Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Standard Co acquired 80% of Odense SA for $520,000 on 1 January 20X4 when the retained earnings of Odense were 2,100,000 Danish Krone. An

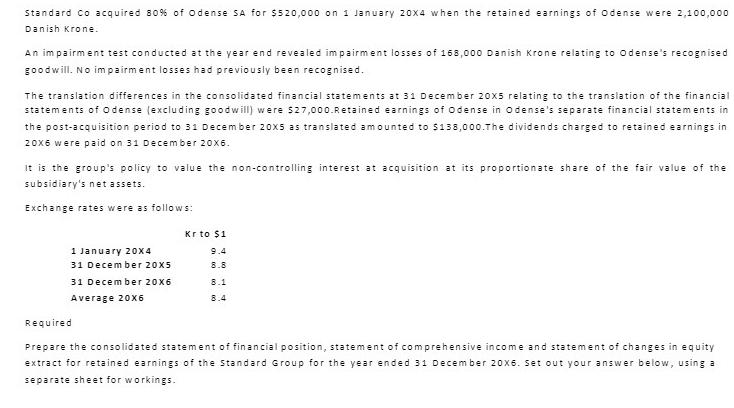

Standard Co acquired 80% of Odense SA for $520,000 on 1 January 20X4 when the retained earnings of Odense were 2,100,000 Danish Krone. An impairment test conducted at the year end revealed impairment losses of 168,000 Danish Krone relating to Odense's recognised goodwill. No impairment losses had previously been recognised. The translation differences in the consolidated financial statements at 31 December 20x5 relating to the translation of the financial statements of Odense (excluding goodwill) were $27,000.Retained earnings of Odense in Odense's separate financial statements in the post-acquisition period to 31 December 20x5 as translated amounted to $138,000. The dividends charged to retained earnings in 20x6 were paid on 31 December 20x6. it is the group's policy to value the non-controlling interest at acquisition at its proportionate share of the fair value of the subsidiary's net assets. Exchange rates were as follows: 1 January 20X4 31 December 20X5 31 December 20X6 Average 20x6 Kr to $1 9.4 8.8 8.1 8.4 Required Prepare the consolidated statement of financial position, statement of comprehensive income and statement of changes in equity extract for retained earnings of the Standard Group for the year ended 31 December 20x6. Set out your answer below, using a separate sheet for workings.

Step by Step Solution

★★★★★

3.26 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started