Standard Costing

Refer to the solution for the module problem. What do the four direct cost variances and flexible budget analysis, taken as a whole, tell you about the production process during July? What recommendations do you have for management?

Hint: do not analyze the variances one by one. Try to look at them in relation to each other.

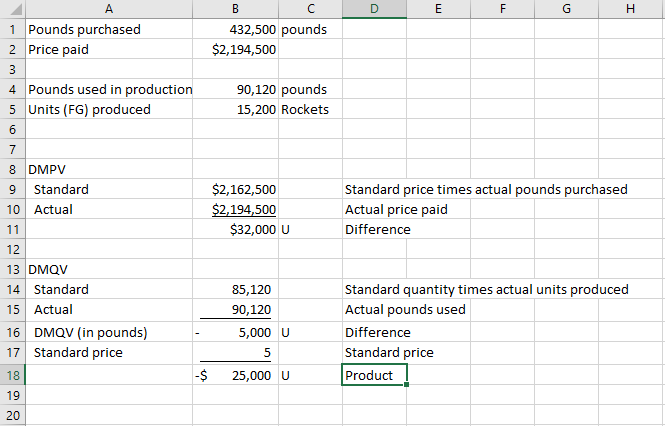

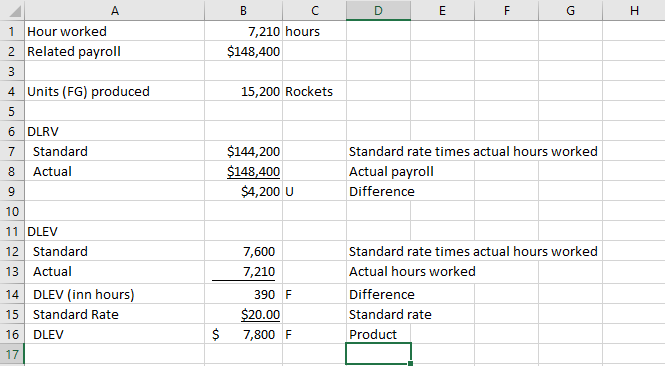

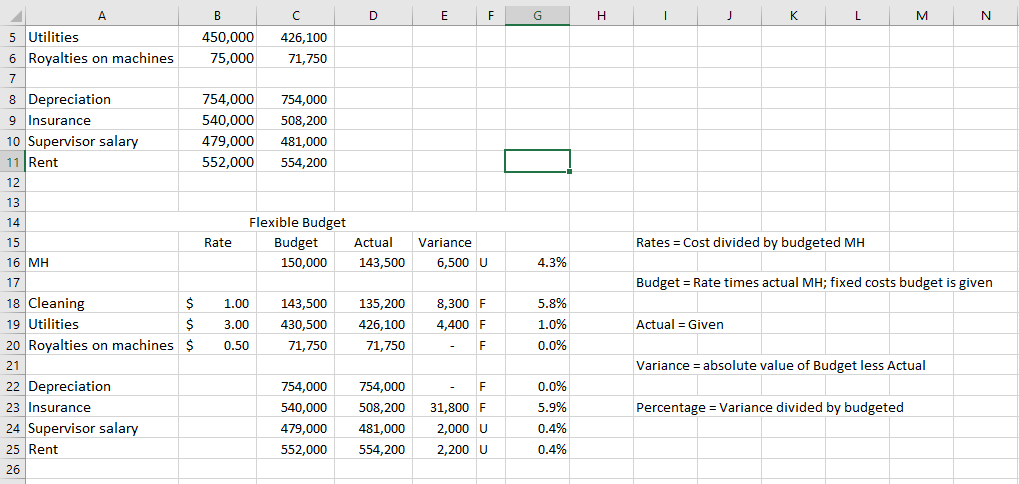

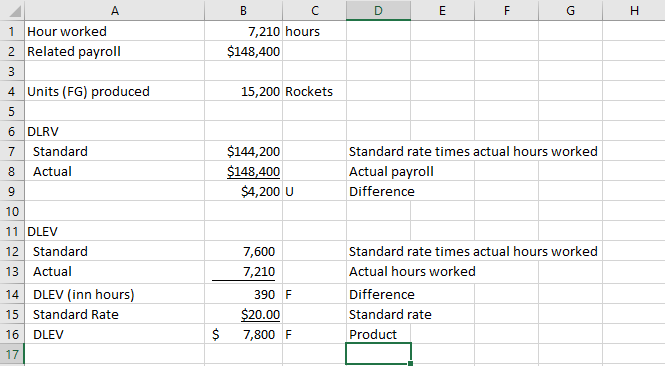

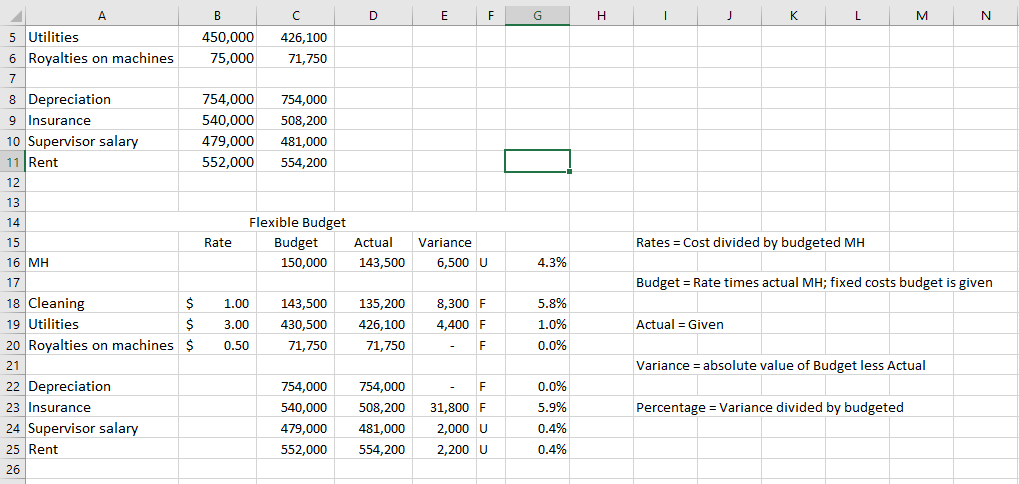

D E F H A B C 1 Pounds purchased 432,500 pounds 2 Price paid $2,194,500 3 4 Pounds used in production 90,120 pounds 5 Units (FG) produced 15,200 Rockets 6 7 8 DMPV 9 Standard $2,162,500 10 Actual $2,194,500 11 $32,000 U 12 13 DMQV 14 Standard 85,120 15 Actual 90,120 16 DMQV (in pounds) 5,000 U 17 Standard price 5 18 -$ 25,000 U 19 Standard price times actual pounds purchased Actual price paid Difference Standard quantity times actual units produced Actual pounds used Difference Standard price Product 20 A B D E F G I 7,210 hours $148,400 15,200 Rockets 1 Hour worked 2 Related payroll 3 4 Units (FG) produced 5 6 DLRV 7 Standard 8 Actual 9 10 11 DLEV 12 Standard 13 Actual 14 DLEV (inn hours) 15 Standard Rate 16 DLEV $144,200 $148,400 $4,200 U Standard rate times actual hours worked Actual payroll Difference 7,600 7,210 390 F $20.00 7,800 F Standard rate times actual hours worked Actual hours worked Difference Standard rate Product $ 17 A B C D E F G H 1 J K L M N 450,000 75,000 426,100 71,750 5 Utilities 6 Royalties on machines 7 8 Depreciation 9 Insurance 10 Supervisor salary 11 Rent 12 754,000 540,000 479,000 552,000 754,000 508,200 481,000 554,200 13 14 Rate Flexible Budget Budget 150,000 Rates = Cost divided by budgeted MH Actual 143,500 Variance 6,500 U 4.3% Budget = Rate times actual MH; fixed costs budget is given 1.00 3.00 143,500 430,500 71,750 135,200 426,100 71,750 8,300 F 4,400 F F 5.8% 1.0% 0.0% Actual = Given 0.50 15 16 MH 17 18 Cleaning $ 19 Utilities $ 20 Royalties