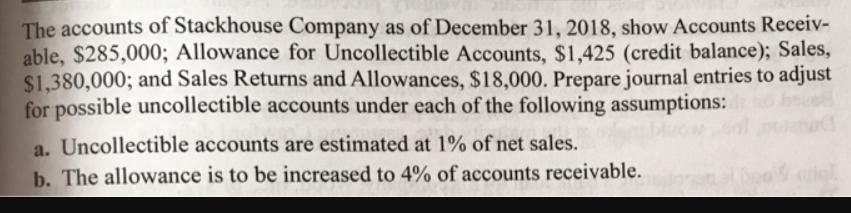

The accounts of Stackhouse Company as of December 31, 2018, show Accounts Receiv- able, $285,000; Allowance...

Fantastic news! We've Found the answer you've been seeking!

Question:

Related Book For

Intermediate Accounting

ISBN: 978-1118742976

16th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Posted Date: