Starbucks wants to increase its sales/revenue by 6% after year 2018.

a. What are the additional funds needed (AFN) if the company wants to grow at 6% in year 2019?

b. What is the Internal Growth Rate?

c. What is the Sustainable Growth Rate?

d.What can the company do if it does not want to borrow or issue new equity to finance a growth in sales?

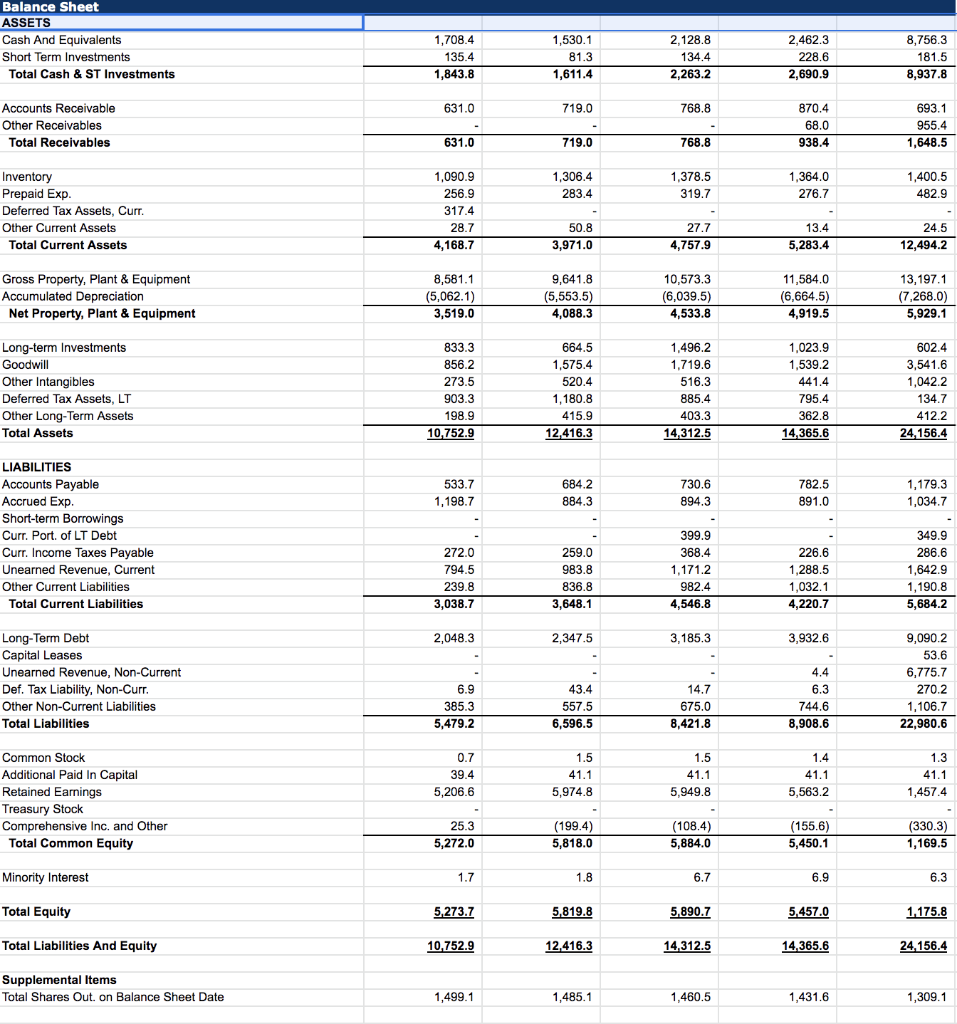

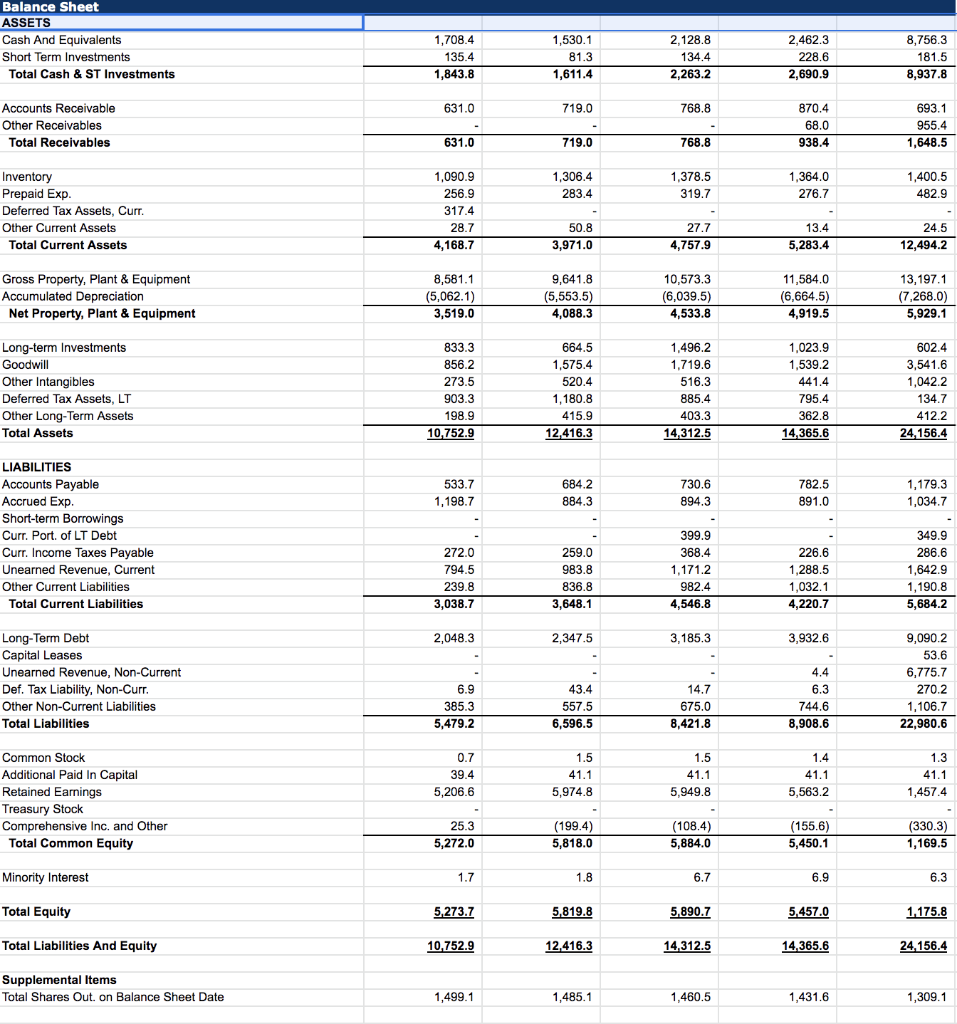

(column 1= 2014, column 2= 2015,...etc, last column=2018)

