Starbucks Coffee Limited (Starbucks) is a division of Starbucks Corporation that focuses on the manufacturing and distribution of coffee products.

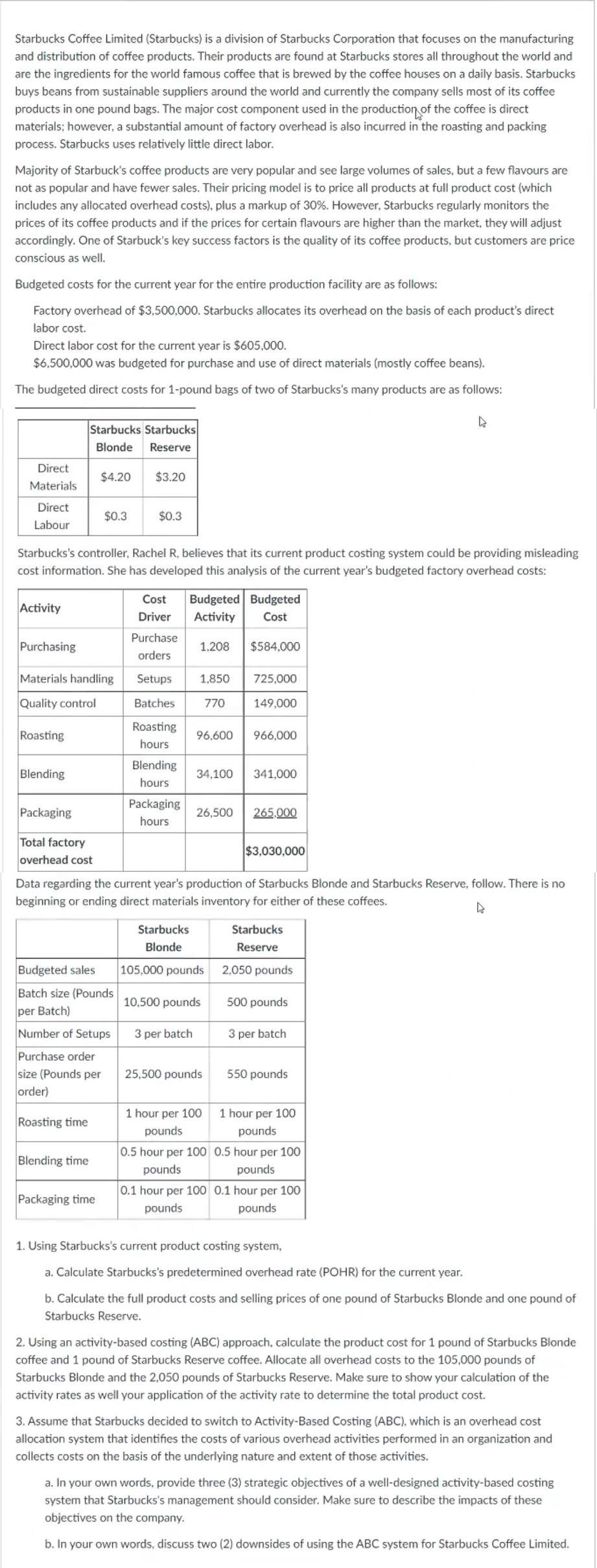

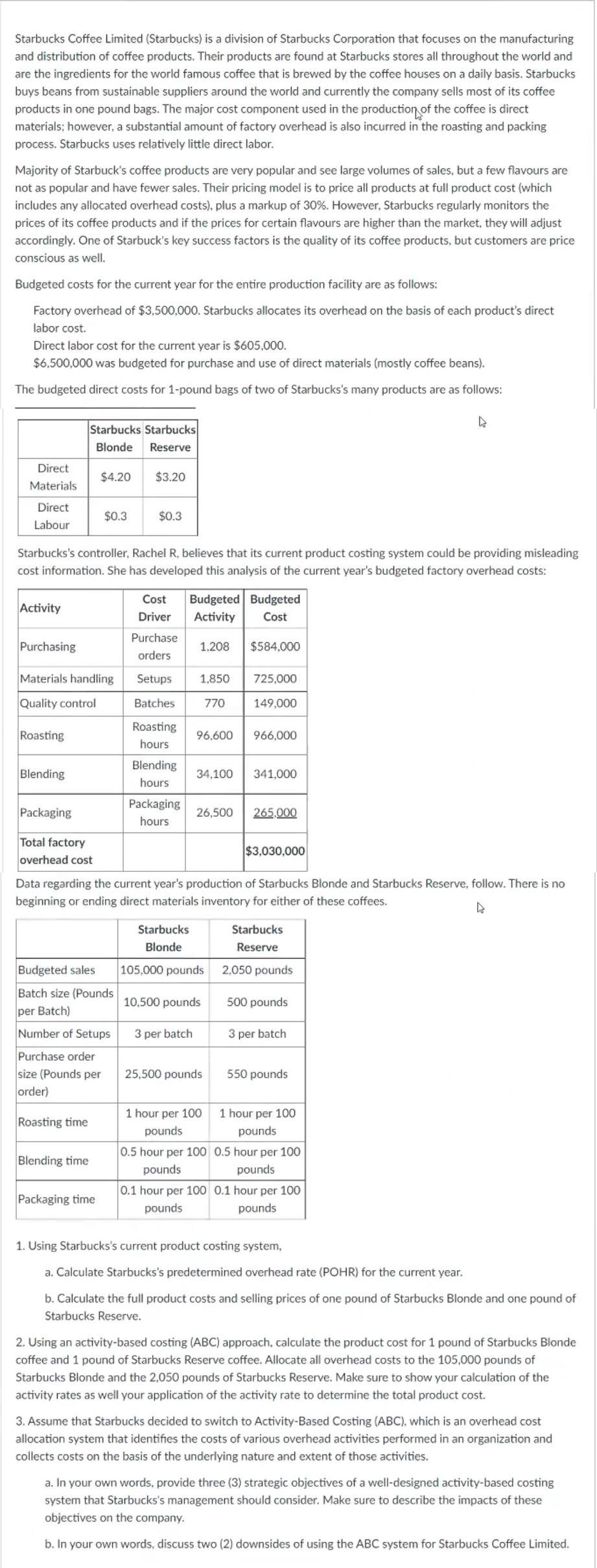

Starbucks Coffee Limited (Starbucks) is a division of Starbucks Corporation that focuses on the manufacturing and distribution of coffee products. Their products are found at Starbucks stores all throughout the world and are the ingredients for the world famous coffee that is brewed by the coffee houses on a daily basis. Starbucks buys beans from sustainable suppliers around the world and currently the company sells most of its coffee products in one pound bags. The major cost component used in the production of the coffee is direct materials; however, a substantial amount of factory overhead is also incurred in the roasting and packing process. Starbucks uses relatively little direct labor. Majority of Starbuck's coffee products are very popular and see large volumes of sales, but a few flavours are not as popular and have fewer sales. Their pricing model is to price all products at full product cost (which includes any allocated overhead costs), plus a markup of 30%. However, Starbucks regularly monitors the prices of its coffee products and if the prices for certain flavours are higher than the market, they will adjust accordingly. One of Starbuck's key success factors is the quality of its coffee products, but customers are price conscious as well. Budgeted costs for the current year for the entire production facility are as follows: Factory overhead of $3,500,000. Starbucks allocates its overhead on the basis of each product's direct labor cost. Direct labor cost for the current year is $605,000. $6,500,000 was budgeted for purchase and use of direct materials (mostly coffee beans). The budgeted direct costs for 1-pound bags of two of Starbucks's many products are as follows: Starbucks Starbucks Blonde Reserve $4.20 $3.20 Direct Materials Direct Labour $0.3 $0.3 Starbucks's controller, Rachel R, believes that its current product costing system could be providing misleading cost information. She has developed this analysis of the current year's budgeted factory