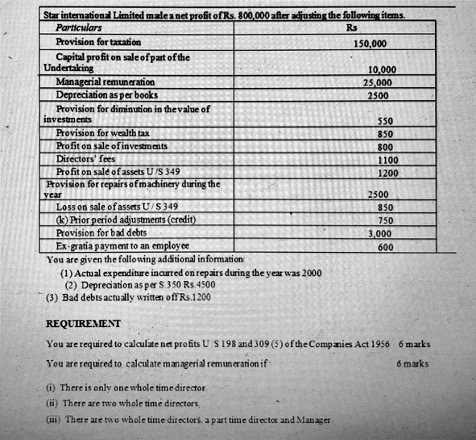

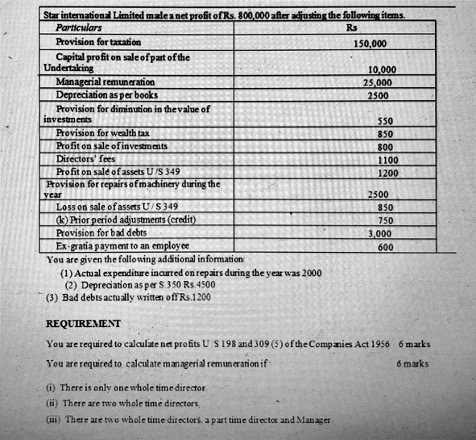

Star international Limited madea net profit of Rs. 300.000 after ostis the followin items Particulars Provision formation 150,000 Capital profit on sale of part of the Undertaking 10.000 Managerial remuneration 25,000 Depreciation as per books 2500 Provision for diminution in the value of investments 550 Provision for wealth tax 850 Profit on sale of investments 800 Directors' fees ! 1100 Profit on sale of assets U/S 349 1200 Hovision for repairs of machinery during the 2500 Loss on sale of assets U/S 349 850 Prior period adjustments (credit) 750 Provision for bad debts 3.000 Ex gratia payment to an employee 600 You are given the following additional information (1) Actual expenditure incurred on repairs during the year was 2000 (2) Depreciation as per S 350 Rs.4500 (3) Bad debts actually written off Rs. 1200 REQUIREMENT You are required to calculate net profits US 198 and 309 (5) of the Companies Act 1956 6 marks You are required to calculate managerial remuneration if 6 marks 6) There is only one whole time director (1) There are two whole time directors, (M) There are two whole time directors, a part time director and Manace Star international Limited madea net profit of Rs. 300.000 after ostis the followin items Particulars Provision formation 150,000 Capital profit on sale of part of the Undertaking 10.000 Managerial remuneration 25,000 Depreciation as per books 2500 Provision for diminution in the value of investments 550 Provision for wealth tax 850 Profit on sale of investments 800 Directors' fees ! 1100 Profit on sale of assets U/S 349 1200 Hovision for repairs of machinery during the 2500 Loss on sale of assets U/S 349 850 Prior period adjustments (credit) 750 Provision for bad debts 3.000 Ex gratia payment to an employee 600 You are given the following additional information (1) Actual expenditure incurred on repairs during the year was 2000 (2) Depreciation as per S 350 Rs.4500 (3) Bad debts actually written off Rs. 1200 REQUIREMENT You are required to calculate net profits US 198 and 309 (5) of the Companies Act 1956 6 marks You are required to calculate managerial remuneration if 6 marks 6) There is only one whole time director (1) There are two whole time directors, (M) There are two whole time directors, a part time director and Manace