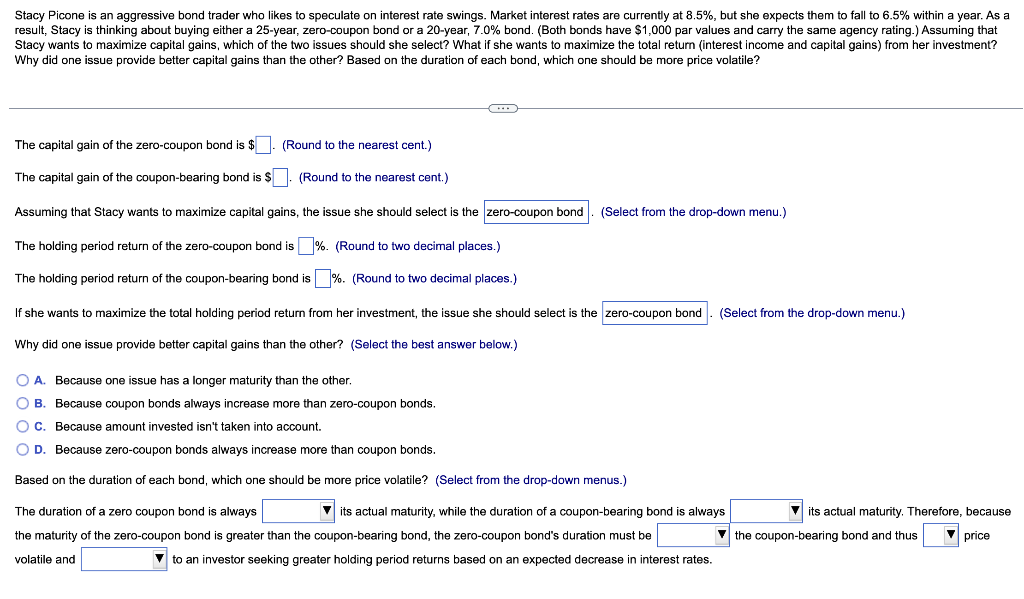

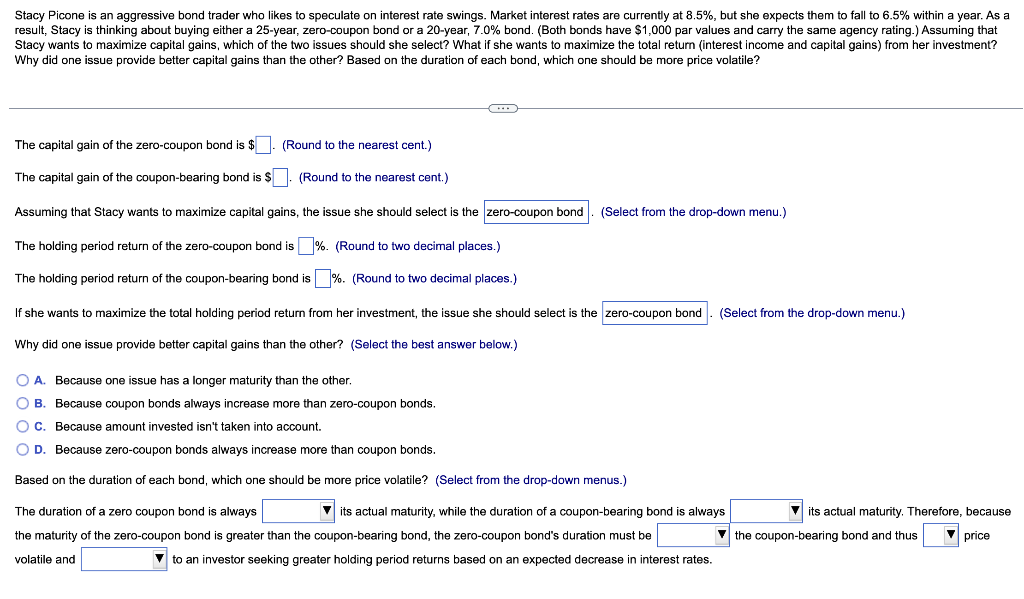

Stacy Picone is an aggressive bond trader who likes to speculate on interest rate swings. Market interest rates are currently at 8.5%, but she expects them to fall to 6.5% within a year. As a result, Stacy is thinking about buying either a 25-year, zero-coupon bond or a 20-year, 7.0% bond. (Both bonds have $1,000 par values and carry the same agency rating.) Assuming that Stacy wants to maximize capital gains, which of the two issues should she select? What if she wants to maximize the total return (interest income and capital gains) from her investment? Why did one issue provide better capital gains than the other? Based on the duration of each bond, which one should be more price volatile? The capital gain of the zero-coupon bond is $ (Round to the nearest cent.) The capital gain of the coupon-bearing bond is 9 (Round to the nearest cent.) Assuming that Stacy wants to maximize capital gains, the issue she should select is the (Select from the drop-down menu.) The holding period return of the zero-coupon bond is \%. (Round to two decimal places.) The holding period return of the coupon-bearing bond is \%. (Round to two decimal places.) If she wants to maximize the total holding period return from her investment, the issue she should select is the (Select from the drop-down menu.) Why did one issue provide better capital gains than the other? (Select the best answer below.) A. Because one issue has a longer maturity than the other. B. Because coupon bonds always increase more than zero-coupon bonds. C. Because amount invested isn't taken into account. D. Because zero-coupon bonds always increase more than coupon bonds. Based on the duration of each bond, which one should be more price volatile? (Select from the drop-down menus.) The duration of a zero coupon bond is always its actual maturity, while the duration of a coupon-bearing bond is always its actual maturity. Therefore, because the maturity of the zero-coupon bond is greater than the coupon-bearing bond, the zero-coupon bond's duration must be the coupon-bearing bond and thus price volatile and to an investor seeking greater holding period returns based on an expected decrease in interest rates