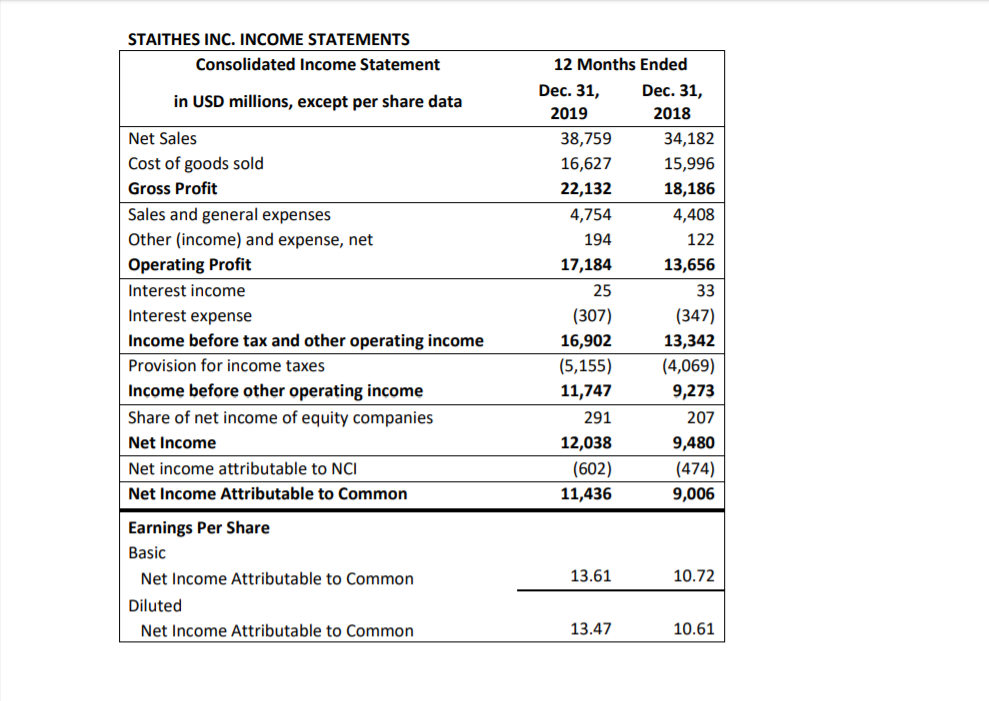

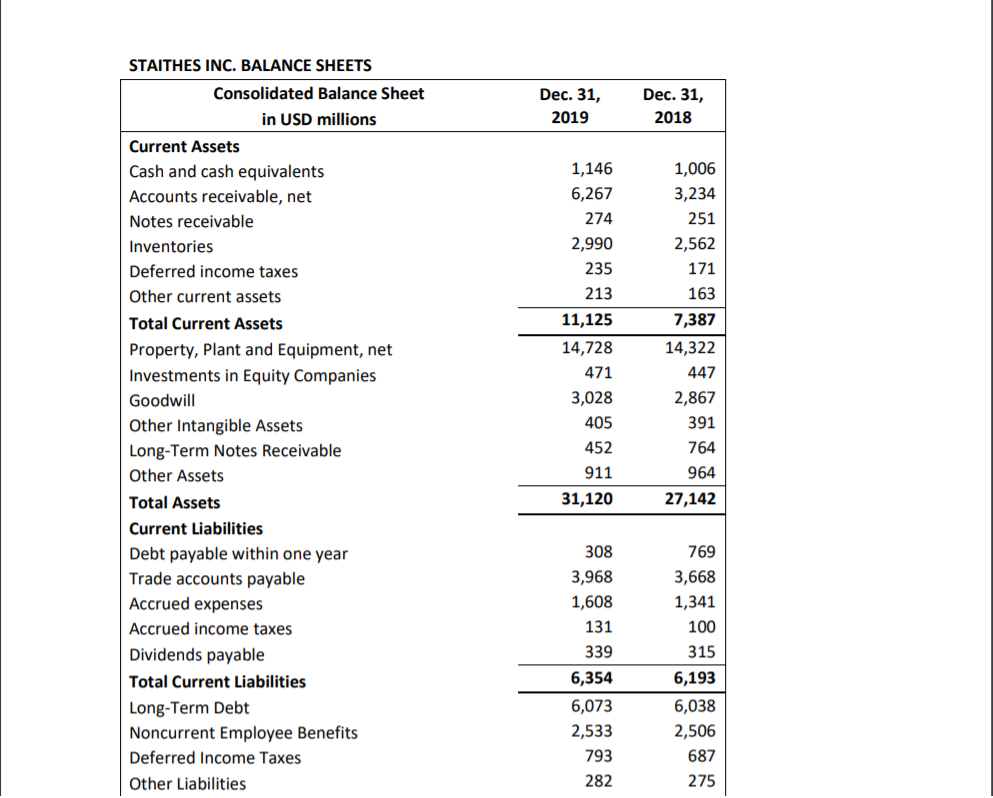

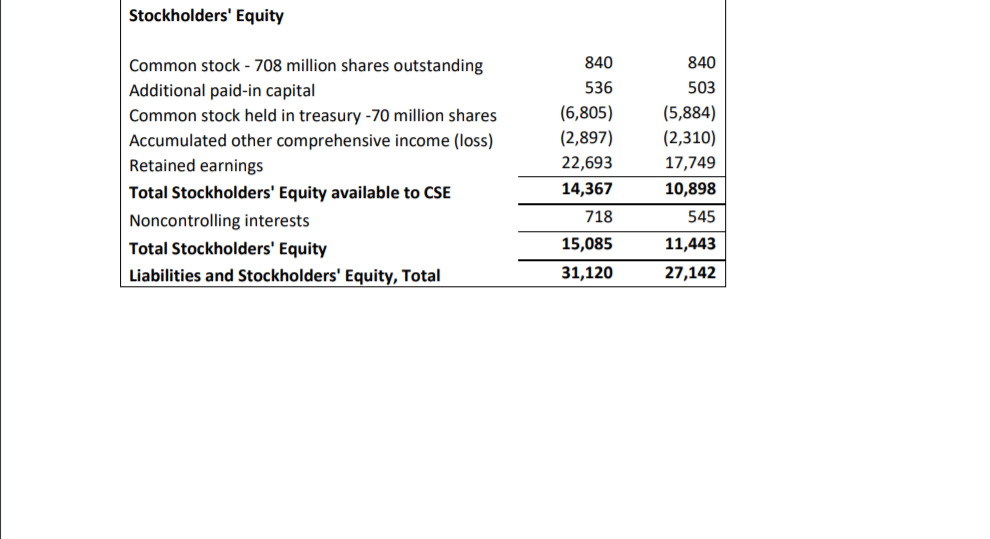

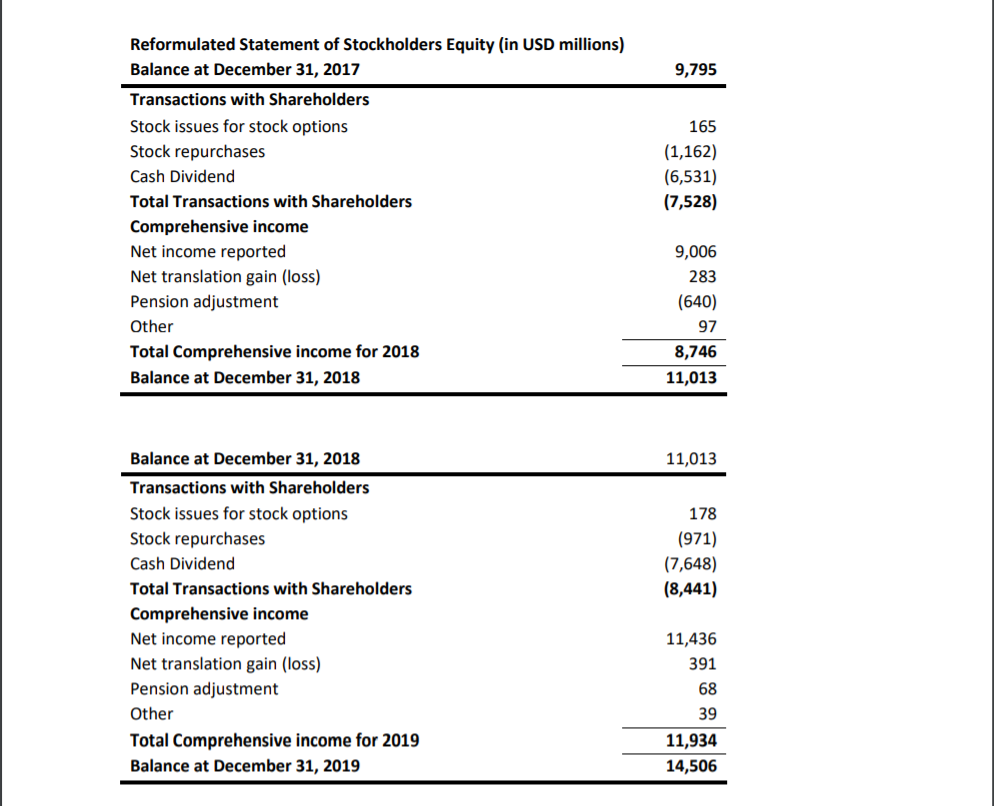

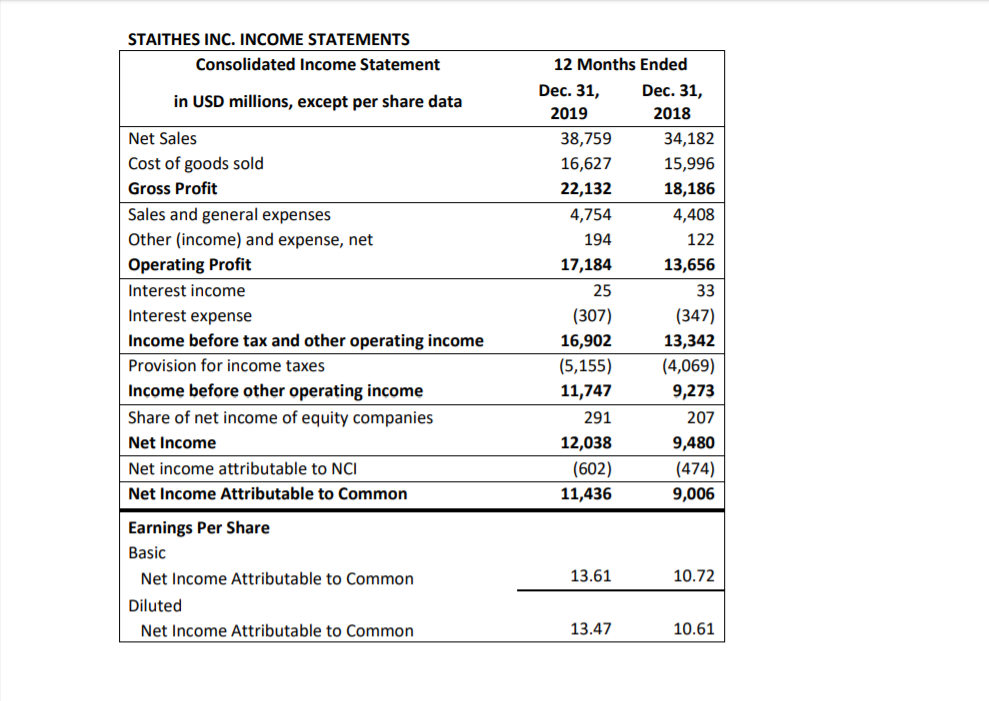

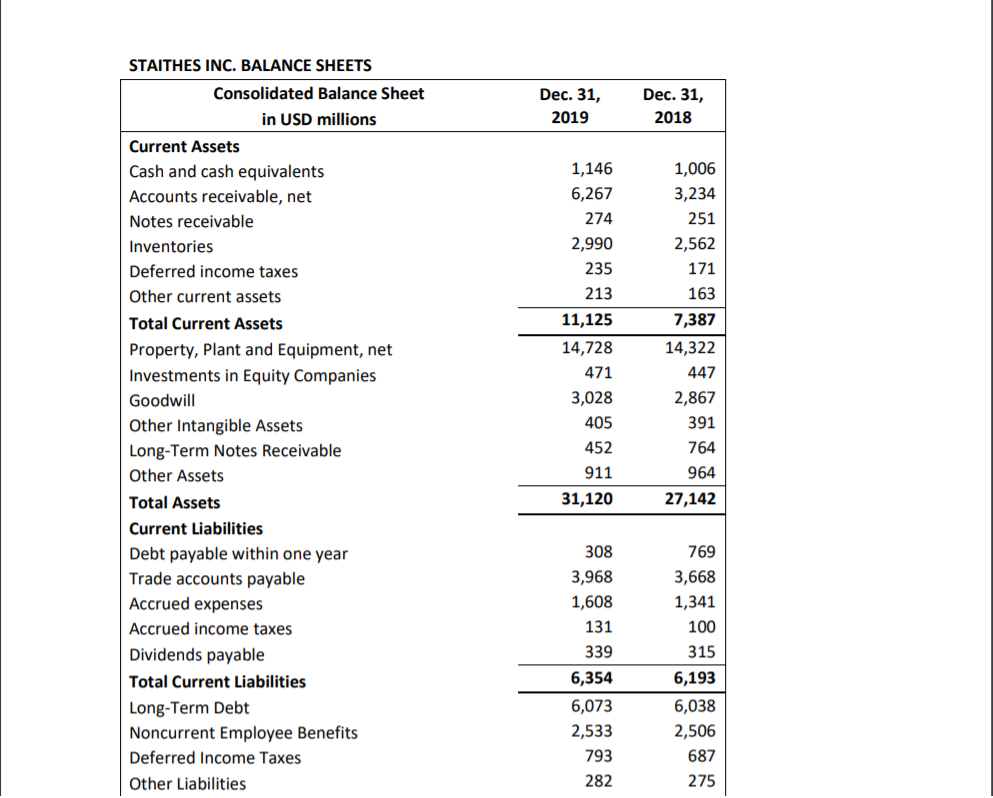

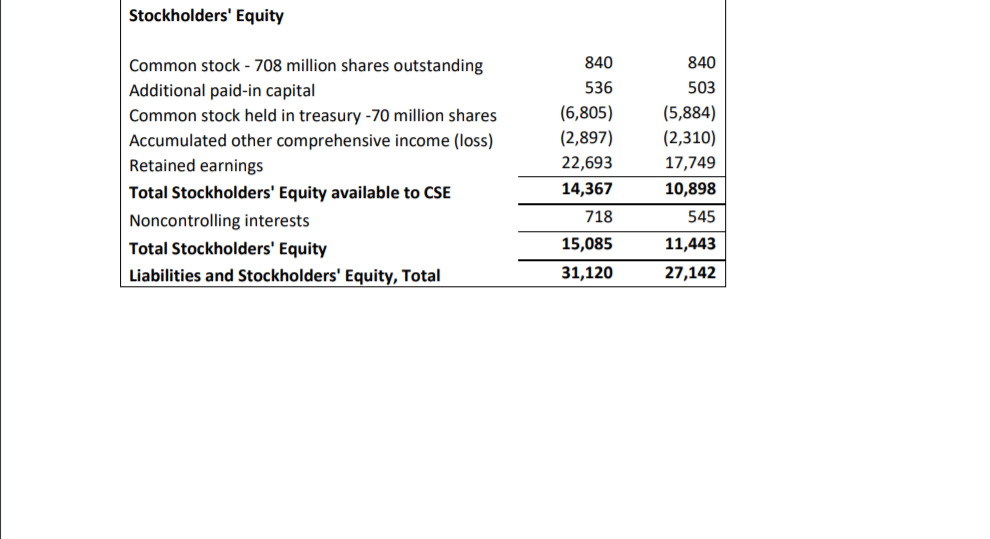

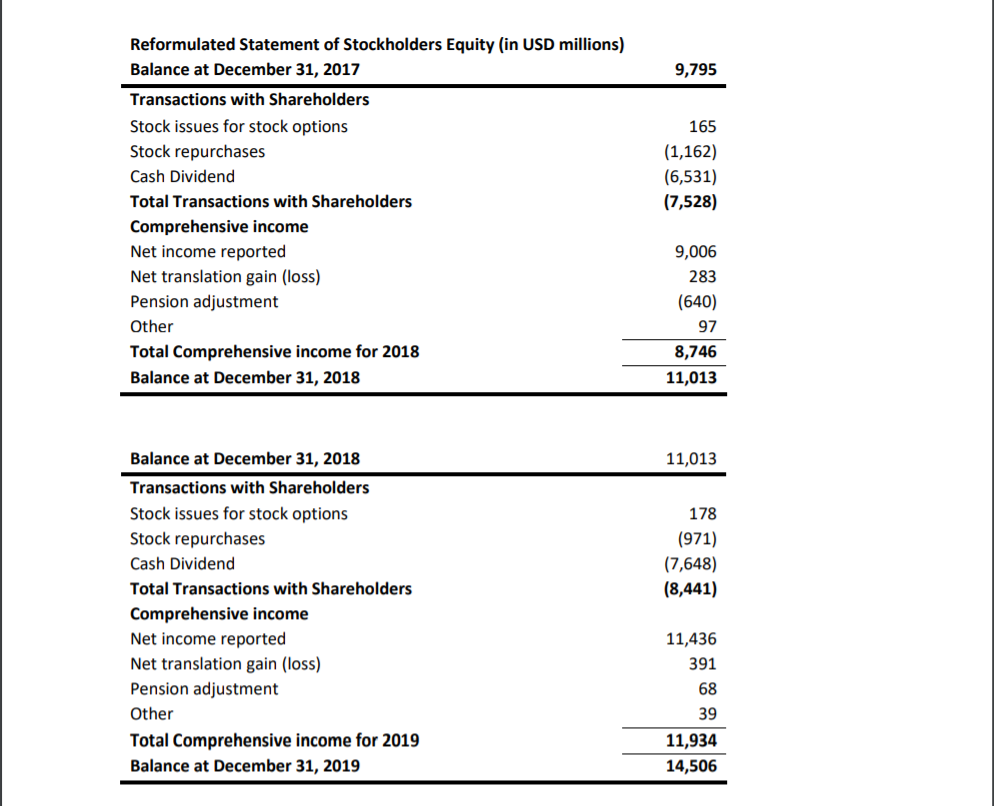

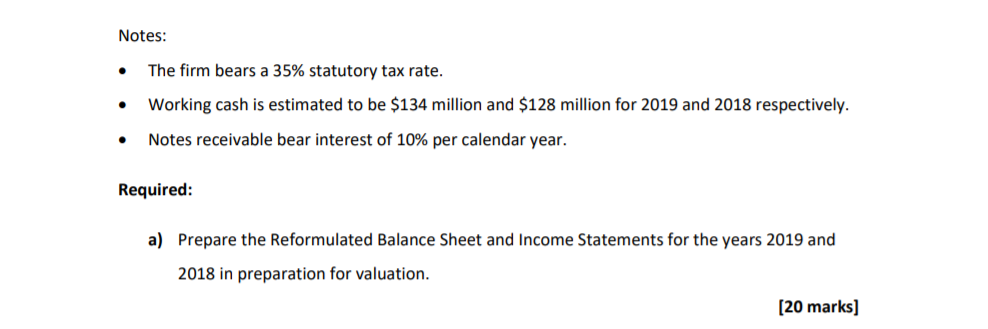

STAITHES INC. INCOME STATEMENTS Consolidated Income Statement in USD millions, except per share data Net Sales Cost of goods sold Gross Profit Sales and general expenses Other (income) and expense, net Operating Profit Interest income Interest