Balance Sheet ASSETS Cash And Equivalents Short Term Investments Total Cash & ST Investments 8,756.3 1,708.4 135.4 1,843.8 1,530.1 81.3 1,611.4 2,128.8 134.4 2,263.2 2,462.3 228.6 2,690.9 181.5 8,937.8 631.0 719.0 768.8 Accounts Receivable Other Receivables Total Receivables 870.4 68.0 938.4 693.1 955.4 1,648.5 631.0 719.0 768.8 1,306.4 283.4 1,378.5 319.7 1,364.0 276.7 1,400.5 482.9 Inventory Prepaid Exp. Deferred Tax Assets, Curr. Other Current Assets Total Current Assets 1,090.9 256.9 317.4 28.7 4,168.7 50.8 3,971.0 27.7 4,757.9 13.4 5,283.4 24.5 12,494.2 Gross Property, Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment 8,581.1 (5,062.1) 3,519.0 9,641.8 (5,553.5) 4,088.3 10,573.3 (6,039.5) 4,533.8 11,584.0 (6,664.5) 4,919.5 13,197.1 (7,268.0) 5,929.1 Long-term Investments Goodwill Other Intangibles Deferred Tax Assets, LT Other Long-Term Assets Total Assets 833.3 856.2 273.5 903.3 198.9 10,752.9 664.5 1,575.4 520.4 1,180.8 415.9 12,416.3 1,496.2 1,719.6 516.3 885.4 403.3 14,312.5 1,023.9 1,539.2 441.4 795,4 362.8 14,365.6 602.4 3,541.6 1,042.2 134.7 412.2 24.156.4 533.7 1,198.7 684.2 884.3 730.6 894.3 782.5 1,179.3 1,034.7 891.0 LIABILITIES Accounts Payable Accrued Exp. Short-term Borrowings Curr. Port of LT Debt Curr. Income Taxes Payable Unearned Revenue, Current Other Current Liabilities Total Current Liabilities 272.0 794.5 239.8 3,038.7 259.0 983.8 836.8 3,648.1 399.9 368.4 1.171.2 982.4 4,546.8 226.6 1,288.5 1,032.1 4,220.7 349.9 286.6 1,642.9 1,190.8 5,684.2 2,048.3 2.347.5 3,185.3 3,932.6 Long-Term Debt Capital Leases Unearned Revenue, Non-Current Def. Tax Liability, Non-Curr. Other Non-Current Liabilities Total Liabilities 9,090.2 53.6 6,775.7 270.2 1,106.7 22,980.6 6.9 385.3 5,479.2 43.4 557.5 6,596.5 4.4 6.3 744.6 8,908.6 14.7 675.0 8,421.8 0.7 39.4 5,206.6 1.5 41.1 5,974.8 1.5 41.1 5,949.8 1.4 41.1 5,563.2 1.3 41.1 1,457.4 Common Stock Additional Paid In Capital Retained Earnings Treasury Stock Comprehensive Inc. and Other Total Common Equity 25.3 5,272.0 (199.4) 5,818.0 (108.4) 5,884.0 (155.6) 5,450.1 (330.3) 1,169.5 Minority Interest 1.7 1.8 6.7 6.9 6.3 Total Equity 5,273.7 5,819.8 5.890.7 5,457.0 1,175.8 Total Liabilities And Equity 10.752.9 12,416.3 14,312.5 14,365.6 24,156.4 Supplemental Items Total Shares Out. on Balance Sheet Date 1,499.1 1,485.1 1,460.5 1,431.6 1,309.1 