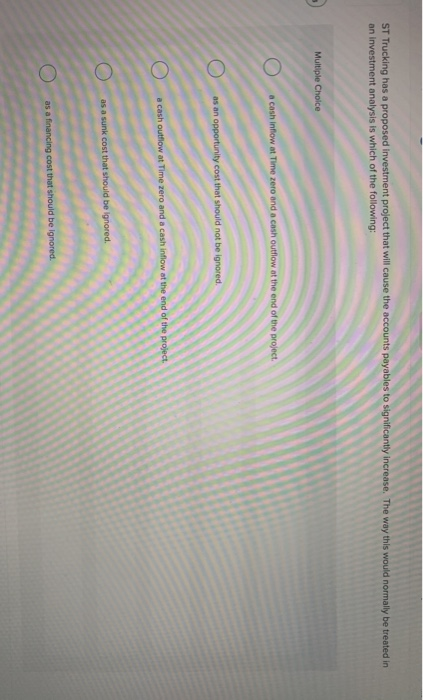

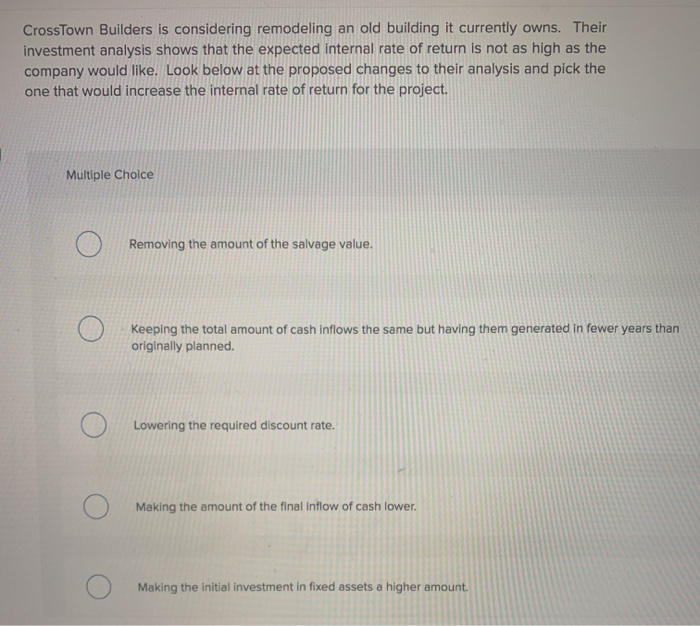

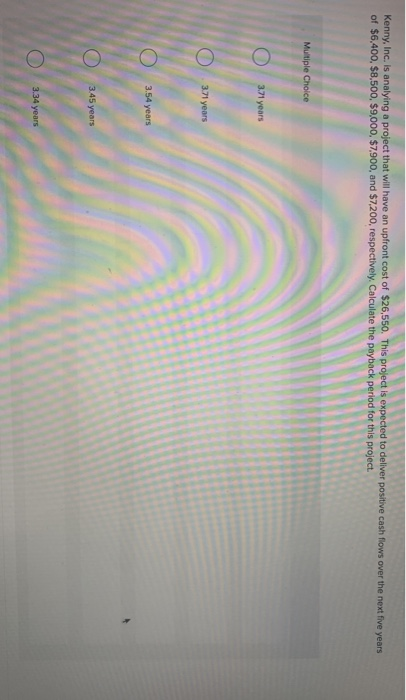

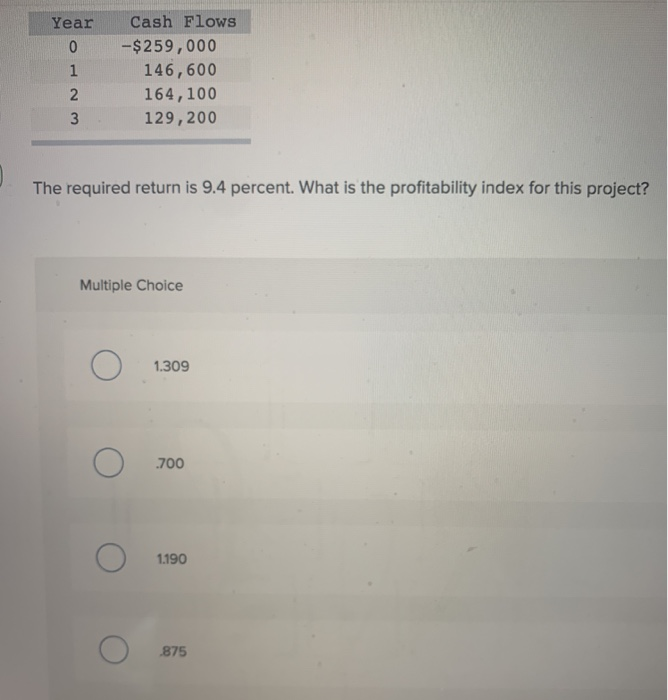

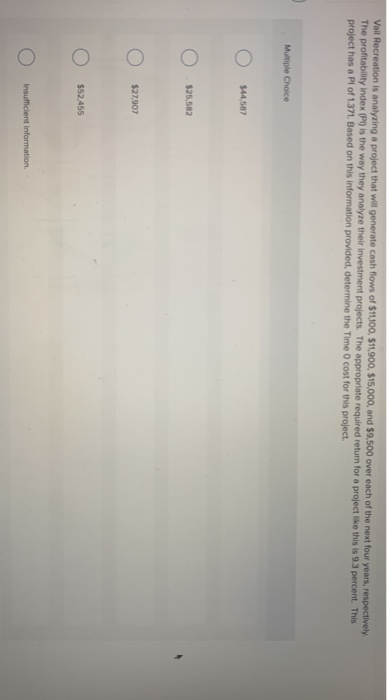

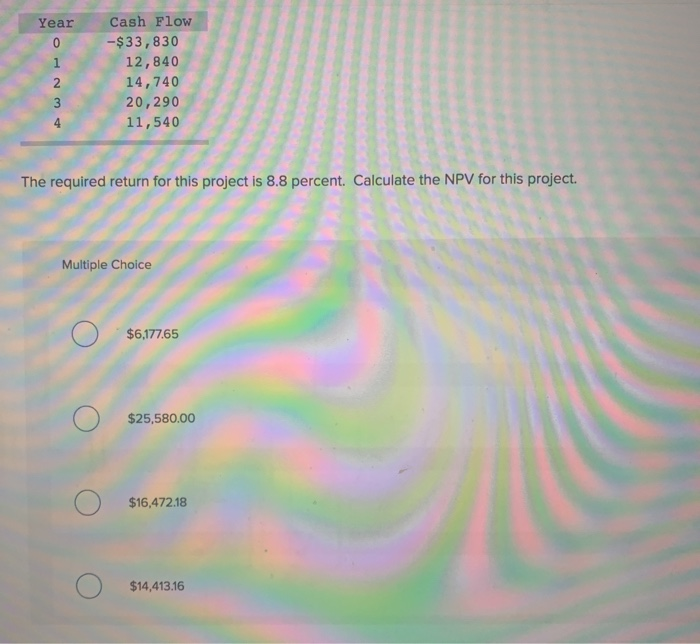

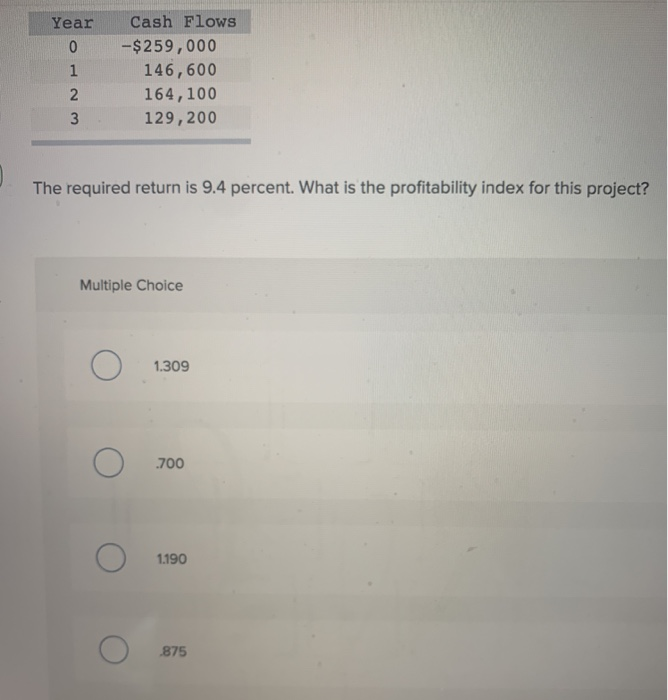

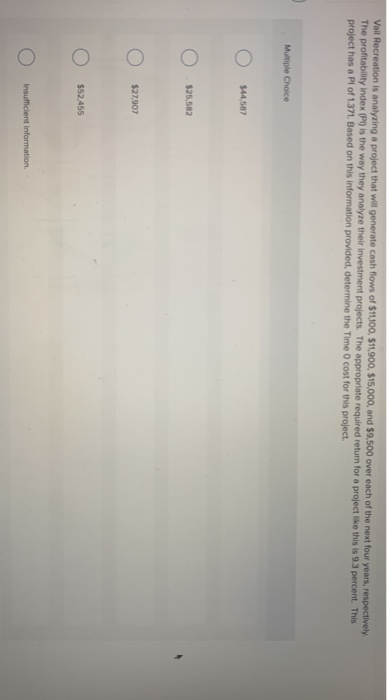

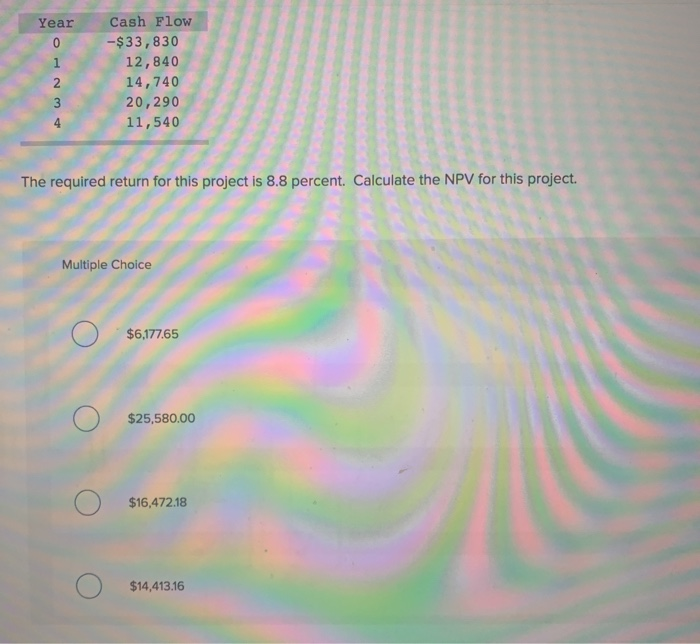

ST Trucking has a proposed Investment project that will cause the accounts payables to significantly increase. The way this would normally be treated in an investment analysis is which of the following: Multiple Choice a cash inflow at Time zero and a cash outflow at the end of the project as an opportunity cost that should not be ignored. a cash outflow at Time zero and a cash inflow at the end of the project. as a sunk cost that should be ignored. as a financing cost that should be ignored. CrossTown Builders is considering remodeling an old building it currently owns. Their investment analysis shows that the expected internal rate of return is not as high as the company would like. Look below at the proposed changes to their analysis and pick the one that would increase the internal rate of return for the project. Multiple Choice Removing the amount of the salvage value. O O Keeping the total amount of cash inflows the same but having them generated in fewer years than originally planned. ) Lowering the required discount rate. O Making the amount of the final inflow of cash lower. O Making the initial Investment in fixed assets a higher amount. O Kenny, Inc. is analying a project that will have an upfront cost of $26,550. This project is expected to deliver positive cash flows over the next five years of $6,400, $8,500, $9,000, $7.900, and $7,200, respectively. Calculate the payback period for this project 3.71 years 3.45 years Year Cash Flows -$259,000 146,600 164,100 129,200 WN The required return is 9.4 percent. What is the profitability index for this project? Multiple Choice 1.309 700 1.190 875 Vall Recreation is analyzing a project that will generate cash flows of $11100, $11.900, $15,000, and $9.500 over each of the next four years, respectively The profitability Index (Pl) is the way they analyze their investment projects. The appropriate required return for a project like this is 9.3 percent This project has a Pl of 1.371. Based on this information provided, determine the Time O cost for this project. Multiple Choice $44,587 $25,582 $27907 552,455 insufficient Information Year Cash Flow -$33,830 12,840 14,740 20,290 11,540 WN The required return for this project is 8.8 percent. Calculate the NPV for this project. Multiple Choice $6,177.65 $25,580.00 0 $16,472.18 $14,413.16