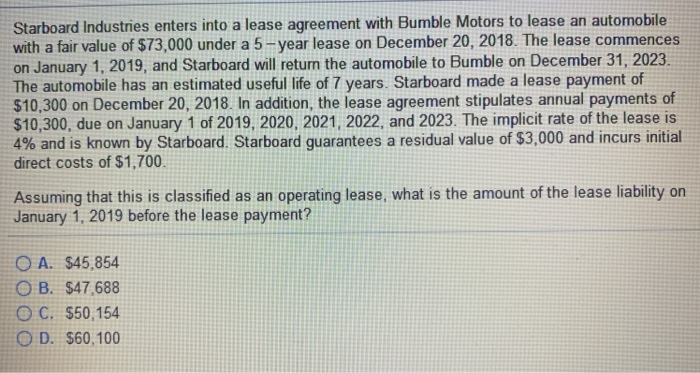

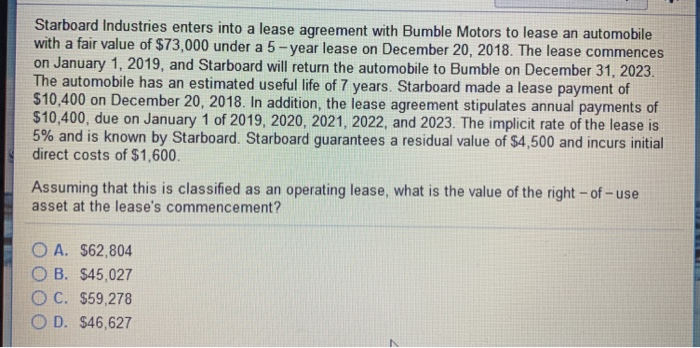

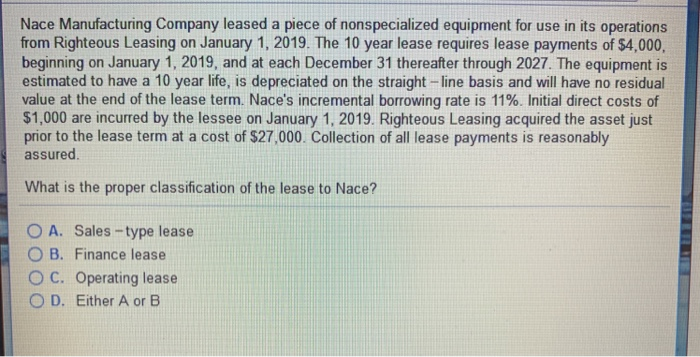

Starboard Industries enters into a lease agreement with Bumble Motors to lease an automobile with a fair value of $73,000 under a 5- year lease on December 20, 2018. The lease commences on January 1, 2019, and Starboard will return the automobile to Bumble on December 31, 2023. The automobile has an estimated useful life of 7 years. Starboard made a lease payment of $10,300 on December 20, 2018. In addition, the lease agreement stipulates annual payments of $10,300, due on January 1 of 2019, 2020, 2021, 2022, and 2023. The implicit rate of the lease is 4% and is known by Starboard, Starboard guarantees a residual value of $3,000 and incurs initial direct costs of $1,700 Assuming that this is classified as an operating lease, what is the amount of the lease liability on January 1, 2019 before the lease payment? O A. $45,854 B. S47588 O C. $50,154 O D. $60,100 Starboard Industries enters into a lease agreement with Bumble Motors to lease an automobile with a fair value of $73,000 under a 5-year lease on December 20, 2018. The lease commences on January 1, 2019, and Starboard will return the automobile to Bumble on December 31, 2023 The automobile has an estimated useful life of 7 years. Starboard made a lease payment of $10,400 on December 20, 2018. In addition, the lease agreement stipulates annual payments of $10,400, due on January 1 of 2019, 2020, 2021, 2022, and 2023. The implicit rate of the lease is 5% and is known by Starboard, Starboard guarantees a residual value of $4,500 and incurs initial direct costs of $1,600 Assuming that this is classified as an operating lease, what is the value of the right -of-use asset at the lease's commencement? OA. OB, $62,804 S45027 O C. $59,278 O D. $46,627 Nace Manufacturing Company leased a piece of nonspecialized equipment for use in its operations from Righteous Leasing on January 1, 2019. The 10 year lease requires lease payments of $4,000, beginning on January 1, 2019, and at each December 31 thereafter through 2027. The equipment is estimated to have a 10 year life, is depreciated on the straight line basis and will have no residual value at the end of the lease term. Nace's incremental borrowing rate is 11%. Initial direct costs of $1,000 are incurred by the lessee on January 1, 2019. Righteous Leasing acquired the asset just prior to the lease term at a cost of $27,000. Collection of all lease payments is reasonably assured What is the proper classification of the lease to Nace? O A. Sales-type lease OB. Finance lease O C. Operating lease O D. Either A or B