Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Standard economic models of corporate investment, output, labor productivity, and wages predicted that the 2017 TCJA cut in maximum corporate income tax from 35%

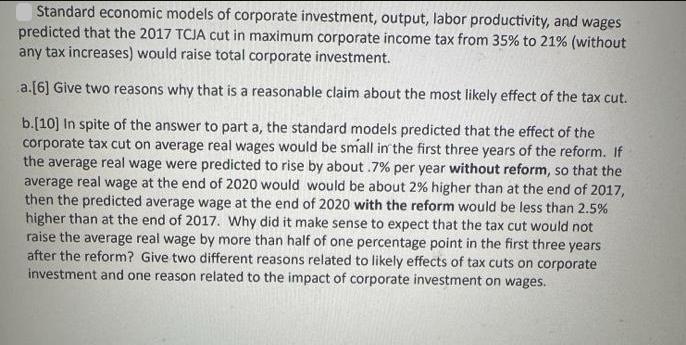

Standard economic models of corporate investment, output, labor productivity, and wages predicted that the 2017 TCJA cut in maximum corporate income tax from 35% to 21% (without any tax increases) would raise total corporate investment. a.[6] Give two reasons why that is a reasonable claim about the most likely effect of the tax cut. b.[10] In spite of the answer to part a, the standard models predicted that the effect of the corporate tax cut on average real wages would be small in the first three years of the reform. If the average real wage were predicted to rise by about .7% per year without reform, so that the average real wage at the end of 2020 would would be about 2% higher than at the end of 2017, then the predicted average wage at the end of 2020 with the reform would be less than 2.5% higher than at the end of 2017. Why did it make sense to expect that the tax cut would not raise the average real wage by more than half of one percentage point in the first three years. after the reform? Give two different reasons related to likely effects of tax cuts on corporate investment and one reason related to the impact of corporate investment on wages.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Sure here are two reasons why it is a reasonable claim that the 2017 TCIA cut in maximum corporate i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started