Question

Stanmore Corporation makes a special-purpose machine, D4H, used in the textile industry. Stanmore has designed the D4H machine for 2017 to be distinct from its

-

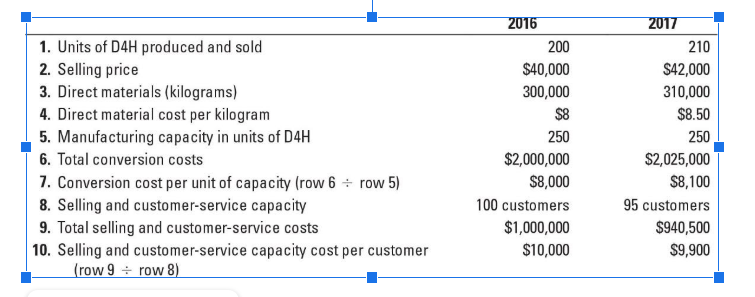

Stanmore Corporation makes a special-purpose machine, D4H, used in the textile industry. Stanmore has designed the D4H machine for 2017 to be distinct from its competitors. It has been generally regarded as a superior machine. Stanmore presents the following data for 2016 and 2017.

Stanmore produces no defective machines, but it wants to reduce direct materials usage per D4H machine in 2017. Conversion costs in each year depend on production capacity defined in terms of D4H units that can be produced, not the actual units produced. Selling and customer-service costs depend on the number of customers that Stanmore can support, not the actual number of customers it serves. Stanmore has 75 customers in 2016 and 80 customers in 2017.

1. Calculate the operating income of Stanmore Corporation in 2016 and 2017.

2. Calculate the growth, price-recovery, and productivity components that explain the change in operating income from 2016 to 2017.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started