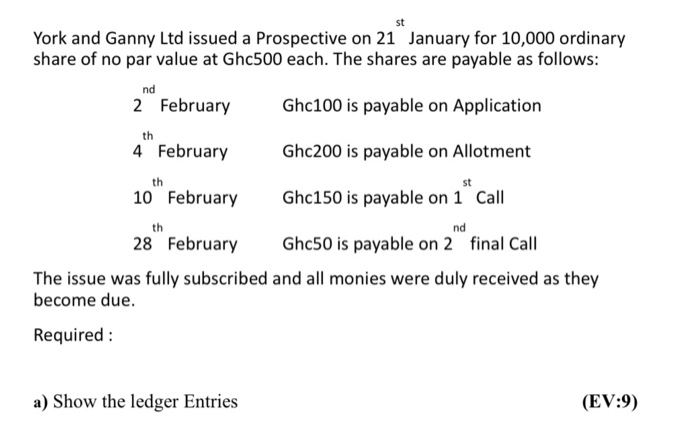

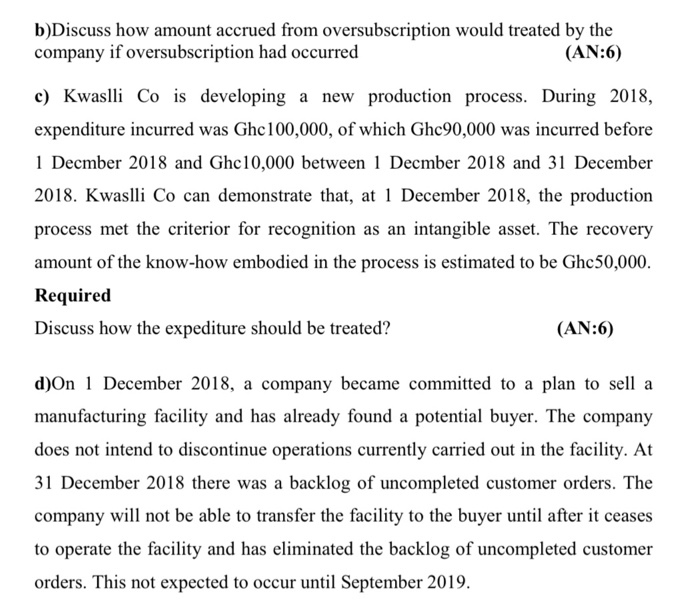

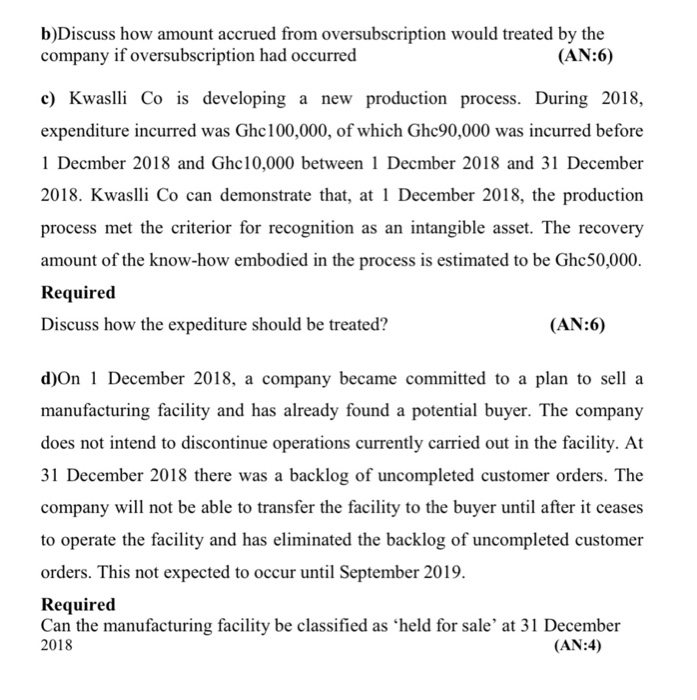

st York and Ganny Ltd issued a Prospective on 21 January for 10,000 ordinary share of no par value at Ghc500 each. The shares are payable as follows: nd 2 February Ghc100 is payable on Application th 4 February Ghc200 is payable on Allotment th 10 February Ghc150 is payable on 1 Call th nd 28 February Ghc50 is payable on 2 final Call The issue was fully subscribed and all monies were duly received as they become due. Required: a) Show the ledger Entries (EV:9) b)Discuss how amount accrued from oversubscription would treated by the company if oversubscription had occurred (AN:6) c) Kwaslli Co is developing a new production process. During 2018, expenditure incurred was Ghc100,000, of which Ghc90,000 was incurred before 1 Decmber 2018 and Ghc10,000 between 1 Decmber 2018 and 31 December 2018. Kwaslli Co can demonstrate that, at 1 December 2018, the production process met the criterior for recognition as an intangible asset. The recovery amount of the know-how embodied in the process is estimated to be Ghc50,000. Required Discuss how the expediture should be treated? (AN:6) d)On 1 December 2018, a company became committed to a plan to sell a manufacturing facility and has already found a potential buyer. The company does not intend to discontinue operations currently carried out in the facility. At 31 December 2018 there was a backlog of uncompleted customer orders. The company will not be able to transfer the facility to the buyer until after it ceases to operate the facility and has eliminated the backlog of uncompleted customer orders. This not expected to occur until September 2019. b)Discuss how amount accrued from oversubscription would treated by the company if oversubscription had occurred (AN:6) c) Kwaslli Co is developing a new production process. During 2018, expenditure incurred was Ghc 100,000, of which Ghc90,000 was incurred before 1 Decmber 2018 and Ghc10,000 between 1 Decmber 2018 and 31 December 2018. Kwaslli Co can demonstrate that, at 1 December 2018, the production process met the criterior for recognition as an intangible asset. The recovery amount of the know-how embodied in the process is estimated to be Ghc50,000. Required Discuss how the expediture should be treated? (AN:6) d)On 1 December 2018, a company became committed to a plan to sell a manufacturing facility and has already found a potential buyer. The company does not intend to discontinue operations currently carried out in the facility. At 31 December 2018 there was a backlog of uncompleted customer orders. The company will not be able to transfer the facility to the buyer until after it ceases to operate the facility and has eliminated the backlog of uncompleted customer orders. This not expected to occur until September 2019. Required Can the manufacturing