Question

Star Health is a small healthcare company that has developed a new multivitamin supplement. The firm is fully owned by its founder and shares outstanding

Star Health is a small healthcare company that has developed a new multivitamin supplement. The firm is fully owned by its founder and shares outstanding is 0.6 million. The founder of Star Health believes that the new product has higher absorption rate than existing multivitamin products do. Therefore, the founder believes that the new product will quickly find a market and that net income will be $15 million by the four year. As a venture capitalist, you have been approached about providing $7 million in additional capital to the firm, primarily to cover the commercial introduction of the product and expanding the market for the next four years. Similar companies which offer multivitamin supplements listed on stock exchanges are trading at an average price-earnings ratio of 12. Since this business has a product, ready for the market, but has no history of commercial success, you decide to use a target rate of return of 50%.

(On some questions, your answer may include a dollar sign, or a percent sign. You should not include these symbols in your answer.)

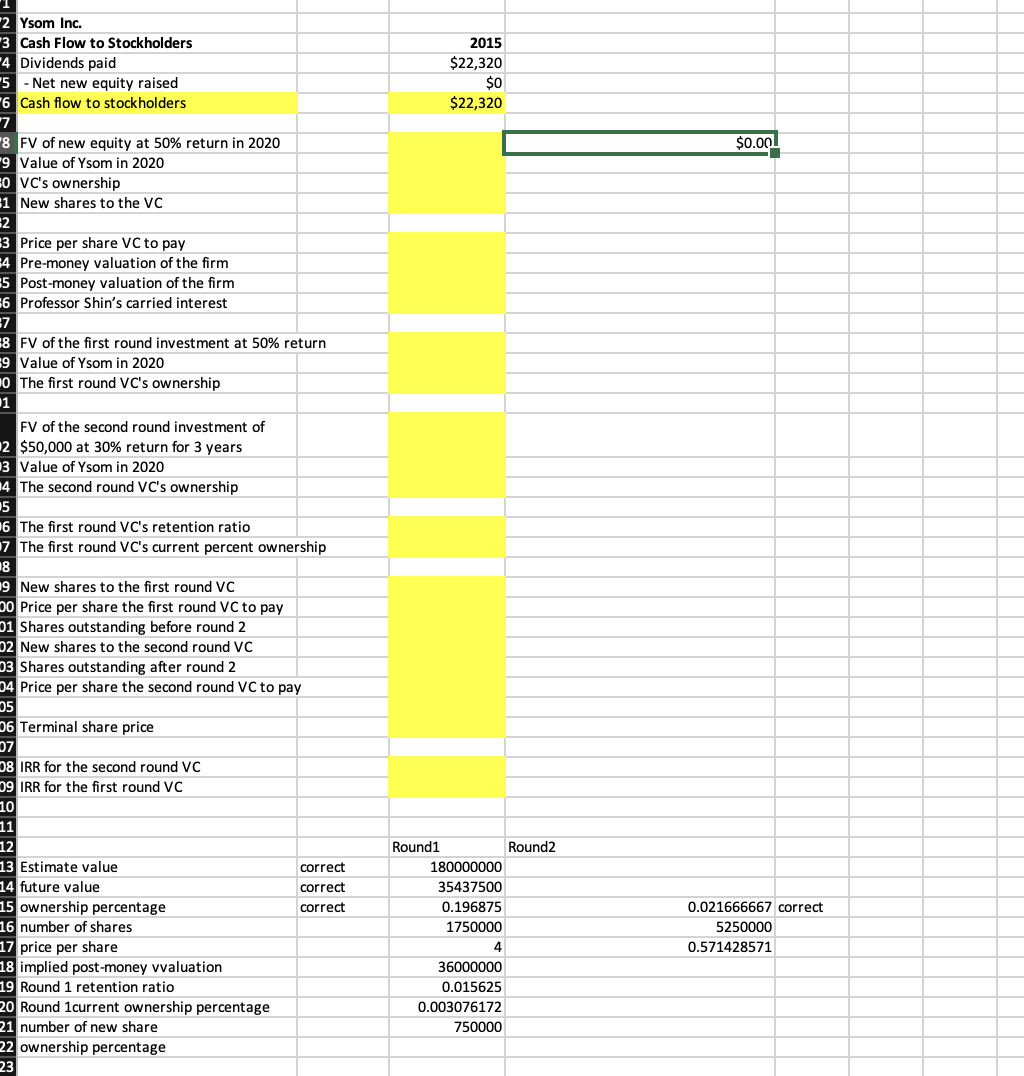

9. (Answered) What is the estimated value of the Star Health in 4 years? Ans: 180000000

