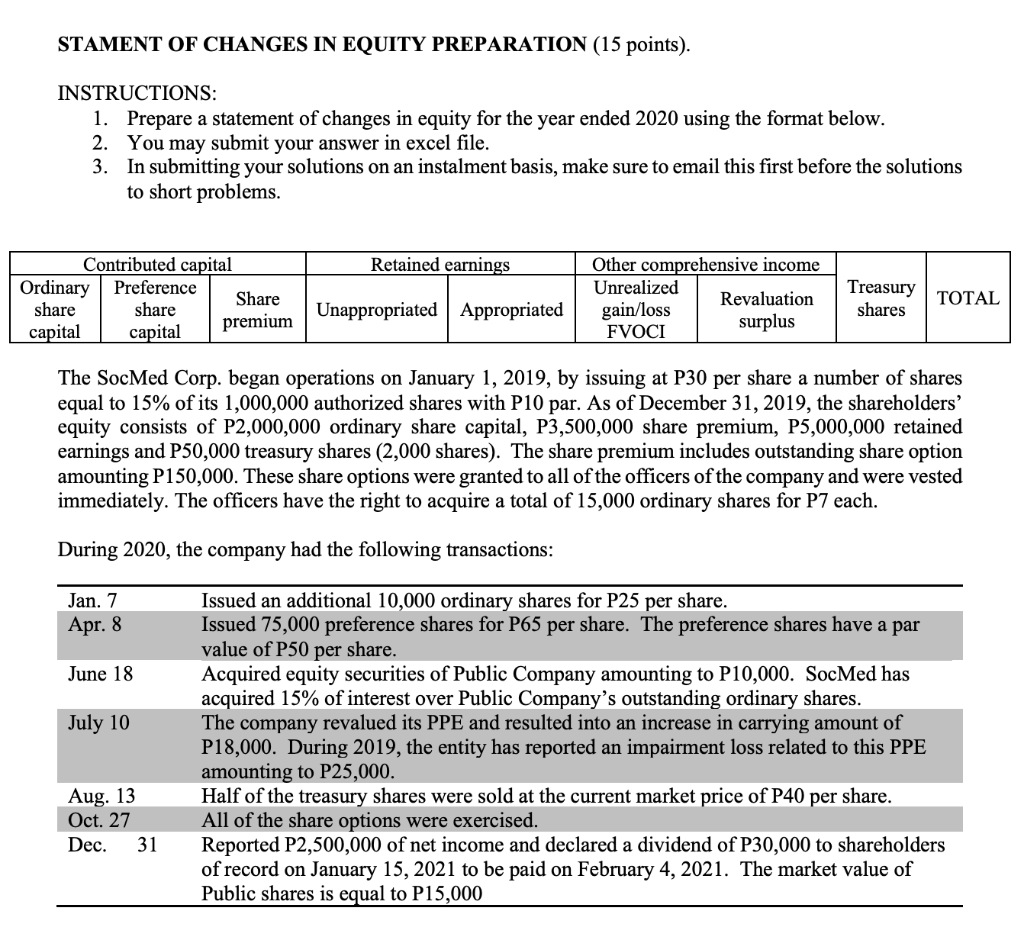

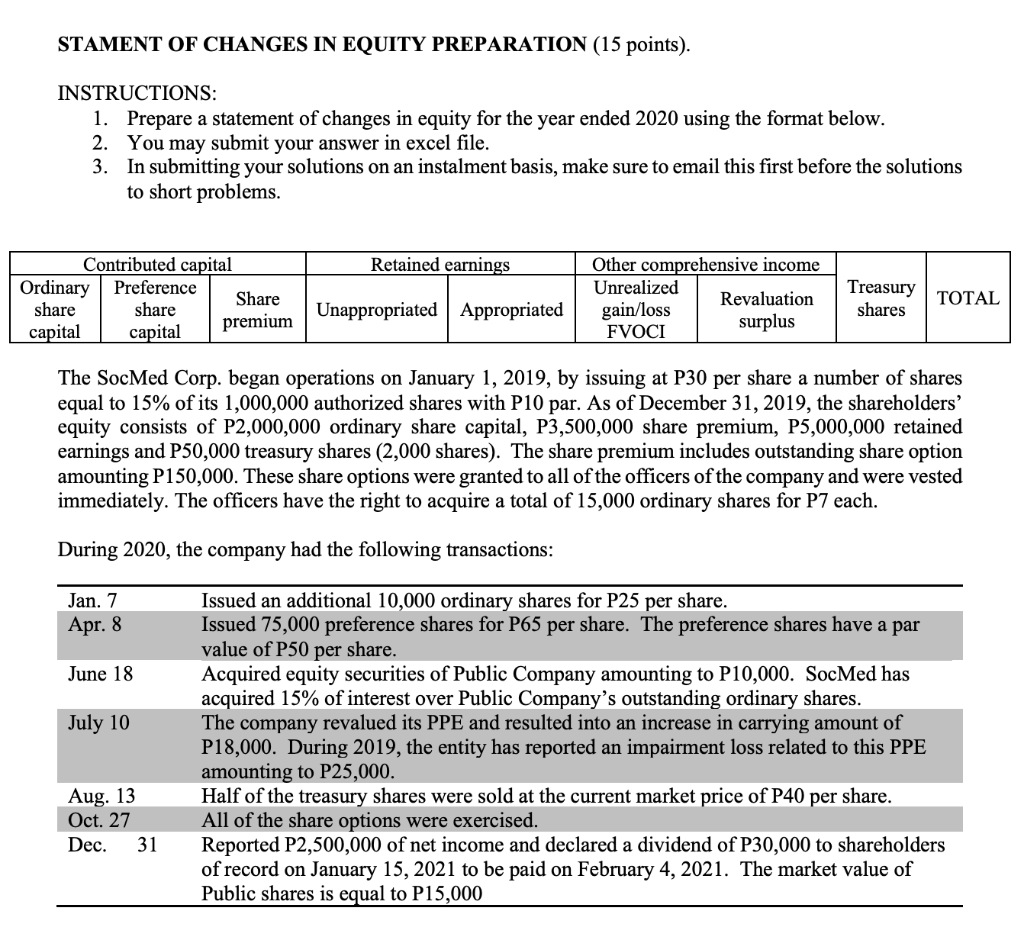

STAMENT OF CHANGES IN EQUITY PREPARATION (15 points). INSTRUCTIONS: 1. Prepare a statement of changes in equity for the year ended 2020 using the format below. 2. You may submit your answer in excel file. 3. In submitting your solutions on an instalment basis, make sure to email this first before the solutions to short problems. Retained earnings Contributed capital Ordinary Preference Share share share premium capital capital Other comprehensive income Unrealized Revaluation gain/loss FVOCI surplus Treasury shares TOTAL Unappropriated Appropriated The SocMed Corp. began operations on January 1, 2019, by issuing at P30 per share a number of shares equal to 15% of its 1,000,000 authorized shares with P10 par. As of December 31, 2019, the shareholders' equity consists of P2,000,000 ordinary share capital, P3,500,000 share premium, P5,000,000 retained earnings and P50,000 treasury shares (2,000 shares). The share premium includes outstanding share option amounting P150,000. These share options were granted to all of the officers of the company and were vested immediately. The officers have the right to acquire a total of 15,000 ordinary shares for P7 each. During 2020, the company had the following transactions: Jan. 7 Apr. 8 June 18 July 10 Issued an additional 10,000 ordinary shares for P25 per share. Issued 75,000 preference shares for P65 per share. The preference shares have a par value of P50 per share. Acquired equity securities of Public Company amounting to P10,000. SocMed has acquired 15% of interest over Public Company's outstanding ordinary shares. The company revalued its PPE and resulted into an increase in carrying amount of P18,000. During 2019, the entity has reported an impairment loss related to this PPE amounting to P25,000. Half of the treasury shares were sold at the current market price of P40 per share. All of the share options were exercised. Reported P2,500,000 of net income and declared a dividend of P30,000 to shareholders of record on January 15, 2021 to be paid on February 4, 2021. The market value of Public shares is equal to P15,000 Aug. 13 Oct. 27 Dec. 31 STAMENT OF CHANGES IN EQUITY PREPARATION (15 points). INSTRUCTIONS: 1. Prepare a statement of changes in equity for the year ended 2020 using the format below. 2. You may submit your answer in excel file. 3. In submitting your solutions on an instalment basis, make sure to email this first before the solutions to short problems. Retained earnings Contributed capital Ordinary Preference Share share share premium capital capital Other comprehensive income Unrealized Revaluation gain/loss FVOCI surplus Treasury shares TOTAL Unappropriated Appropriated The SocMed Corp. began operations on January 1, 2019, by issuing at P30 per share a number of shares equal to 15% of its 1,000,000 authorized shares with P10 par. As of December 31, 2019, the shareholders' equity consists of P2,000,000 ordinary share capital, P3,500,000 share premium, P5,000,000 retained earnings and P50,000 treasury shares (2,000 shares). The share premium includes outstanding share option amounting P150,000. These share options were granted to all of the officers of the company and were vested immediately. The officers have the right to acquire a total of 15,000 ordinary shares for P7 each. During 2020, the company had the following transactions: Jan. 7 Apr. 8 June 18 July 10 Issued an additional 10,000 ordinary shares for P25 per share. Issued 75,000 preference shares for P65 per share. The preference shares have a par value of P50 per share. Acquired equity securities of Public Company amounting to P10,000. SocMed has acquired 15% of interest over Public Company's outstanding ordinary shares. The company revalued its PPE and resulted into an increase in carrying amount of P18,000. During 2019, the entity has reported an impairment loss related to this PPE amounting to P25,000. Half of the treasury shares were sold at the current market price of P40 per share. All of the share options were exercised. Reported P2,500,000 of net income and declared a dividend of P30,000 to shareholders of record on January 15, 2021 to be paid on February 4, 2021. The market value of Public shares is equal to P15,000 Aug. 13 Oct. 27 Dec. 31