Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Star Villas, Inc. is completing the accounting process for its year ended 12/31/22. The transactions for the year have been journalized and posted. Information for

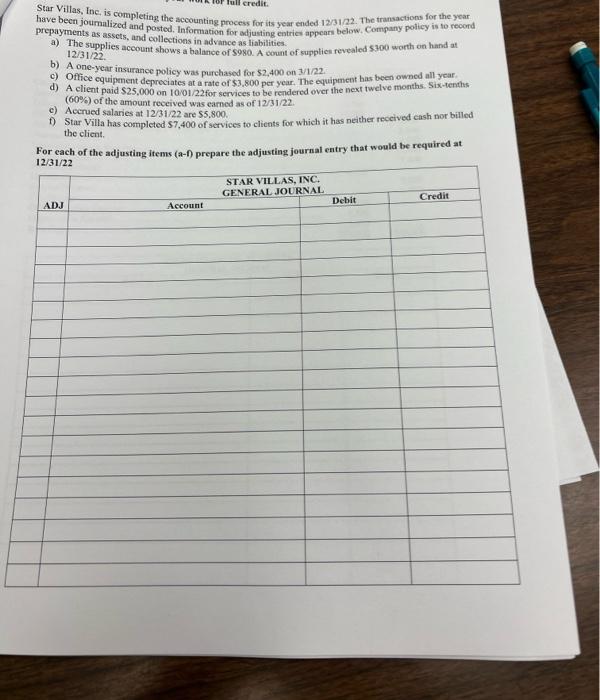

Star Villas, Inc. is completing the accounting process for its year ended 12/31/22. The transactions for the year have been journalized and posted. Information for adjusting entries appears below. Company policy is to record prepayments as assets, and collections in advance as liabilities. a) The supplies account shows a balance of $980. A count of supplies revealed $300 worth on hand at full credit. 12/31/22. b) A one-year insurance policy was purchased for $2,400 on 3/1/22. c) Office equipment depreciates at a rate of $3,800 per year. The equipment has been owned all year. d) A client paid $25,000 on 10/01/22for services to be rendered over the next twelve months. Six-tenths (60%) of the amount received was earned as of 12/31/22. e) Accrued salaries at 12/31/22 are $5,800. f) Star Villa has completed $7,400 of services to clients for which it has neither received cash nor billed the client. For each of the adjusting items (a-f) prepare the adjusting journal entry that would be required at 12/31/22 ADJ Account STAR VILLAS, INC. GENERAL JOURNAL Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started