overhead costs: Activity Cost Driver Budgeted Budgeted Activity Cost Purchasing Purchase orders 1.208 $584.000 Materials handling Setups 1.850 725,000 Quality control Batches 770 149,000 Roasting Roasting hours 96.600 966,000 Blending Blending hours 34,100 341,000 Packaging Packaging hours 26,500 265,000 Total factory overhead cost $3,030,000 Data regarding the current year's production of Starbucks Blonde and Starbucks Reserve, follow. There is no beginning or ending direct materials inventory for either of these coffees. Starbucks Blonde Starbucks Reserve Budgeted sales 105.000 pounds 2,050 pounds Batch size (Pounds 10,500 pounds 500 pounds per Batch) Number of Setups 3 per batch 3 per batch Purchase order size (Pounds per order) 25,500 pounds 550 pounds Roasting time Blending time 1 hour per 100 1 hour per 100 pounds pounds 0.5 hour per 100 0.5 hour per 100 pounds pounds 0.1 hour per 100 0.1 hour per 100 pounds pounds Packaging time 1. Using Starbucks's current product costing system, a. Calculate Starbucks's predetermined overhead rate (POHR) for the current year. b. Calculate the full product costs and selling prices of one pound of Starbucks Blonde and one pound of Starbucks Reserve. 2. Using an activity-based costing (ABC) approach, calculate the product cost for 1 pound of Starbucks Blonde coffee and 1 pound of Starbucks Reserve coffee. Allocate all overhead costs to the 105,000 pounds of Starbucks Blonde and the 2,050 pounds of Starbucks Reserve. Make sure to show your calculation of the activity rates as well your application of the activity rate to determine the total product cost. 3. Assume that Starbucks decided to switch to Activity-Based Costing (ABC), which is an overhead cost allocation system that identifies the costs of various overhead activities performed in an organization and collects costs on the basis of the underlying nature and extent of those activities. a. In your own words, provide three (3) strategic objectives of a well-designed activity-based costing system that Starbucks's management should consider. Make sure to describe the impacts of these objectives on the company. b. In your own words, discuss two (2) downsides of using the ABC system for Starbucks Coffee Limited