facility be classified as held for sale at 31 December 2018 (AN:4) st York and Ganny Ltd issued a Prospective on 21 January for 10,000 ordinary share of no par value at Ghc500 each. The shares are payable as follows: nd 2 February Ghc100 is payable on Application th 4 February Ghc200 is payable on Allotment th 10 February Ghc150 is payable on 1 Call th nd 28 February Ghc50 is payable on 2 final Call The issue was fully subscribed and all monies were duly received as they become due. Required: a) Show the ledger Entries (EV:9) b)Discuss how amount accrued from oversubscription would treated by the company if oversubscription had occurred (AN:6) c) Kwaslli Co is developing a new production process. During 2018, expenditure incurred was Ghc100,000, of which Ghc90,000 was incurred before 1 Decmber 2018 and Ghc10,000 between 1 Decmber 2018 and 31 December 2018. Kwaslli Co can demonstrate that, at 1 December 2018, the production process met the criterior for recognition as an intangible asset. The recovery amount of the know-how embodied in the process is estimated to be Ghc50,000. Required Discuss how the expediture should be treated? (AN:6) d)On 1 December 2018, a company became committed to a plan to sell a manufacturing facility and has already found a potential buyer. The company does not intend to discontinue operations currently carried out in the facility. At 31 December 2018 there was a backlog of uncompleted customer orders. The company will not be able to transfer the facility to the buyer until after it ceases to operate the facility and has eliminated the backlog of uncompleted customer orders. This not expected to occur until September 2019. b)Discuss how amount accrued from oversubscription would treated by the company if oversubscription had occurred (AN:6) c) Kwaslli Co is developing a new production process. During 2018, expenditure incurred was Ghc 100,000, of which Ghc90,000 was incurred before 1 Decmber 2018 and Ghc10,000 between 1 Decmber 2018 and 31 December 2018. Kwaslli Co can demonstrate that, at 1 December 2018, the production process met the criterior for recognition as an intangible asset. The recovery amount of the know-how embodied in the process is estimated to be Ghc50,000. Required Discuss how the expediture should be treated? (AN:6) d)On 1 December 2018, a company became committed to a plan to sell a manufacturing facility and has already found a potential buyer. The company does not intend to discontinue operations currently carried out in the facility. At 31 December 2018 there was a backlog of uncompleted customer orders. The company will not be able to transfer the facility to the buyer until after it ceases to operate the facility and has eliminated the backlog of uncompleted customer orders. This not expected to occur until September 2019. Required Can the manufacturing facility be classified as held for sale at 31 December 2018 (AN:4)