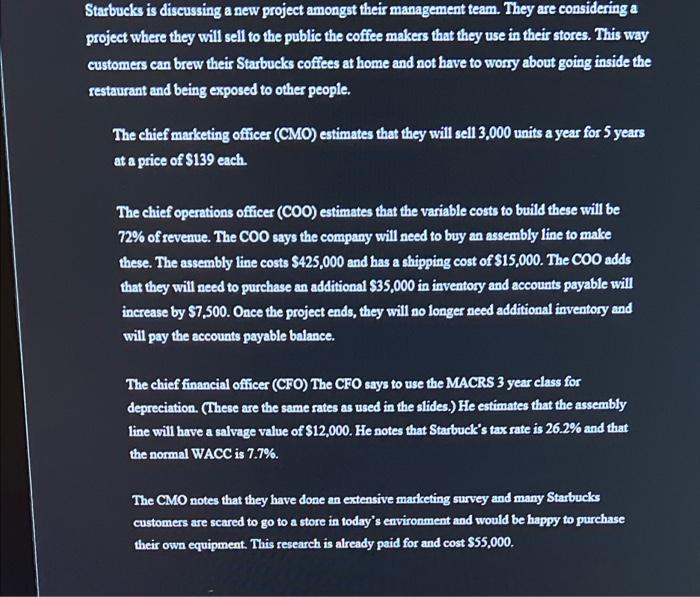

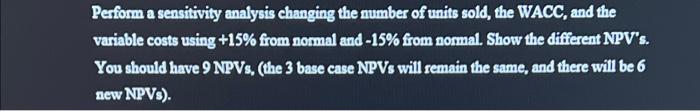

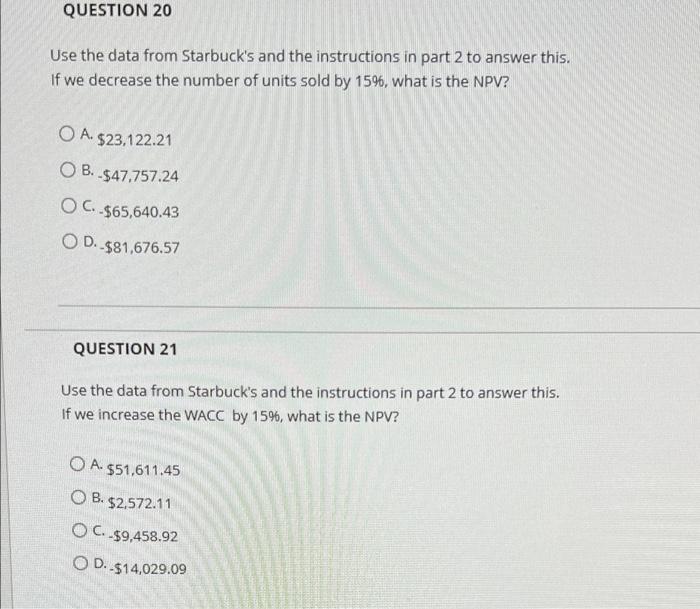

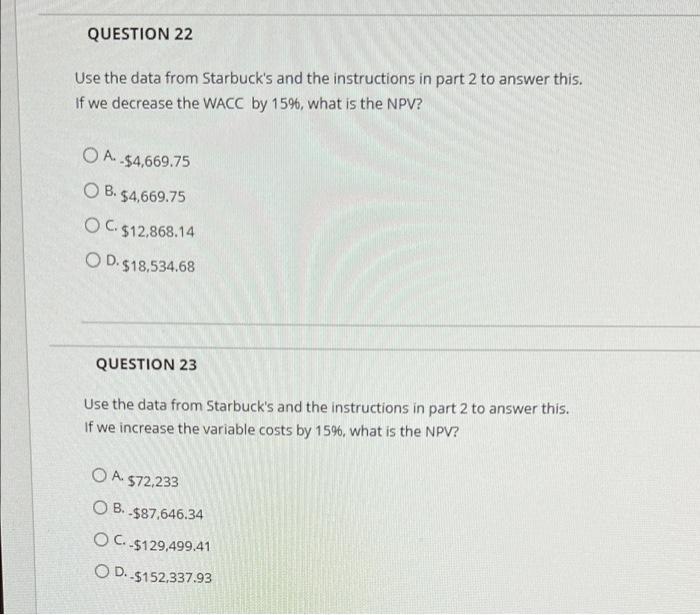

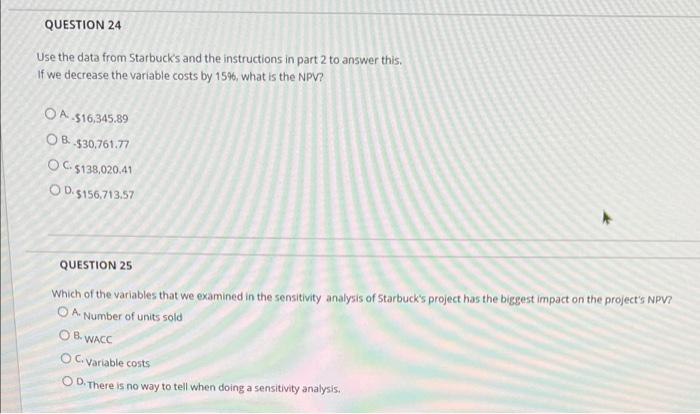

Starbucks is discussing a new project amongst their management team. They are considering a project where they will sell to the public the coffee makers that they use in their stores. This way customers can brew their Starbucks coffees at home and not have to worry about going inside the restaurant and being exposed to other people. The chief marketing officer (CMO) estimates that they will sell 3,000 units a year for 5 years at a price of $139 each. The chief operations officer (COO) estimates that the variable costs to build these will be 72% of revenue. The COO says the company will need to buy an assembly line to make these. The assembly line costs $425,000 and has a shipping cost of $15,000. The COO adds that they will need to purchase an additional $35,000 in inventory and accounts payable will increase by $7,500. Once the project ends, they will no longer need additional inventory and will pay the accounts payable balance. The chief financial officer (CFO) The CFO says to use the MACRS 3 year class for depreciation. (These are the same rates as used in the slides.) He estimates that the assembly line will have a salvage value of $12,000. He notes that Starbuck's tax rate is 26.2% and that the normal WACC is 7.7%. The CMO notes that they have done an extensive marketing survey and many Starbucks customers are scared to go to a store in today's environment and would be happy to purchase their own equipment. This research is already paid for and cost $55,000. Perform a sensitivity analysis changing the number of units sold, the WACC, and the variable costs using +15% from normal and -15% from normal. Show the different NPV's. You should have 9 NPVs, (the 3 base case NPVs will remain the same, and there will be 6 new NPVs). QUESTION 20 Use the data from Starbuck's and the instructions in part 2 to answer this. If we decrease the number of units sold by 15%, what is the NPV? OA. $23,122.21 OB. $47,757.24 OC. $65,640.43 OD. $81,676.57 QUESTION 21 Use the data from Starbuck's and the instructions in part 2 to answer this. If we increase the WACC by 15%, what is the NPV? OA. $51,611.45 OB. $2,572.11 OC.$9,458.92 OD. -$14,029.09 QUESTION 22 Use the data from Starbuck's and the instructions in part 2 to answer this. If we decrease the WACC by 15%, what is the NPV? OA. $4,669.75 OB. $4,669.75 OC. $12,868.14 OD. $18,534.68 QUESTION 23 Use the data from Starbuck's and the instructions in part 2 to answer this. If we increase the variable costs by 15%, what is the NPV? OA. $72,233 OB. $87.646.34 OC. $129,499.41 OD. -$152,337.93 QUESTION 24 Use the data from Starbuck's and the instructions in part 2 to answer this. If we decrease the variable costs by 15%6, what is the NPV? OA $16,345.89 OB $30,761.77 OC-$138,020.41 OD. $156,713.57 QUESTION 25 Which of the variables that we examined in the sensitivity analysis of Starbuck's project has the biggest impact on the project's NPV? OA Number