Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Star Company began operations on January 1, 2019, suffering a $287,000 loss for that year. There were no permanent or reversing differences in 2019.

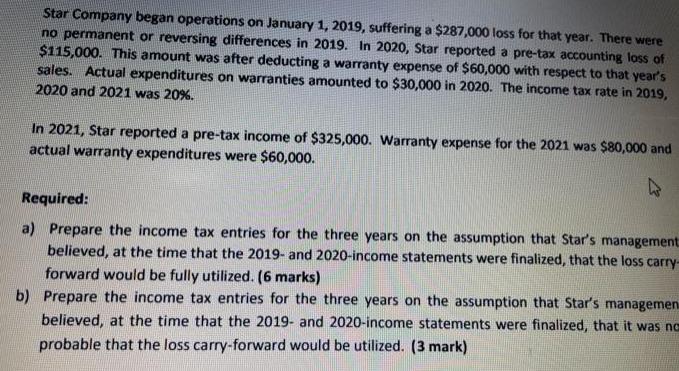

Star Company began operations on January 1, 2019, suffering a $287,000 loss for that year. There were no permanent or reversing differences in 2019. In 2020, Star reported a pre-tax accounting loss of $115,000. This amount was after deducting a warranty expense of $60,000 with respect to that year's sales. Actual expenditures on warranties amounted to $30,000 in 2020. The income tax rate in 2019, 2020 and 2021 was 20%. In 2021, Star reported a pre-tax income of $325,000. Warranty expense for the 2021 was $80,000 and actual warranty expenditures were $60,000. k Required: a) Prepare the income tax entries for the three years on the assumption that Star's management believed, at the time that the 2019- and 2020-income statements were finalized, that the loss carry- forward would be fully utilized. (6 marks) b) Prepare the income tax entries for the three years on the assumption that Star's managemen believed, at the time that the 2019- and 2020-income statements were finalized, that it was no probable that the loss carry-forward would be utilized. (3 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entries Amounts in a Date Account Title Debit Credit Dec 31 2019 Deferred Tax Asset 57400 Be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started