expense Income before tax and other operating income Provision for income taxes Income before other operating income Share of net income of equity companies Net Income Net income attributable to NCI Net Income Attributable to Common 12 Months Ended Dec. 31, Dec. 31, 2019 2018 38,759 34,182 16,627 15,996 22,132 18,186 4,754 4,408 194 122 17,184 13,656 25 33 (307) (347) 16,902 13,342 (5,155) (4,069) 11,747 9,273 291 207 12,038 9,480 (602) (474) 11,436 9,006 Earnings Per Share Basic Net Income Attributable to Common Diluted Net Income Attributable to Common 13.61 10.72 13.47 10.61 Dec. 31, 2019 Dec. 31, 2018 STAITHES INC. BALANCE SHEETS Consolidated Balance Sheet in USD millions Current Assets Cash and cash equivalents Accounts receivable, net Notes receivable Inventories Deferred income taxes Other current assets Total Current Assets Property, plant and Equipment, net Investments in Equity Companies Goodwill Other Intangible Assets Long-Term Notes Receivable Other Assets Total Assets Current Liabilities Debt payable within one year Trade accounts payable Accrued expenses Accrued income taxes Dividends payable Total Current Liabilities Long-Term Debt Noncurrent Employee Benefits Deferred Income Taxes Other Liabilities 1,146 6,267 