Answered step by step

Verified Expert Solution

Question

1 Approved Answer

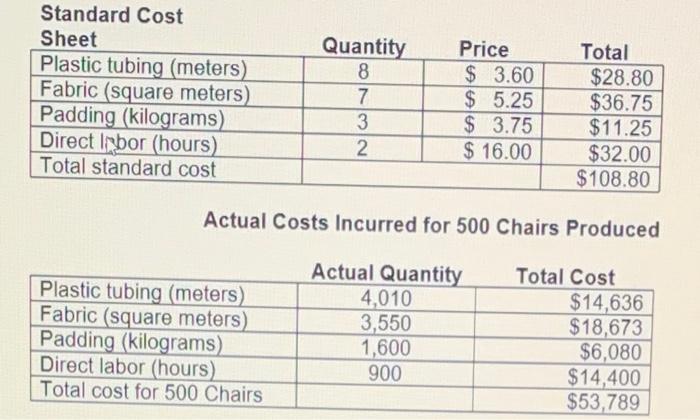

Standard Cost Sheet Quantity Price Total Plastic tubing (meters) 8 $ 3.60 $28.80 Fabric (square meters) 7 $ 5.25 $36.75 Padding (kilograms) 3 $

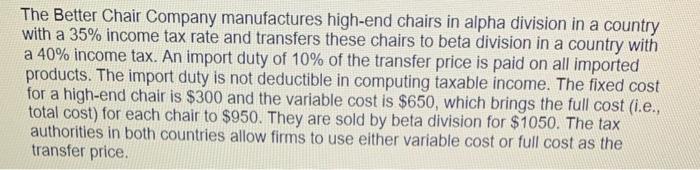

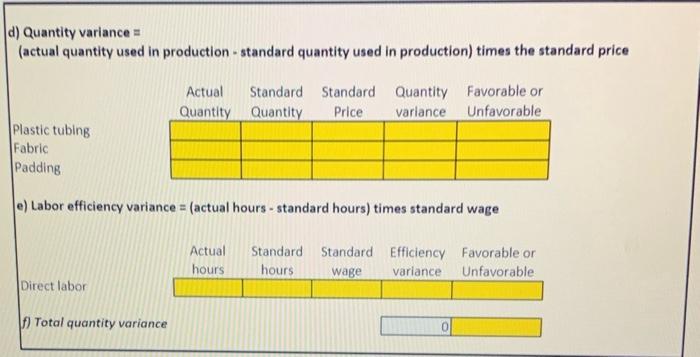

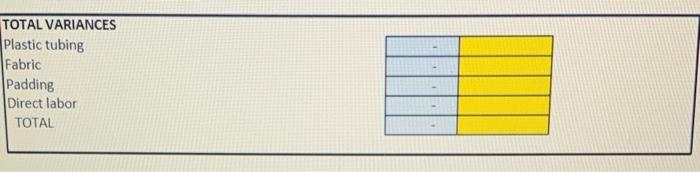

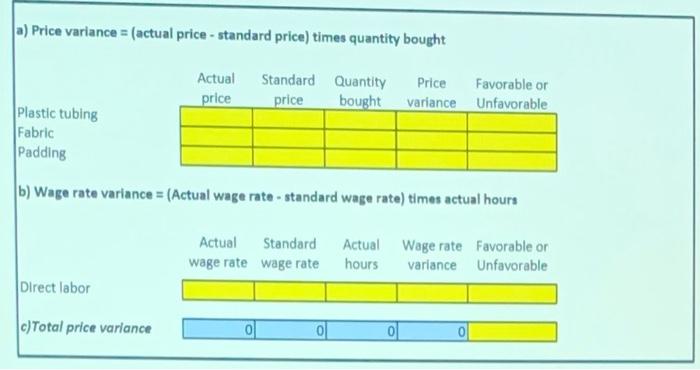

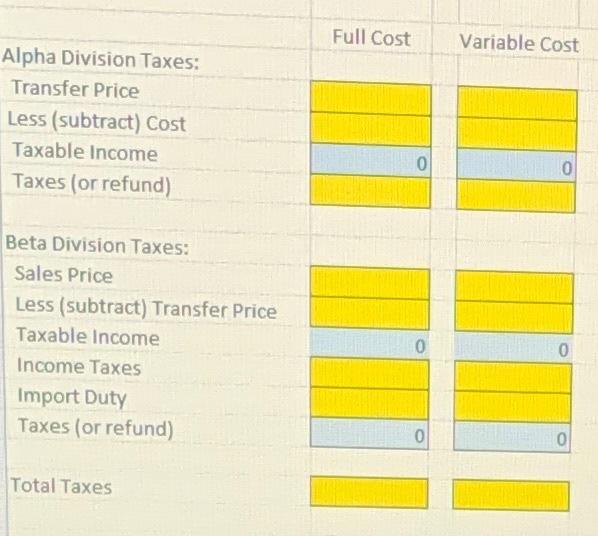

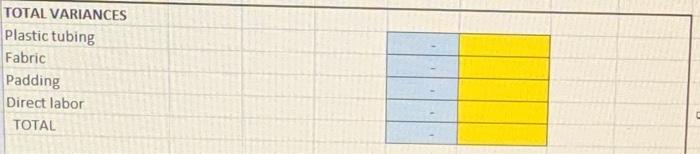

Standard Cost Sheet Quantity Price Total Plastic tubing (meters) 8 $ 3.60 $28.80 Fabric (square meters) 7 $ 5.25 $36.75 Padding (kilograms) 3 $ 3.75 $11.25 Direct Inbor (hours) 2 $ 16.00 $32.00 Total standard cost $108.80 Actual Costs Incurred for 500 Chairs Produced Actual Quantity Total Cost Plastic tubing (meters) 4,010 $14,636 Fabric (square meters) 3,550 $18,673 Padding (kilograms) 1,600 $6,080 Direct labor (hours) 900 $14,400 Total cost for 500 Chairs $53,789 The Better Chair Company manufactures high-end chairs in alpha division in a country with a 35% income tax rate and transfers these chairs to beta division in a country with a 40% income tax. An import duty of 10% of the transfer price is paid on all imported products. The import duty is not deductible in computing taxable income. The fixed cost for a high-end chair is $300 and the variable cost is $650, which brings the full cost (i.e., total cost) for each chair to $950. They are sold by beta division for $1050. The tax authorities in both countries allow firms to use either variable cost or full cost as the transfer price. d) Quantity variance = (actual quantity used in production - standard quantity used in production) times the standard price Actual Standard Standard Quantity Quantity Quantity Price variance Favorable or Unfavorable Plastic tubing Fabric Padding e) Labor efficiency variance = (actual hours - standard hours) times standard wage Direct labor f) Total quantity variance hours Actual Standard Standard Efficiency hours variance Favorable or wage Unfavorable TOTAL VARIANCES Plastic tubing Fabric Padding Direct labor TOTAL a) Price variance (actual price- standard price) times quantity bought price Actual Standard Quantity price bought Price variance Plastic tubing Fabric Favorable or Unfavorable Padding b) Wage rate variance = (Actual wage rate-standard wage rate) times actual hours Actual Standard wage rate wage rate Actual hours Wage rate Favorable or variance Unfavorable Direct labor c)Total price variance Alpha Division Taxes: Transfer Price Less (subtract) Cost Taxable Income Taxes (or refund) Beta Division Taxes: Sales Price Less (subtract) Transfer Price Taxable Income Income Taxes Import Duty Taxes (or refund) Total Taxes Full Cost Variable Cost 0 0 0 0 0 TOTAL VARIANCES Plastic tubing Fabric Padding Direct labor TOTAL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started