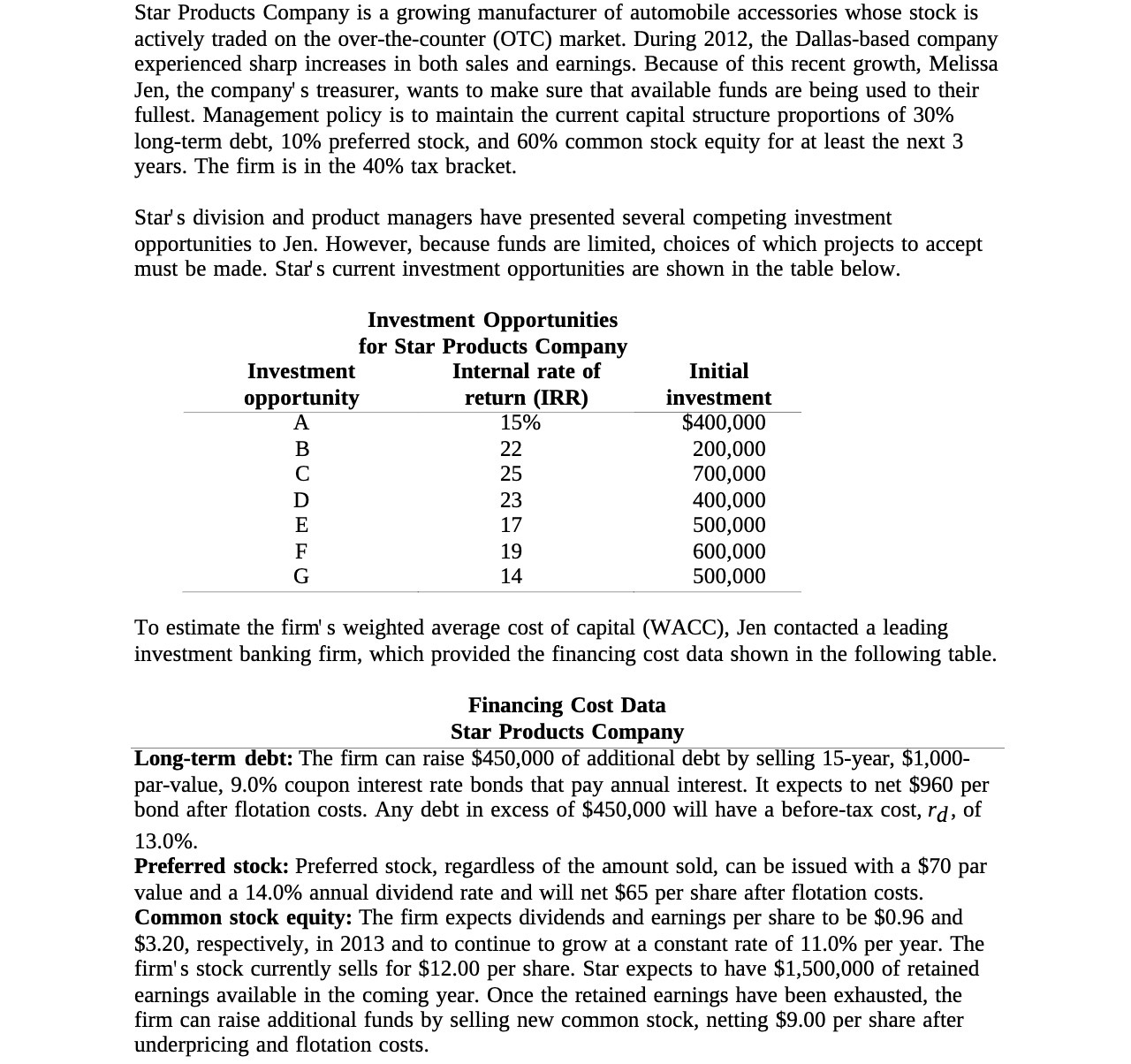

Star Products Company is a growing manufacturer of automobile accessories whose stock is actively traded on the over-the-counter (OTC) market. During 2012, the Dallas-based company experienced sharp increases in both sales and earnings. Because of this recent growth, Melissa Jen, the company' s treasurer, wants to make sure that available funds are being used to their fullest. Management policy is to maintain the current capital structure proportions of 30% longterm debt, 10% preferred stock, and 60% common stock equity for at least the next 3 years. The firm is in the 40% tax bracket. StarJ s division and product managers have presented several competing investment opportunities to Jen. However, because funds are limited, choices of which projects to accept must be made. Star' 5 current investment opportunities are shown in the table below. Investment Opportunities for Star Products Company Investment Internal rate of Initial opportunity return (IRR) investment A 15% $400,000 B 22 200,000 C 25 700,000 D 23 400,000 E 17 500,000 F 19 600,000 G 14 500,000 To estimate the firm' 5 weighted average cost of capital (WACC), Jen contacted a leading investment banking firm, which provided the nancing cost data shown in the following table. Financing Cost Data Star Products Company Long-term debt: The firm can raise $450,000 of additional debt by selling 15-year, $1,000- parvalue, 9.0% coupon interest rate bonds that pay annual interest. It expects to net $960 per bond after otation costs. Any debt in excess of $450,000 will have a before-tax cost, rd, of 13.0%. Preferred stock: Preferred stock, regardless of the amount sold, can be issued with a $70 par value and a 14.0% annual dividend rate and will net $65 per share after otation costs. Common stock equity: The firm expects dividends and earnings per share to be $0.96 and $3.20, respectively, in 2013 and to continue to grow at a constant rate of 11.0% per year. The firm' 5 stock currently sells for $12.00 per share. Star expects to have $1,500,000 of retained earnings available in the coming year. Once the retained earnings have been exhausted, the firm can raise additional funds by selling new common stock, netting $9.00 per share after underpricing and otation costs