Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Star holds an available-for-sale debt investment with an amortized cost of $488,500. The current fair value of the investment is $224,000. There is objective evidence

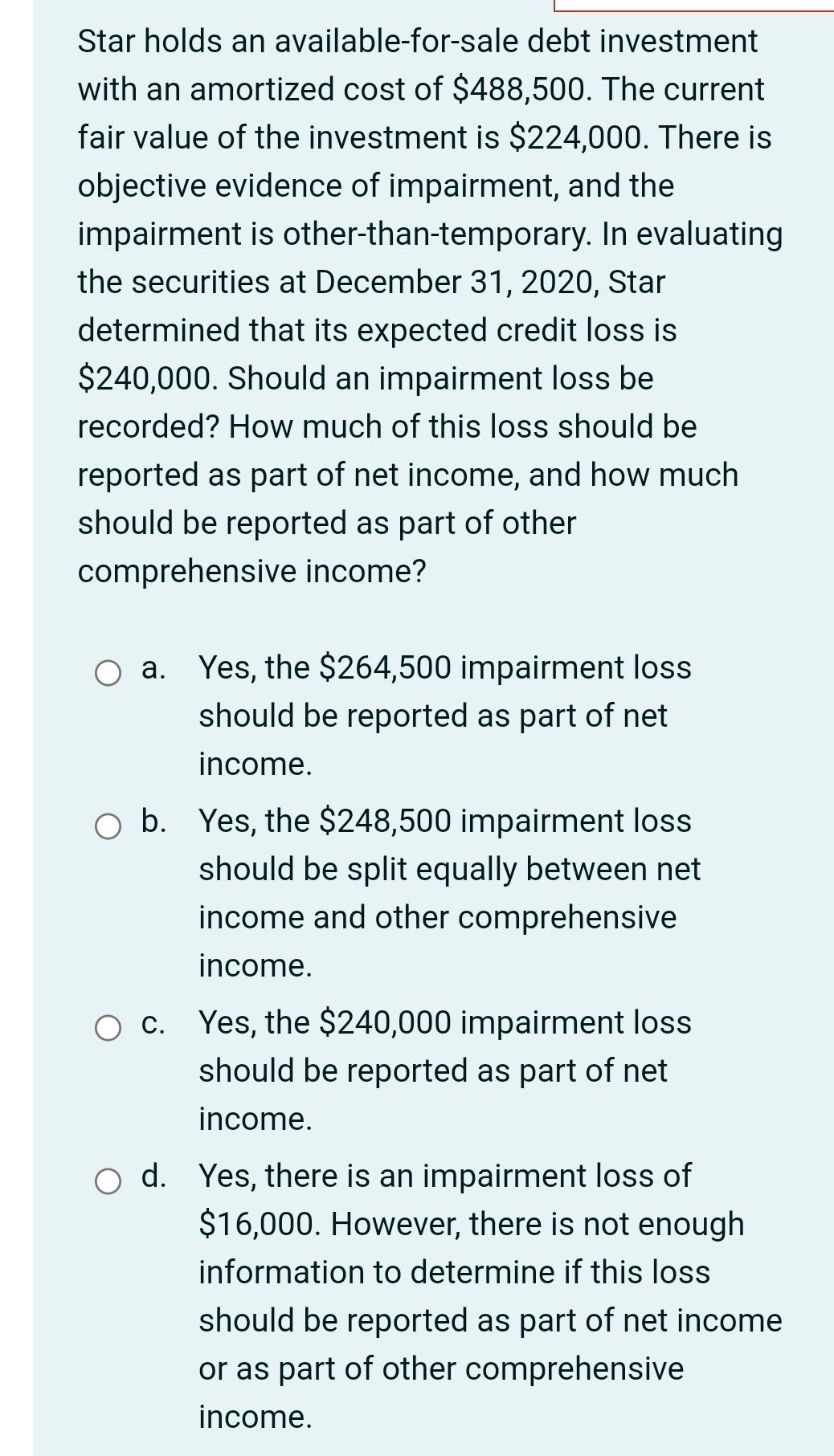

Star holds an available-for-sale debt investment with an amortized cost of $488,500. The current fair value of the investment is $224,000. There is objective evidence of impairment, and the impairment is other-than-temporary. In evaluating the securities at December 31, 2020, Star determined that its expected credit loss is $240,000. Should an impairment loss be recorded? How much of this loss should be reported as part of net income, and how much should be reported as part of other comprehensive income? O a. Yes, the $264,500 impairment loss should be reported as part of net income. ob. Yes, the $248,500 impairment loss should be split equally between net income and other comprehensive income. C. Yes, the $240,000 impairment loss should be reported as part of net income. d. Yes, there is an impairment loss of $16,000. However, there is not enough information to determine if this loss should be reported as part of net income or as part of other comprehensive income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started