on machines $ 21 22 Depreciation 23 Insurance 24 Supervisor salary 25 Rent 26 Variance = absolute value of Budget less Actual Percentage = Variance divided by budgeted 754,000 540,000 479,000 552,000 754,000 508,200 481,000 554,200 F 31,800 F 2,000 U 2,200 U 0.0% 5.9% 0.4% 0.4% D E F H A B C 1 Pounds purchased 432,500 pounds 2 Price paid $2,194,500 3 4 Pounds used in production 90,120 pounds 5 Units (FG) produced 15,200 Rockets 6 7 8 DMPV 9 Standard $2,162,500 10 Actual $2,194,500 11 $32,000 U 12 13 DMQV 14 Standard 85,120 15 Actual 90,120 16 DMQV (in pounds) 5,000 U 17 Standard price 5 18 -$ 25,000 U 19 Standard price times actual pounds purchased Actual price paid Difference Standard quantity times actual units produced Actual pounds used Difference Standard price Product 20 A B D E F G I 7,210 hours $148,400 15,200 Rockets 1 Hour worked 2 Related payroll 3 4 Units (FG) produced 5 6 DLRV 7 Standard 8 Actual 9 10 11 DLEV 12 Standard 13 Actual 14 DLEV (inn hours) 15 Standard Rate 16 DLEV $144,200 $148,400 $4,200 U Standard rate times actual hours worked Actual payroll Difference 7,600 7,210 390 F $20.00 7,800 F Standard rate times actual hours worked Actual hours worked Difference Standard rate Product $ 17 A B C D E F G H 1 J K L M N 450,000 75,000 426,100 71,750 5 Utilities 6 Royalties on machines 7 8 Depreciation 9 Insurance 10 Supervisor salary 11 Rent 12 754,000 540,000 479,000 552,000 754,000 508,200 481,000 554,200 13 14 Rate Flexible Budget Budget 150,000 Rates = Cost divided by budgeted MH Actual 143,500 Variance 6,500 U 4.3% Budget = Rate times actual MH; fixed costs budget is given 1.00 3.00 143,500 430,500 71,750 135,200 426,100 71,750 8,300 F 4,400 F F 5.8% 1.0% 0.0% Actual = Given 0.50 15 16 MH 17 18 Cleaning $ 19 Utilities $ 20 Royalties on machines $ 21 22 Depreciation 23 Insurance 24 Supervisor salary 25 Rent 26 Variance = absolute value of Budget less Actual Percentage = Variance divided by budgeted 754,000 540,000 479,000 552,000 754,000 508,200 481,000 554,200 F 31,800 F 2,000 U 2,200 U 0.0% 5.9% 0.4% 0.4%