Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stafford Co. Issued $200,000 face value, 6%, 10-year bonds on January 1, 2017 for $172,740. The market rate of interest was 8%. Interest is payable

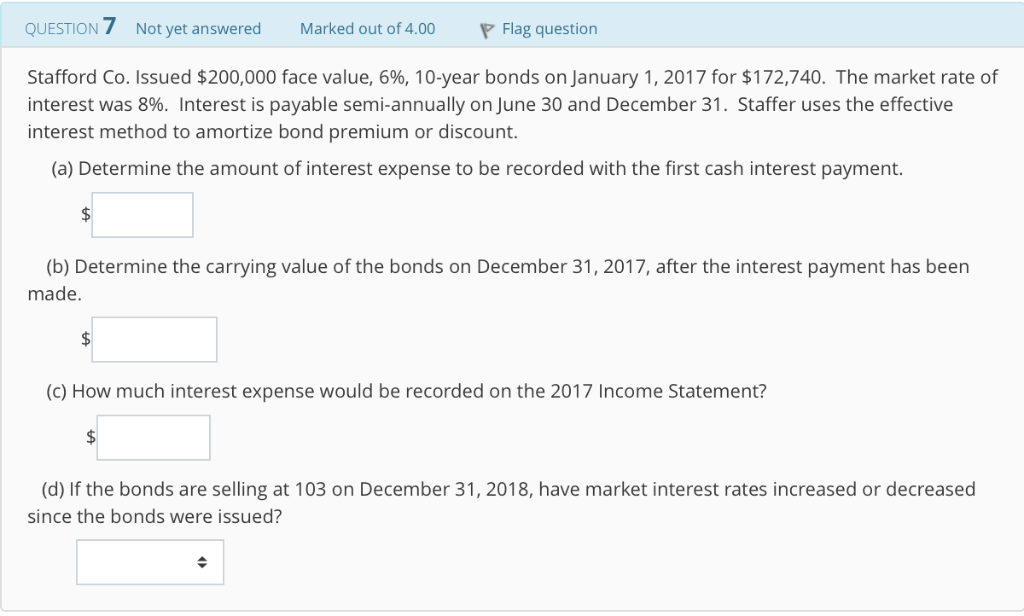

Stafford Co. Issued $200,000 face value, 6%, 10-year bonds on January 1, 2017 for $172,740. The market rate of interest was 8%. Interest is payable semi-annually on June 30 and December 31. Staffer uses the effective interest method to amortize bond premium or discount.

QUESTION 7 Not yet answered Marked out of 4.00 Flag question Stafford Co. issued $200,000 face value, 696, 10-year bonds on January 1, 2017 for $172740. The market ate of interest was 8%. Interest is payable semi-annually on June 30 and December 31 . Staffer uses the effective interest method to amortize bond premium or discount (a) Determine the amount of interest expense to be recorded with the first cash interest payment. (b) Determine the carrying value of the bonds on December 31, 2017, after the interest payment has been made. c) How much interest expense would be recorded on the 2017 Income Statement? (d) If the bonds are selling at 103 on December 31, 2018, have market interest rates increased or decreased since the bonds were issuedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started