Question

Stacy Nelson is the newly hired assistant controller of Kemp Industries, a regional supplier of hardwood products. The company sponsors a defined benefit pension plan

Stacy Nelson is the newly hired assistant controller of Kemp Industries, a regional supplier of hardwood products. The company sponsors a defined benefit pension plan that covers its 420 employees. On reviewing last years financial statements, Stacy was concerned about some items reported in the disclosure notes relating to the pension plan. Portions of the relevant note follow:

Kemps income statements reported total pension expense of $108,000 in 2021 and $86,520 in 2020. Since employment has remained constant in recent years, Stacy expressed concern over the increase in the pension expense. She expressed her concern to you, a three-year senior accountant at Kemp. Im also interested in the differences in these liability measurements, she mentioned.

Write a memo to Stacy. In the memo, do the following:

- Identify the topic explaining accounting for defined benefit plans in FASB codification.

- Find code that describes the definition of accumulated benefit obligation and projected benefit obligation. Explain the differences and similarities between the accumulated benefit obligation and the projected benefit obligation.

- Find the code that describes the reporting of pension related liabilities and assets. Explain how the Projected benefit obligation in excess of plan assets is reported in the financial statements.

Find the code that describes the composition of pension expense. Briefly describe the components of pension expense. Explain what may cause the increase in pension expense even though employment has remained constant in recent years.

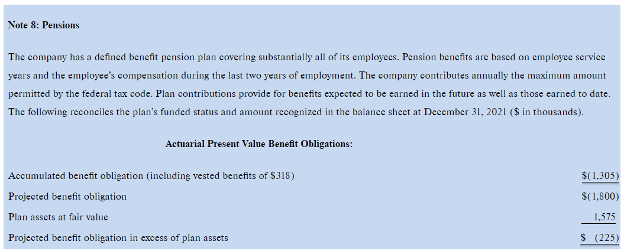

Note 8: Pensions The company has a defined benefit pension plan covering substantially all of its employees. Pension benefits are based on employee service years and the employee's compensution during the last two years of employment. The compuny contributes annually the maximum amount permitted by the federal tax code. Plan contributions provide for benefits expected to be earned in the future as well as those earned to date. The following reconciles the plan's funded status and amount recognized in the balance sheet at December 31, 2021 ($ in thousands). Actuarial Present Value Benefit Obligations: Accumulated benefit obligation (including vested benefits of $318) Projected benefit obligation $(1.305) $(1,800) Plan assets at fair value 1,575 Projected benefit obligation in excess of plan assets S (225)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started