10. (Answered) What is the venture capitalists future value given its required rate of return? Ans: 35437500

11. (Answered) How much is the venture capitalists ownership percentage? (Round the result to one decimal places) Ans: 19.7

15. (Continued) Suppose further that Star Health would need another $3 million at the beginning of year 3 Round 2 investor require 30% return. How much is the Round 2 investors final ownership percentage? (Time horizon is 1 year and round the result to one decimal places.) Ans: 2.2

Need to be solved:

12. How many shares should Star Health give to venture capitalist? (Round the result to the nearest whole number)

13. What price per share should venture capitalist agree to pay? (Round the result to one decimal places)

14. How much is the implied post-money valuation?

16. What is the Round 1 venture capitalists retention ratio?

17. How much is the Round 1 venture capitalists current ownership percentage? (Round the result to one decimal places)

18. How many new shares venture capitalist should purchase at 1st round? (Round the result to the nearest whole number)

Note: Use the answer from previous problem. Instead calculating correctly using Excel and then rounded for each parameter.

19. How many new shares round 2 investor should purchase at 2nd round? (Round the result to one decimal places)

Note: Use the answer from previous problem. Instead calculating correctly using Excel and then rounded for each parameter.

20. What price per share should the Round 1 venture capitalist agree to pay? (Round the result to one decimal places)

Note: Use the answer from previous problem. Instead calculating correctly using Excel and then rounded for each parameter.

Excel File:

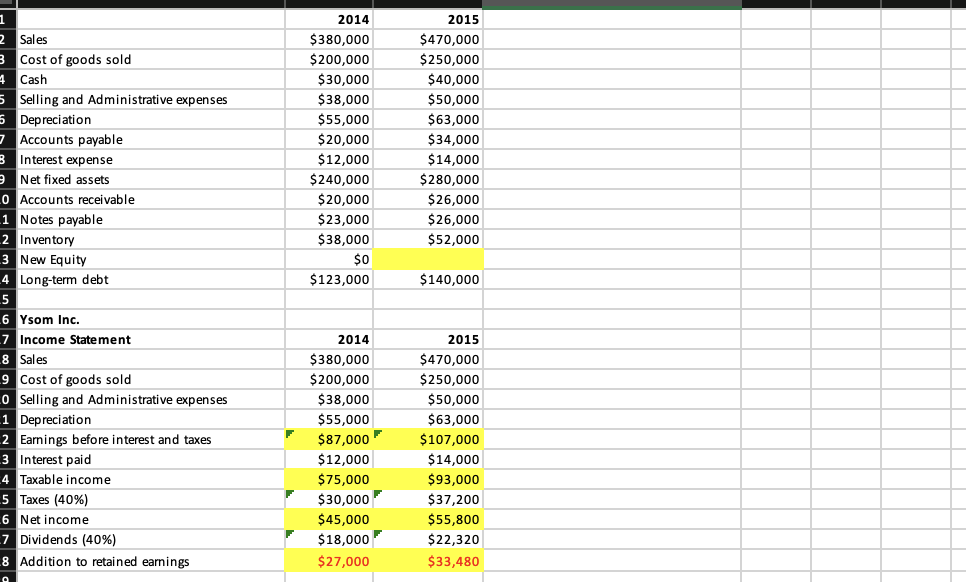

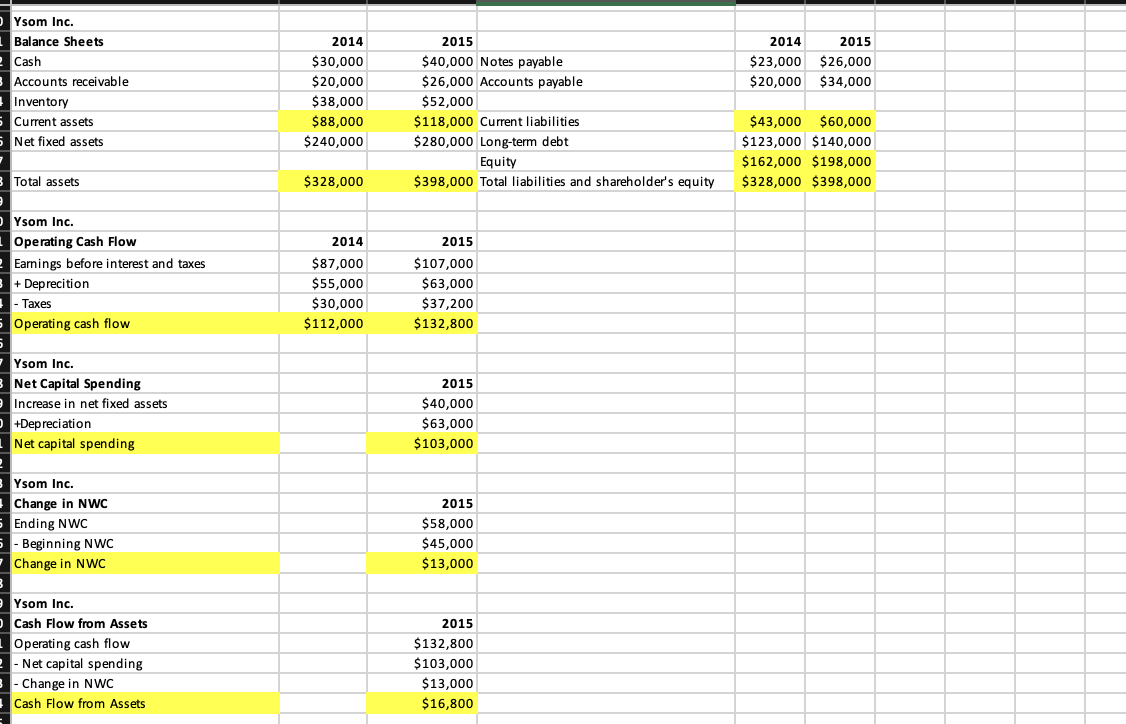

Ysom Inc. Balance Sheets Cash Accounts receivable Inventory Current assets Net fixed assets Total assets Ysom Inc. Operating Cash Flow Earnings before interest and taxes + Deprecition - Taxes Operating cash flow Ysom Inc. Net Capital Spending Increase in net fixed assets +Depreciation Net capital spending Ysom Inc. Change in NWC Ending NWC - Beginning NWC Change in NWC Ysom Inc. Cash Flow from Assets Operating cash flow - Net capital spending - Change in NWC Cash Flow from Assets 2014 2015 $30,000 $40,000 $26,000 Accounts payable $52,000 $118,000 Current liabilities $280,000 Long-term debt Equity $328,000 $398,000 Total liabilities and shareholder's equity 2014 $23,000 $20,000 $43,000 $123,000 $162,000$198,000 $328,000$398,000 2015 $26,000 $34,000 $60,000 $140,000 \begin{tabular}{|r|r|} \hline & \\ \hline 2014 & 2015 \\ \hline$87,000 & $107,000 \\ \hline$55,000 & $63,000 \\ \hline$30,000 & $37,200 \\ \hline$112,000 & $132,800 \\ \hline \end{tabular} 2015 $40,000 $63,000 $103,000 2015 $58,000 $45,000 $13,000 2015 $132,800 $103,000 $13,000 $16,800

Ysom Inc. Balance Sheets Cash Accounts receivable Inventory Current assets Net fixed assets Total assets Ysom Inc. Operating Cash Flow Earnings before interest and taxes + Deprecition - Taxes Operating cash flow Ysom Inc. Net Capital Spending Increase in net fixed assets +Depreciation Net capital spending Ysom Inc. Change in NWC Ending NWC - Beginning NWC Change in NWC Ysom Inc. Cash Flow from Assets Operating cash flow - Net capital spending - Change in NWC Cash Flow from Assets 2014 2015 $30,000 $40,000 $26,000 Accounts payable $52,000 $118,000 Current liabilities $280,000 Long-term debt Equity $328,000 $398,000 Total liabilities and shareholder's equity 2014 $23,000 $20,000 $43,000 $123,000 $162,000$198,000 $328,000$398,000 2015 $26,000 $34,000 $60,000 $140,000 \begin{tabular}{|r|r|} \hline & \\ \hline 2014 & 2015 \\ \hline$87,000 & $107,000 \\ \hline$55,000 & $63,000 \\ \hline$30,000 & $37,200 \\ \hline$112,000 & $132,800 \\ \hline \end{tabular} 2015 $40,000 $63,000 $103,000 2015 $58,000 $45,000 $13,000 2015 $132,800 $103,000 $13,000 $16,800 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started