Balance Sheet ASSETS Cash And Equivalents Short Term Investments Total Cash & ST Investments 8,756.3 1,708.4 135.4 1,843.8 1,530.1 81.3 1,611.4 2,128.8 134.4 2,263.2 2,462.3 228.6 2,690.9 181.5 8,937.8 631.0 719.0 768.8 Accounts Receivable Other Receivables Total Receivables 870.4 68.0 938.4 693.1 955.4 1,648.5 631.0 719.0 768.8 1,306.4 283.4 1,378.5 319.7 1,364.0 276.7 1,400.5 482.9 Inventory Prepaid Exp. Deferred Tax Assets, Curr. Other Current Assets Total Current Assets 1,090.9 256.9 317.4 28.7 4,168.7 50.8 3,971.0 27.7 4,757.9 13.4 5,283.4 24.5 12,494.2 Gross Property, Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment 8,581.1 (5,062.1) 3,519.0 9,641.8 (5,553.5) 4,088.3 10,573.3 (6,039.5) 4,533.8 11,584.0 (6,664.5) 4,919.5 13,197.1 (7,268.0) 5,929.1 Long-term Investments Goodwill Other Intangibles Deferred Tax Assets, LT Other Long-Term Assets Total Assets 833.3 856.2 273.5 903.3 198.9 10,752.9 664.5 1,575.4 520.4 1,180.8 415.9 12,416.3 1,496.2 1,719.6 516.3 885.4 403.3 14,312.5 1,023.9 1,539.2 441.4 795,4 362.8 14,365.6 602.4 3,541.6 1,042.2 134.7 412.2 24.156.4 533.7 1,198.7 684.2 884.3 730.6 894.3 782.5 1,179.3 1,034.7 891.0 LIABILITIES Accounts Payable Accrued Exp. Short-term Borrowings Curr. Port of LT Debt Curr. Income Taxes Payable Unearned Revenue, Current Other Current Liabilities Total Current Liabilities 272.0 794.5 239.8 3,038.7 259.0 983.8 836.8 3,648.1 399.9 368.4 1.171.2 982.4 4,546.8 226.6 1,288.5 1,032.1 4,220.7 349.9 286.6 1,642.9 1,190.8 5,684.2 2,048.3 2.347.5 3,185.3 3,932.6 Long-Term Debt Capital Leases Unearned Revenue, Non-Current Def. Tax Liability, Non-Curr. Other Non-Current Liabilities Total Liabilities 9,090.2 53.6 6,775.7 270.2 1,106.7 22,980.6 6.9 385.3 5,479.2 43.4 557.5 6,596.5 4.4 6.3 744.6 8,908.6 14.7 675.0 8,421.8 0.7 39.4 5,206.6 1.5 41.1 5,974.8 1.5 41.1 5,949.8 1.4 41.1 5,563.2 1.3 41.1 1,457.4 Common Stock Additional Paid In Capital Retained Earnings Treasury Stock Comprehensive Inc. and Other Total Common Equity 25.3 5,272.0 (199.4) 5,818.0 (108.4) 5,884.0 (155.6) 5,450.1 (330.3) 1,169.5 Minority Interest 1.7 1.8 6.7 6.9 6.3 Total Equity 5,273.7 5,819.8 5.890.7 5,457.0 1,175.8 Total Liabilities And Equity 10.752.9 12,416.3 14,312.5 14,365.6 24,156.4 Supplemental Items Total Shares Out. on Balance Sheet Date 1,499.1 1,485.1 1,460.5 1,431.6 1,309.1