274 2,990 235 213 11,125 14,728 471 3,028 405 1,006 3,234 251 2,562 171 163 7,387 14,322 447 2,867 391 764 964 27,142 452 911 31,120 308 3,968 1,608 131 339 769 3,668 1,341 100 315 6,193 6,038 2,506 687 275 6,354 6,073 2,533 793 282 Stockholders' Equity 840 Common stock - 708 million shares outstanding Additional paid-in capital Common stock held in treasury -70 million shares Accumulated other comprehensive income (loss) Retained earnings Total Stockholders' Equity available to CSE Noncontrolling interests Total Stockholders' Equity Liabilities and Stockholders' Equity, Total 840 536 (6,805) (2,897) 22,693 14,367 718 15,085 31,120 503 (5,884) (2,310) 17,749 10,898 545 11,443 27,142 9,795 Reformulated Statement of Stockholders Equity (in USD millions) Balance at December 31, 2017 Transactions with Shareholders Stock issues for stock options Stock repurchases Cash Dividend Total Transactions with Shareholders Comprehensive income Net income reported Net translation gain (loss) Pension adjustment Other Total Comprehensive income for 2018 Balance at December 31, 2018 165 (1,162) (6,531) (7,528) 9,006 283 (640) 97 8,746 11,013 11,013 178 (971) (7,648) (8,441) Balance at December 31, 2018 Transactions with Shareholders Stock issues for stock options Stock repurchases Cash Dividend Total Transactions with Shareholders Comprehensive income Net income reported Net translation gain (loss) Pension adjustment Other Total Comprehensive income for 2019 Balance at December 31, 2019 11,436 391 68 39 11,934 14,506 Notes: . The firm bears a 35% statutory tax rate. Working cash is estimated to be $134 million and $128 million for 2019 and 2018 respectively. Notes receivable bear interest of 10% per calendar year. Required: a) Prepare the Reformulated Balance Sheet and Income Statements for the years 2019 and 2018 in preparation for valuation. [20 marks]