of units sold OB. WACC OC. Variable costs OD. There is no way to tell when doing a sensitivity analysis. Starbucks is discussing a new project amongst their management team. They are considering a project where they will sell to the public the coffee makers that they use in their stores. This way customers can brew their Starbucks coffees at home and not have to worry about going inside the restaurant and being exposed to other people. The chief marketing officer (CMO) estimates that they will sell 3,000 units a year for 5 years at a price of $139 each. The chief operations officer (COO) estimates that the variable costs to build these will be 72% of revenue. The COO says the company will need to buy an assembly line to make these. The assembly line costs $425,000 and has a shipping cost of $15,000. The COO adds that they will need to purchase an additional $35,000 in inventory and accounts payable will increase by $7,500. Once the project ends, they will no longer need additional inventory and will pay the accounts payable balance. The chief financial officer (CFO) The CFO says to use the MACRS 3 year class for depreciation. (These are the same rates as used in the slides.) He estimates that the assembly line will have a salvage value of $12,000. He notes that Starbuck's tax rate is 26.2% and that the normal WACC is 7.7%. The CMO notes that they have done an extensive marketing survey and many Starbucks customers are scared to go to a store in today's environment and would be happy to purchase their own equipment. This research is already paid for and cost $55,000. Perform a sensitivity analysis changing the number of units sold, the WACC, and the variable costs using +15% from normal and -15% from normal. Show the different NPV's. You should have 9 NPVs, (the 3 base case NPVs will remain the same, and there will be 6 new NPVs). QUESTION 20 Use the data from Starbuck's and the instructions in part 2 to answer this. If we decrease the number of units sold by 15%, what is the NPV? OA. $23,122.21 OB. $47,757.24 OC. $65,640.43 OD. $81,676.57 QUESTION 21 Use the data from Starbuck's and the instructions in part 2 to answer this. If we increase the WACC by 15%, what is the NPV? OA. $51,611.45 OB. $2,572.11 OC.$9,458.92 OD. -$14,029.09 QUESTION 22 Use the data from Starbuck's and the instructions in part 2 to answer this. If we decrease the WACC by 15%, what is the NPV? OA. $4,669.75 OB. $4,669.75 OC. $12,868.14 OD. $18,534.68 QUESTION 23 Use the data from Starbuck's and the instructions in part 2 to answer this. If we increase the variable costs by 15%, what is the NPV? OA. $72,233 OB. $87.646.34 OC. $129,499.41 OD. -$152,337.93 QUESTION 24 Use the data from Starbuck's and the instructions in part 2 to answer this. If we decrease the variable costs by 15%6, what is the NPV? OA $16,345.89 OB $30,761.77 OC-$138,020.41 OD. $156,713.57 QUESTION 25 Which of the variables that we examined in the sensitivity analysis of Starbuck's project has the biggest impact on the project's NPV? OA Number of units sold OB. WACC OC. Variable costs OD. There is no way to tell when doing a sensitivity analysis