Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thesele Ltd produces cutlery sets out of high-quality wood and steel. The company makes a standard and a deluxe cutlery set. These sets are

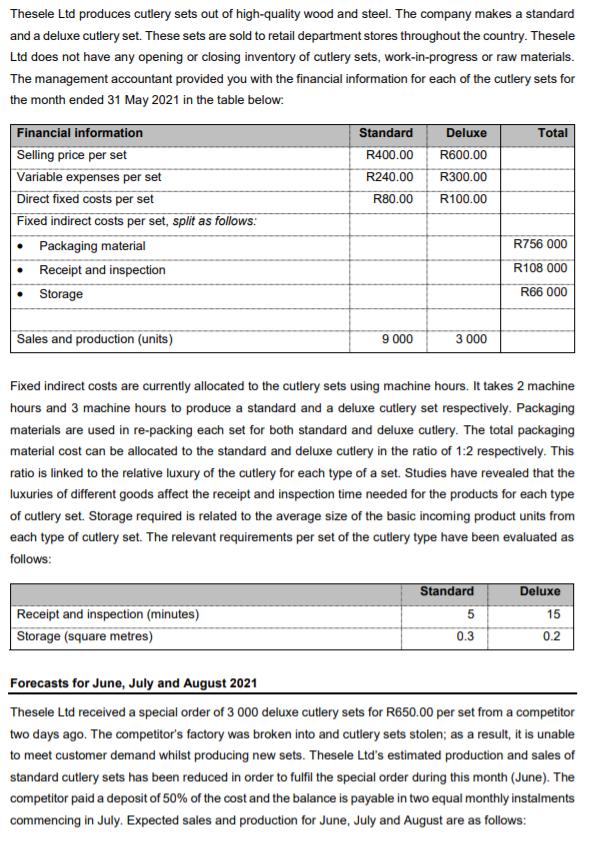

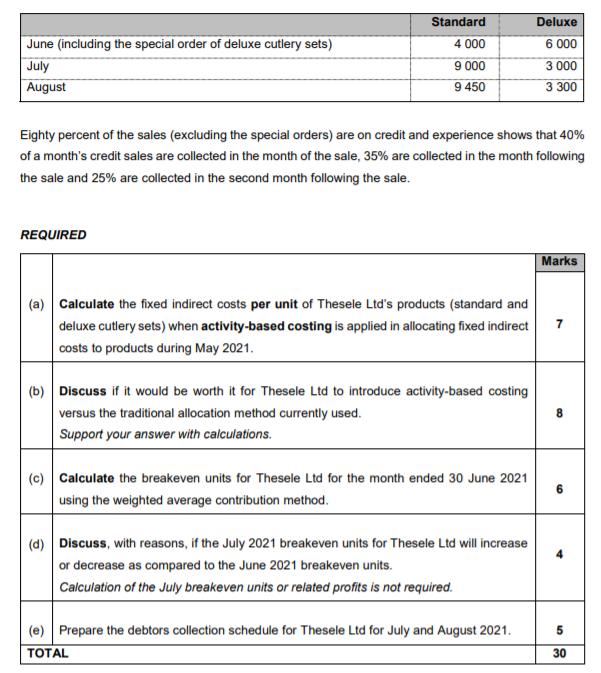

Thesele Ltd produces cutlery sets out of high-quality wood and steel. The company makes a standard and a deluxe cutlery set. These sets are sold to retail department stores throughout the country. Thesele Ltd does not have any opening or closing inventory of cutlery sets, work-in-progress or raw materials. The management accountant provided you with the financial information for each of the cutlery sets for the month ended 31 May 2021 in the table below: Financial information Selling price per set Variable expenses per set Direct fixed costs per set Standard Deluxe Total R400.00 R600.00 R240.00 R300.00 R80.00 R100.00 Fixed indirect costs per set, split as follows: Packaging material R756 000 Receipt and inspection R108 000 Storage R66 000 Sales and production (units) 9 000 3 000 Fixed indirect costs are currently allocated to the cutlery sets using machine hours. It takes 2 machine hours and 3 machine hours to produce a standard and a deluxe cutlery set respectively. Packaging materials are used in re-packing each set for both standard and deluxe cutlery. The total packaging material cost can be allocated to the standard and deluxe cutlery in the ratio of 1:2 respectively. This ratio is linked to the relative luxury of the cutlery for each type of a set. Studies have revealed that the luxuries of different goods affect the receipt and inspection time needed for the products for each type of cutlery set. Storage required is related to the average size of the basic incoming product units from each type of cutlery set. The relevant requirements per set of the cutlery type have been evaluated as follows: Standard Deluxe Receipt and inspection (minutes) 15 Storage (square metres) 0.3 0.2 Forecasts for June, July and August 2021 Thesele Ltd received a special order of 3 000 deluxe cutlery sets for R650.00 per set from a competitor two days ago. The competitor's factory was broken into and cutlery sets stolen; as a result, it is unable to meet customer demand whilst producing new sets. Thesele Ltd's estimated production and sales of standard cutlery sets has been reduced in order to fulfil the special order during this month (June). The competitor paid a deposit of 50% of the cost and the balance is payable in two equal monthly instalments commencing in July. Expected sales and production for June, July and August are as follows: Standard Deluxe June (including the special order of deluxe cutlery sets) 4 000 6 000 July 9 000 3 000 August 9 450 3 300 Eighty percent of the sales (excluding the special orders) are on credit and experience shows that 40% of a month's credit sales are collected in the month of the sale, 35% are collected in the month following the sale and 25% are collected in the second month following the sale. REQUIRED Marks (a) Calculate the fixed indirect costs per unit of Thesele Ltd's products (standard and deluxe cutlery sets) when activity-based costing is applied in allocating fixed indirect 7 costs to products during May 2021. (b) Discuss if it would be worth it for Thesele Ltd to introduce activity-based costing versus the traditional allocation method currently used. 8. Support your answer with calculations. (c) Calculate the breakeven units for Thesele Ltd for the month ended 30 June 2021 using the weighted average contribution method. (d) Discuss, with reasons, if the July 2021 breakeven units for Thesele Ltd will increase or decrease as compared to the June 2021 breakeven units. 4 Calculation of the July breakeven units or related profits is not required. (e) Prepare the debtors collection schedule for Thesele Ltd for July and August 2021. 5 TOTAL 30

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

D a Calculation of fixed indirect cost per unit Particulars Standard Delux Total Packing material 25...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started