Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Starbucks records asset retirement obligations (ARO) for leasehold improvements that they are contractually obligated to remove at the end of the lease. What summary journal

- Starbucks records asset retirement obligations (ARO) for leasehold improvements that they are contractually obligated to remove at the end of the lease. What summary journal entries did Starbucks make to record changes to the ARO asset (included in property, plant, and equipment) and the ARO liability (included in other long-term liabilities) in fiscal 2022? Assume that an ARO liability with a carrying amount of $15.0M was settled on October 4, 2022, for $12.0M (the associated ARO asset had already been fully depreciated), and that no new ARO liabilities were incurred.

Journal entries required for Depreciation expense, Accretion expense, ARO, etc. Should be 3 journal entries but I can't figure out how to do them.

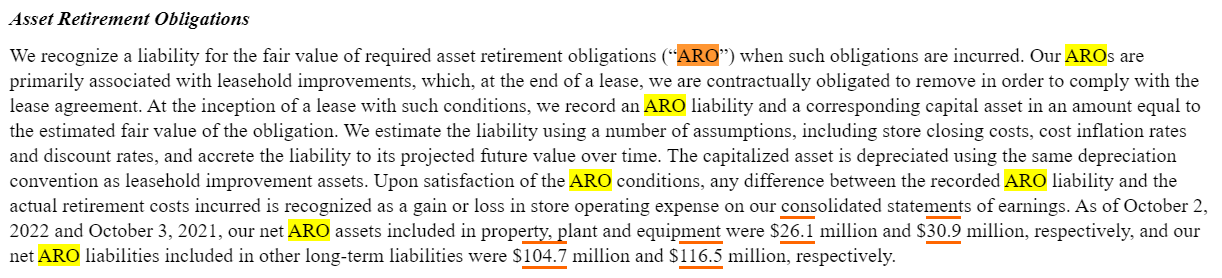

We recognize a liability for the fair value of required asset retirement obligations ("ARO") when such obligations are incurred. Our AROs are primarily associated with leasehold improvements, which, at the end of a lease, we are contractually obligated to remove in order to comply with the lease agreement. At the inception of a lease with such conditions, we record an ARO liability and a corresponding capital asset in an amount equal to the estimated fair value of the obligation. We estimate the liability using a number of assumptions, including store closing costs, cost inflation rates and discount rates, and accrete the liability to its projected future value over time. The capitalized asset is depreciated using the same depreciation convention as leasehold improvement assets. Upon satisfaction of the ARO conditions, any difference between the recorded ARO liability and the actual retirement costs incurred is recognized as a gain or loss in store operating expense on our consolidated statements of earnings. As of October 2, 2022 and October 3, 2021, our net ARO assets included in property, plant and equipment were $26.1 million and $30.9 million, respectively, and our net ARO liabilities included in other long-term liabilities were $104.7 million and $116.5 million, respectively

We recognize a liability for the fair value of required asset retirement obligations ("ARO") when such obligations are incurred. Our AROs are primarily associated with leasehold improvements, which, at the end of a lease, we are contractually obligated to remove in order to comply with the lease agreement. At the inception of a lease with such conditions, we record an ARO liability and a corresponding capital asset in an amount equal to the estimated fair value of the obligation. We estimate the liability using a number of assumptions, including store closing costs, cost inflation rates and discount rates, and accrete the liability to its projected future value over time. The capitalized asset is depreciated using the same depreciation convention as leasehold improvement assets. Upon satisfaction of the ARO conditions, any difference between the recorded ARO liability and the actual retirement costs incurred is recognized as a gain or loss in store operating expense on our consolidated statements of earnings. As of October 2, 2022 and October 3, 2021, our net ARO assets included in property, plant and equipment were $26.1 million and $30.9 million, respectively, and our net ARO liabilities included in other long-term liabilities were $104.7 million and $116.5 million, respectively Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started